AUTHOR : LISA WEBB

Introduction

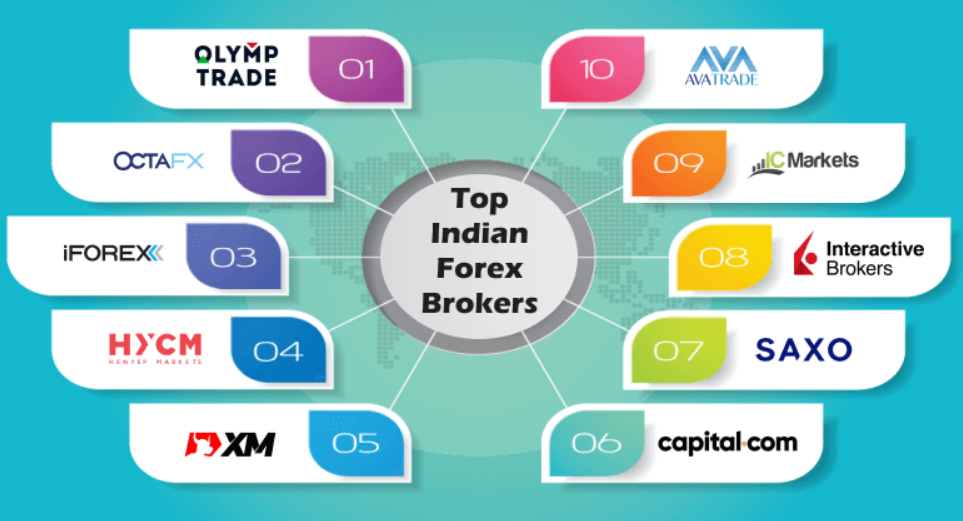

The foreign exchange (Forex or FX) market is the largest and most liquid financial market globally, with a daily trading volume exceeding $6 trillion. For Indian traders, entering the world of forex trading can be highly lucrative but requires careful planning and choosing the right forex broker. In this blog, we explore the top forex brokers for Indian traders, discussing what makes them stand out and their unique offerings. How many bad reviews would make a forex broker untrustworthy?

What Makes a Good Forex Broker for Indian Traders?

- Regulation and Licensing: A reliable Forex broker must be regulated by a reputable financial authority. In India, the Reserve Bank of India (RBI) governs Forex transactions, and brokers must adhere to these regulations. International brokers[1] with licenses.

- Low Spreads and Competitive Fees: Forex trading involves the buying and selling of currencies, and the spread is the difference between the buying and selling price. A broker with low spreads and low fees ensures that traders can maximize their profit potential.

- Variety of Currency Pairs: Indian traders[2] may have a preference for trading particular currency pairs like USD/INR (U.S. Dollar to Indian Rupee), EUR/USD, or GBP/INR.

IC Markets

IC Markets is one of the most popular forex[3] brokers among Indian traders due to its excellent trading conditions and competitive spreads. Founded in 2007 and based in Australia.

Why choose IC Markets?

- Tight Spreads: IC Markets is known for offering some of the tightest spreads in the industry, starting from 0.0 pips on major currency pairs.

- Leverage: The broker offers[4] leverage of up to 1:500, making it an attractive option for traders who want to maximize their positions.

- Multiple Platforms: Indian traders can access the MetaTrader 4, MetaTrader 5, and cTrader platforms, which are all user-friendly and highly customizable.

- Regulation: IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

Exness

Exness has made a name for itself by offering exceptional customer service, competitive spreads, and innovative tools for forex traders.

Why choose Exness?

- Low Minimum Deposit: Exness allows traders to open accounts with a minimum deposit as low as $1, making it ideal for beginners who want to start trading with minimal capital.

- Zero Commissions: The broker offers commission-free trading on most of its accounts, allowing traders to keep more of their profits.

- Wide Range of Payment Methods: Exness offers a variety of payment methods, including credit/debit cards, bank transfers, and e-wallets, which makes it convenient for Indian traders.

- Leverage Options: Exness offers leverage of up to 1:2000, which is among the highest available in the industry.

OctaFX

Indian traders[5] prefer OctaFX for its competitive spreads, low minimum deposit requirements, and robust trading platforms

Why choose OctaFX?

- Low Spreads and Commission: OctaFX offers spreads starting from 0.2 pips and provides low commission rates, which helps increase profitability.

- Variety of Account Types: The broker offers several account types, including micro, pro, and ECN accounts, allowing traders to choose the most suitable option.

- Education and Tools: OctaFX provides an array of educational resources, including webinars, guides, and market analysis tools, making it easier for new traders.

- Indian-Friendly Payments: OctaFX supports local payment options such as UPI, Neteller, and Skrill, making deposit and withdrawal processes smoother for Indian traders.

FBS

FBS has gained significant popularity among Indian traders due to its low minimum deposit, a wide range of trading instruments, and high leverage options.

Why choose FBS?

- Minimum Deposit: FBS offers a very low minimum deposit requirement, starting at just $1 for its Cent account. This makes it an excellent choice for beginner traders in India who are looking to start trading with little capital.

- Leverage: FBS offers leverage of up to 1:3000, one of the highest leverage ratios available in the market.

- Promotions and Bonuses: FBS offers several promotions and bonuses, such as deposit bonuses and trading contests, giving traders additional incentives to trade.

- Fast Withdrawals: Indian traders appreciate FBS for its efficient withdrawal process, with several payment methods available, including Indian Rupees (INR) and local payment systems.

Admiral Markets

Admiral Markets is a trusted and well-regulated forex broker with a global presence. Established in 2001, the broker offers a wide variety of financial instruments, including forex, stocks, indices, and cryptocurrencies.

Why choose Admiral Markets?

- Regulation and Security: Admiral Markets is regulated by top-tier authorities, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC), providing a safe and secure trading environment.

- Advanced Trading Tools: The broker offers traders access to powerful tools such as MetaTrader 4 and MetaTrader 5, along with a variety of indicators, charting tools,

- Indian Payment Methods: Admiral Markets offers payment solutions suitable for Indian traders, including Skrill and Neteller.

- Educational Resources: The broker offers a wide range of educational materials, including articles, webinars, and online courses.

Conclusion

Selecting the right forex broker is crucial to successful trading in India. Each of the brokers mentioned above has unique features and benefits that cater to the diverse needs of Indian traders. Whether you are a beginner looking for a low deposit requirement or an experienced trader seeking tight spreads and high leverage,.

FAQs

Which Forex brokers accept Indian clients?

Popular brokers for Indian clients include IC Markets, Exness, FBS, and HotForex.

What is the minimum deposit required to start Forex trading in India?

The range typically varies from $1 to $100 depending on the platform and broker.

What payment methods are available for Indian traders?

Most brokers accept bank transfers, UPIs, and credit/debit cards.

Is forex trading legal in India?

Yes, Forex trading is legal in India if done on exchanges like the NSE or via authorized brokers.

Can I trade forex on mobile?

Yes, most Forex brokers offer mobile trading apps for both Android and iOS.