ATHOUR : DARLAKIM

Introduction

In the fast-paced and volatile world of Forex trading, emotions play a significant role in determining the success or failure of a trader. While technical knowledge, strategies, and market analysis are crucial, understanding the psychological aspects of trading can be just as important for achieving long-term success. This is especially true for traders in India, where the Forex market has become increasingly popular in recent years.Let’s explore how psychology directly influences Forex trading success in India and how traders can harness the power of their minds to enhance performance. Is-Finq-com-a-scam-or-a-good-forex-broker

This article delves into the profound connection between psychology and Forex success in India, exploring how emotional intelligence, mindset, and self-awareness are key to navigating the complex world of currency trading.

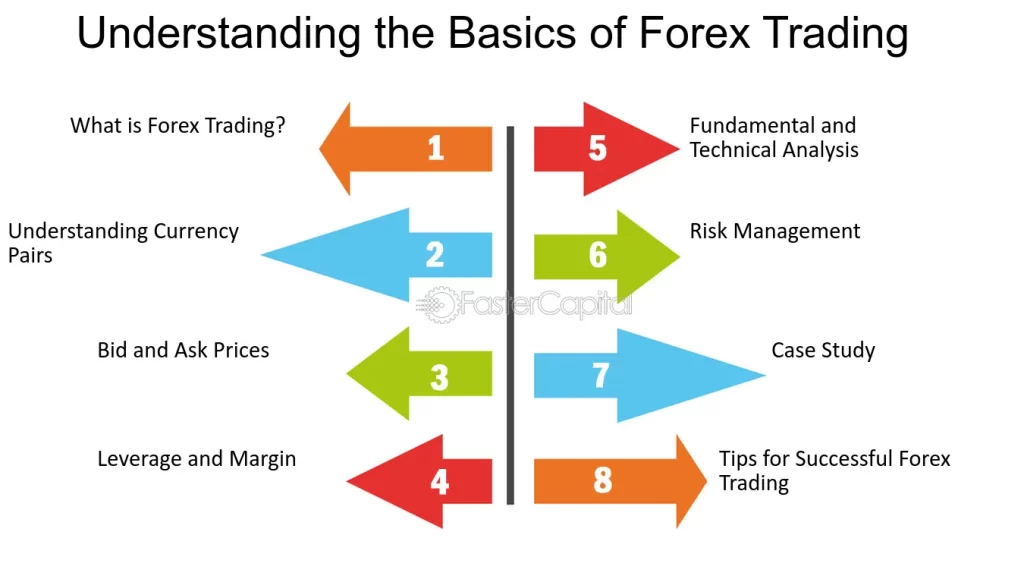

Understanding Forex Trading

Forex, or foreign exchange, is the worldwide market where currencies are bought and sold, enabling traders[1] to profit from fluctuations in exchange rates. Unlike other forms of financial trading, Forex operates 24 hours a day, five days a week, and involves trading currency pairs such as USD/INR, EUR/USD, and GBP/INR. The goal of Forex trading is to profit from the price fluctuations between two currencies.

The Forex market is unique in many ways, one of which is its unpredictability. With millions of variables influencing currency prices, traders often find themselves in situations where fast decisions are required. This is where psychology comes into play.

