Author : Nobita Nobi

Introduction

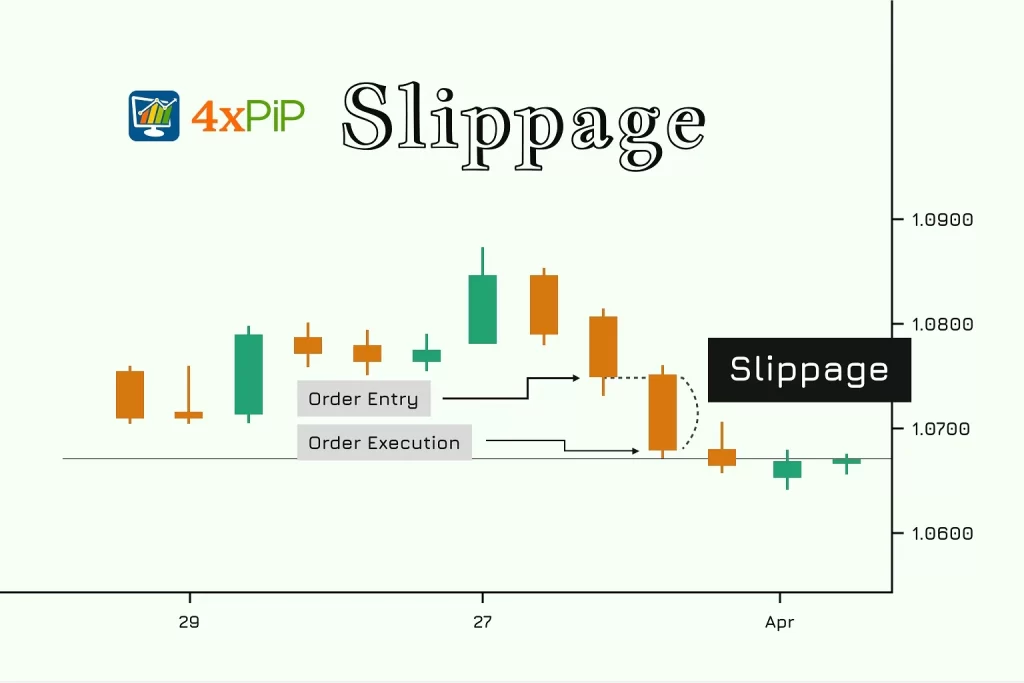

Slippage in forex trading[1] occurs when there is a discrepancy between the anticipated execution price and the actual price at which the trade is filled. This is a common occurrence in fast-moving markets, and it can be especially frustrating for traders when it negatively impacts their positions. In India, forex trading has grown significantly due to its potential for high returns, but slippage remains[2] a critical issue for traders. This guide aims to explain how to reduce slippage in forex trading in India, helping you minimize losses and maximize profits. Is Forex trading easy or difficult?

What is Slippage in Forex Trading?

Before discussing how to reduce slippage[3] in forex trading in India, it is essential to understand what it is. Slippage happens when there is a delay between placing an order and its execution. This can happen for several reasons, such as market volatility, low liquidity, or high-frequency trading[4]. The price at which you intended to buy or sell may change, leading to a discrepancy between the expected and actual execution price. Can I trust Indian Forex brokers?

While slippage is common, it can significantly affect a trader’s profitability, especially in volatile markets like forex. Traders in India[5], just like those globally, often face slippage during key economic events, central bank announcements, or other periods of high volatility.

Why Does Slippage Occur in Forex Trading in India?

There are several reasons why slippage occurs in forex trading in India, and understanding these factors is crucial to finding ways to reduce it. Some common causes include: How do Forex spreads affect trading costs?

- Market Volatility: Major economic events, geopolitical developments, or news releases can cause significant price fluctuations in the forex market. During these volatile periods, prices can change rapidly, leading to slippage.

- Liquidity Issues: If there is insufficient liquidity in the currency pair being traded, it can result in slippage. This often happens with exotic currency pairs or during off-hours when trading volume is low.

