Author: Nobita Nobi

Introduction

Forex trading has become a popular investment avenue in India, with increasing participation from both novice and experienced traders. One crucial aspect of successful forex trading[1] is position sizing, which is often overlooked by many traders. Position sizing in forex trading is vital for managing risk and maximizing profits. In this guide, we will explore the importance of Forex trading position sizing in India, how to calculate it, and why it is essential for sustainable trading[2] success. How long should you hold an open position in Forex trading?

What is Position Sizing in Forex Trading?

Position sizing[3] refers to determining the number of units or lots to buy or sell in a forex trade. It involves calculating how much of your capital you should risk on each trade, which directly affects both your potential profit and loss. Effective position sizing helps traders protect[4] their accounts from large, unexpected losses, and it ensures they trade within their risk tolerance. Binary Options vs. Forex: Which is best?

In Forex trading position sizing in India, traders need to adjust their trade size according to their capital, risk tolerance, and the specific characteristics of the currency pair being traded[5]. This allows traders to keep their risks under control while optimizing their profits.

The Importance of Position Sizing in Forex Trading

Position sizing is a fundamental concept for every forex trader, whether in India or globally. Understanding position sizing can be the difference between long-term success and quick account depletion. Here are a few reasons why Forex trading position sizing in India is crucial: Does Forex trading have a high risk?

Risk Management

Without proper position sizing, traders may expose themselves to significant risk, leading to large losses that are difficult to recover from. By using correct position sizing techniques, traders ensure they are risking only a small portion of their capital on any single trade. This allows them to endure periods of losing trades without exhausting their entire trading capital.

Maximizing Profit Potential

Position sizing also plays a role in maximizing profits. By adjusting the size of their trades based on the market conditions, traders can ensure they make the most of favorable price movements without overexposing their capital. Forex trading position sizing in India allows traders to capitalize on market trends while safeguarding their account balance.

Preventing Emotional Trading

When traders do not follow proper position-sizing rules, they may become emotionally involved in the trade. Large losses can lead to impulsive decisions, and traders may either risk too much on a trade or completely avoid trading when they should. By maintaining a disciplined position sizing strategy, traders can eliminate emotions from their trading decisions.

How to Calculate Position Size in Forex Trading?

To effectively manage risk and capitalize on opportunities, it is essential for traders to know how to calculate their position size accurately. There are a few factors to consider when calculating position size in Forex trading position sizing in India:

Determine Your Risk Per Trade

Risk per trade refers to the amount of capital you are willing to risk on any given trade. This amount is usually expressed as a percentage of your total trading capital. A common risk tolerance for forex traders is 1-2% of the account balance. For example, if your account balance is INR 1,00,000 and you are willing to risk 2%, you will risk INR 2,000 per trade.

Define the Stop-Loss Level

A stop-loss is an order placed to automatically close a trade at a predetermined price level to limit potential losses. Your stop-loss level will determine the amount of price movement you are willing to tolerate before exiting the trade. A typical stop-loss distance can range from 20 to 50 pips, depending on the currency pair and market volatility.

Calculate the Position Size

To determine your position size, apply this formula:

Position Size = Risk Amount / (Stop Loss in Pips * Value per Pip)

For instance, if you are risking INR 2,000 on a trade, the stop-loss is 30 pips, and the value per pip for the EUR/USD currency pair is INR 80, then

Position Size = 2,000 / (30 * 80) = 0.833 lots

This means you would trade approximately 0.83 standard lots.

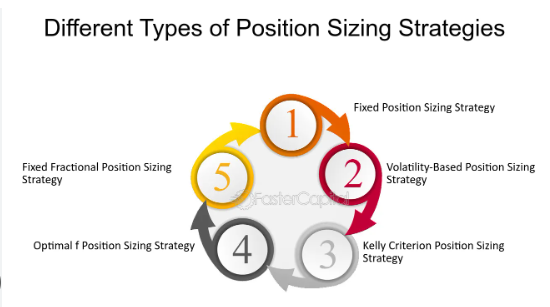

Different Position Sizing Strategies

There are various position-sizing methods that traders in India can adopt depending on their risk tolerance and trading style. The following are some common position-sizing strategies:

1. Fixed Position Sizing

In this strategy, the trader risks a fixed amount per trade, typically a percentage of the total account balance. It is the most straightforward method of position sizing and is simple to implement. For example, if you risk 2% of your capital on each trade, the amount at risk remains constant for every trade.

2. Percentage of Equity

This method adjusts the position size based on the current account balance. If your account balance increases due to successful trades, your position size also increases, allowing you to take larger trades. On the other hand, if your account balance decreases, the position size will be reduced to reflect the lower risk.

3. Volatility-Based Position Sizing

In this strategy, position size is determined based on the volatility of the currency pair. Highly volatile pairs may require smaller position sizes to reduce risk, while low-volatility pairs may allow for larger positions. This method helps traders adjust their position size according to the market conditions.

Position Sizing in the Indian Forex Market

The Indian forex market is highly regulated, and trading positions must be managed carefully. India’s Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) regulate forex trading, and these bodies have set specific rules and guidelines for forex trading, including position limits.

For Indian traders, position sizing must be aligned with the risk parameters set by regulatory authorities. Many Indian brokers offer forex trading accounts with different leverage options, ranging from 1:1 to 1:50. Traders should carefully consider leverage when determining their position size, as higher leverage can lead to larger potential profits but also greater risk.

Common Mistakes in Position Sizing

Many forex traders, especially beginners in India, tend to make several common mistakes when it comes to position sizing. These mistakes can lead to significant losses and damage to trading accounts. Some of the most frequent errors include:

1. Overleveraging

Traders may overuse leverage to increase the size of their trades, which exposes them to higher risks. While leverage can amplify profits, it also increases the chances of margin calls and liquidation if the trade moves against you.

2. Ignoring Risk Management

Position sizing is closely linked to risk management. Traders who do not calculate proper position sizes may end up risking too much on each trade, leading to unnecessary losses. It is essential to follow a disciplined risk management approach when determining position sizes.

3. Chasing Losses

After experiencing a losing streak, some traders might increase their position size in an attempt to recover their losses quickly. This can lead to even larger losses and may drain their account balance.

Conclusion

Forex trading position sizing in India is a vital skill for traders who want to achieve long-term success. By understanding how to calculate position sizes and implement proper risk management techniques, traders can minimize their exposure to large losses and maximize their chances of profitability. Whether you are a beginner or an experienced trader, mastering position sizing will be a key factor in your trading journey. Always ensure that you are trading responsibly and that you are not risking more than you can afford to lose.

(FAQs)

1. How much should I risk per trade in Forex trading?

It is recommended to risk no more than 1-2% of your total trading capital per trade. This allows you to endure losing streaks without depleting your account.

2. What is the best position sizing method in Forex trading?

There is no one-size-fits-all approach. The best position-sizing method depends on your risk tolerance, trading strategy, and market conditions. Fixed position sizing and volatility-based position sizing are commonly used methods.

3. How does leverage affect position sizing?

Leverage amplifies both profits and losses. Higher leverage increases the position size, but it also increases the potential risk. Traders should be cautious when using leverage and always calculate their position sizes based on risk management principles.

4. What are the advantages of proper position sizing in Forex trading?

Proper position sizing helps manage risk, maximize profits, and prevent emotional trading. It ensures that you don’t risk more than you can afford to lose and helps you maintain a steady and sustainable trading strategy.

5. Can position sizing be adjusted during a trade?

Yes, position sizing can be adjusted during a trade if the trader wants to reduce risk or capitalize on a favorable price movement. However, this should be done carefully and based on a structured risk management plan.