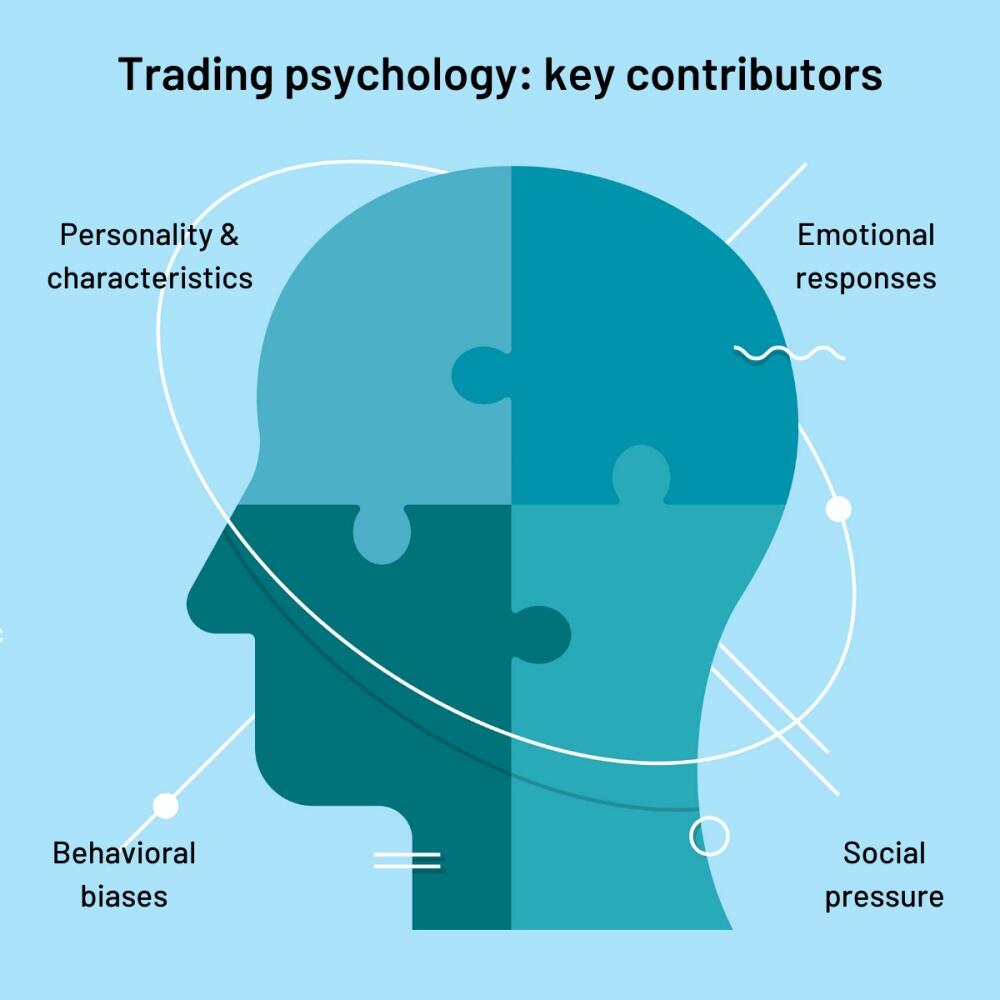

The Role of Psychology in Forex Trading

Psychology refers to the mental and emotional factors that influence behavior. In Forex trading,[2] psychology impacts decision-making, risk management, and even the ability to remain calm under pressure. Traders need to control their emotions to avoid impulsive decisions that could lead to losses.

Let’s look at some of the key psychological factors that affect Forex success:

1. Emotional Control

One of the most significant psychological aspects of trading is emotional control. Day traders, especially beginners, let emotions like fear and greed dictate their trading decisions. Fear can prevent traders from entering the market or cause them to exit too early, while greed may push them to take on more risk than they should.

In India, where the culture of trading is gaining popularity, this emotional aspect becomes even more pronounced. Forex traders in India may feel pressured to make quick profits due to societal expectations or their own financial goals. This often leads to high levels of stress, which can cloud judgment and lead to poor trading decisions.

Solution: Learning to manage emotions is critical. Traders need to accept that losses are part of the game and learn how to handle them calmly. Developing a solid trading plan and sticking to it can help reduce the influence of emotions on decision-making.

2. Confidence vs. Overconfidence

Confidence in Forex trading is essential, as it enables traders to follow their strategies without hesitation. However, overconfidence can be dangerous. Many successful traders in India often become too confident after a series of profitable trades. They may start taking unnecessary risks or deviate from their trading plan, believing that they can “beat the market.”

Overconfidence can lead to larger losses than expected and can cause traders to ignore important risk management strategies, such as stop losses.

Solution: Traders need to strike a balance between confidence and humility. It’s important to stay grounded, regardless of past success, and always follow a disciplined approach to trading.