- Order Type and Execution Speed: Market orders are more prone to slippage because they are executed at the best available price, even if that price has shifted. Limit orders, on the other hand, provide a specific entry or exit point, reducing the risk of slippage.

- Brokerage Issues: The type of forex broker you use can also affect the likelihood of slippage. Some brokers may have poor execution speed or low-quality liquidity providers, leading to more frequent slippage.

How to Reduce Slippage in Forex Trading in India

Reducing slippage in forex trading in India requires a combination of strategies, proper planning, and choosing the right tools. Here are some practical tips to help reduce slippage:

1. Use Limit Orders Instead of Market Orders

One of the most effective ways to reduce slippage in forex trading in India is to use limit orders instead of market orders. A limit order allows you to specify the exact price at which you want to enter or exit a trade. Unlike a market order, which is executed at the best available price, a limit order ensures that your trade will only be executed at the price you set (or better). This minimizes the risk of slippage, especially in volatile market conditions.

2. Trade During High Liquidity Periods

Forex market liquidity plays a significant role in slippage. Low liquidity often leads to higher slippage, while high liquidity helps reduce it. In India, the forex market experiences higher liquidity during overlapping trading hours, particularly when the London and New York sessions overlap with the Asian session. To reduce slippage, try to trade during these periods when market participation is high, and price movements are more predictable.

3. Choose a Reliable Broker with Fast Execution Speed

The quality of your broker’s execution speed plays a crucial role in minimizing slippage. If you’re facing frequent slippage, it could be due to delays in order execution. Ensure that you choose a forex broker with a strong reputation for fast and reliable order execution. Look for brokers that offer Direct Market Access (DMA), as this provides faster execution and better pricing.

4. Avoid Trading During Major News Releases

One of the most volatile times in the forex market is during economic news releases or geopolitical events. Major reports, such as central bank interest rate decisions or non-farm payroll announcements, can cause price movements of hundreds of pips in seconds. During these times, slippage is often unavoidable. If you want to reduce slippage in forex trading in India, consider avoiding trading during high-impact news releases or use advanced order types like stop-loss orders to minimize the risk.

5. Use Smaller Trade Sizes

Slippage tends to occur more frequently with large trades, especially during periods of low liquidity. To minimize the risk, consider trading smaller positions. While this won’t eliminate slippage entirely, it can help mitigate the impact of slippage on your overall portfolio.

6. Monitor Market Conditions

Keeping an eye on market conditions is essential for reducing slippage. Pay attention to the economic calendar for important news events that may cause volatility, and adjust your trading strategy accordingly. Additionally, watch for signs of lower liquidity during off-hours or during the holiday season, as this can increase the chances of slippage.

7. Test and Adjust Your Strategy

It’s essential to test your forex trading strategies under different market conditions to understand how slippage may impact your trades. Use demo accounts to practice and adjust your strategy based on the slippage you experience. The more you understand how slippage affects your trades, the better you can adapt and manage the risk.

Conclusion

Slippage is an inevitable aspect of forex trading, especially in fast-moving and volatile markets. However, by following the tips outlined in this article, traders in India can significantly reduce slippage and protect their profitability. By using limit orders, choosing the right broker, trading during periods of high liquidity, and managing your trading strategy, you can minimize the impact of slippage on your forex trades.

Remember, while it is impossible to eliminate slippage entirely, adopting the right strategies will give you the best chance to minimize its effects.

FAQs

1. What is the main cause of slippage in forex trading in India?

Slippage in forex trading in India is primarily caused by market volatility, liquidity issues, and delays in order execution.

2. Can slippage be completely avoided in forex trading?

No, slippage can never be completely avoided, but it can be minimized by using limit orders, trading during high liquidity periods, and avoiding major news releases.

3. How can I minimize slippage during volatile market conditions?

To minimize slippage during volatile market conditions, you can use limit orders, trade smaller positions, and avoid trading during news releases or high-impact events.

4. Does slippage affect all types of trades?

Slippage can affect all types of trades, but market orders are more susceptible to it compared to limit orders.

5. Which is the best order type to reduce slippage in forex trading in India?

Limit orders are the best order type to reduce slippage because they guarantee a specific entry or exit price.