3. Fear of Missing Out (FOMO)

The fear of missing out (FOMO) is a common psychological trap that many traders fall into. It happens when traders feel the urge to enter a trade simply[4] because they believe that a profitable opportunity is passing them by. In a country like India, where Forex trading is often seen as a way to quickly build wealth, FOMO can lead to impulsive decisions that are not based on analysis or strategy.

Solution: Successful traders learn to recognize FOMO and avoid acting impulsively. Staying patient and waiting for the right setup according to the strategy is key to avoiding poor decisions driven by emotions.

4. Risk Aversion and Loss Aversion

Loss aversion is the tendency to fear losses more than the pleasure of equivalent gains. Traders in India, especially new ones, often struggle with this psychological phenomenon. They may be hesitant to cut their losses and end up holding onto losing positions for too long, hoping the market will turn around. This behavior can lead to larger losses than initially planned.

Risk aversion, on the other hand, can prevent traders from taking well-calculated risks. They may avoid trading altogether or hesitate to enter profitable opportunities due to fear of loss.

Solution: Developing a clear risk management strategy is crucial. Traders should define their risk tolerance, set stop-loss orders, and adhere to predetermined risk-reward ratios to protect themselves from emotional decision-making.

5. Psychological Flexibility

The Forex market is always evolving, and so should traders’ mindsets. Psychological flexibility refers to the ability to adapt to changing market conditions and alter strategies as needed. This is crucial for success, especially for Indian traders who may be dealing with a volatile and uncertain market environment.

A rigid mindset can lead to frustration when things don’t go as planned, and it can cause traders to miss new opportunities.

Solution: Traders should learn to adapt and stay open to modifying their strategies based on the market conditions. Flexibility is a sign of maturity in Forex trading.

How to Improve Trading Psychology

Improving trading psychology[5] is a gradual process that requires time, practice, and self-awareness. Here are a few steps to enhance trading psychology:

1. Mindfulness and Meditation

Practicing mindfulness or meditation can help traders manage stress and improve emotional control. By focusing on the present moment, traders can reduce anxiety and make more rational decisions.

2. Journaling

Keeping a trading journal can help traders identify patterns in their decision-making. Reflecting on past trades can provide insight into emotional triggers and help traders make more informed decisions in the future.

3. Setting Realistic Expectations

Setting realistic goals and expectations is vital. Traders should understand that success in Forex is not guaranteed, and profits require consistent effort over time. By setting achievable goals, traders can maintain a positive mindset.

4. Risk Management Techniques

Developing a sound risk management plan, including setting stop-loss orders and position sizes, can help traders manage the emotional toll of loss and avoid excessive risk-taking.

Conclusion

The connection between psychology and Forex success in India is undeniable. A trader’s mindset directly impacts their ability to make rational decisions, manage risk, and stay disciplined in the face of adversity. By understanding the psychological factors at play and incorporating techniques to manage emotions, Indian traders can improve their chances of long-term success in the Forex market.

FAQs

1. How important is psychology in Forex trading?

Psychology is crucial in Forex trading, as it influences traders’ emotions, decision-making, and ability to stick to their trading plans. Emotional control, confidence, and risk management are essential for success in the market.

2. Can emotions like fear and greed affect my Forex trading?

Yes, emotions like fear and greed can cloud judgment and lead to impulsive decisions. Fear may cause you to avoid trades or exit early, while greed can push you to take excessive risks.

3. How can I manage stress while trading Forex in India?

Practicing mindfulness, taking regular breaks, and maintaining a healthy work-life balance can help you manage stress. Also, following a clear and well-researched trading strategy can reduce uncertainty and emotional strain.

4. What role does discipline play in Forex trading success?

Discipline is key to Forex success. It allows traders to follow their strategies, control emotions, and manage risks consistently. Without discipline, traders are more likely to make emotional decisions that lead to losses.

5. How can I improve my trading psychology?

Improving trading psychology requires self-awareness, emotional regulation, and continuous learning. Techniques like mindfulness, journaling, setting realistic goals, and adhering to a structured trading plan can help.