AUTHOR : SIMON DRAVIS

Introduction

The forex market[1] is notoriously volatile, and unexpected market movements can significantly impact traders, especially those operating in emerging markets like India. Whether you’re a novice or an experienced trader, handling sudden price shifts with composure is crucial for long-term success. In this article, we’ll explore strategies to help Indian forex traders manage unexpected market movements, stay disciplined, and protect their investments.

1. Understanding the Nature of Forex Market Movements

Before diving into strategies for managing unexpected market movements, it’s essential to understand why these shifts occur in the first place. The forex market is influenced by a range of factors, including economic data releases, geopolitical events, and market sentiment[2]. Sudden movements can happen due to:

- Economic News and Reports: Data like inflation rates, GDP, and employment figures can shift market sentiment rapidly.

- Geopolitical Events: Elections, political instability, or conflicts can lead to uncertainty and cause sudden price swings.

- Central Bank Policies: Decisions made by the Reserve Bank of India (RBI) or other central banks, including interest rate changes, can trigger sharp market movements.

With this understanding, you can anticipate and prepare for such events, ensuring you react calmly when market shifts occur.

2. Build a Solid Risk Management Plan

A comprehensive risk management strategy[3] is a trader’s best defense against unexpected market movements. In the fast-paced world of forex trading, a solid plan ensures that you’re not caught off-guard when market conditions[4] change.

a. Set Stop-Loss and Take-Profit Orders

One of the simplest and most effective ways to manage risk is by using stop-loss and take-profit orders. A stop-loss order automatically closes a trade when the market moves against you beyond a predetermined point, limiting your loss. Similarly, take-profit orders close your position once the market moves in your favor and hits a predefined target.

Setting these orders prevents you from emotional decision-making[5] and helps protect your capital when unexpected price movements occur.

b. Determine Your Risk-Reward Ratio

The risk-reward ratio represents the amount you’re willing to risk versus the potential reward. For example, if you’re risking 1% of your account for a potential reward of 3%, your risk-reward ratio is 1:3. By maintaining an appropriate risk-reward ratio, you ensure that even if some trades are negatively impacted by unexpected market shifts, your profitable trades will more than compensate.

c. Use Proper Leverage

Leverage allows you to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also increases the potential for significant losses. As a forex trader in India, use leverage cautiously, especially during periods of market uncertainty. Always ensure that you’re not overexposed, as this can lead to sudden and substantial losses in the event of unexpected movements.

3. Stay Calm and Avoid Emotional Trading

Emotions like fear, greed, and panic can cloud judgment, leading to poor decisions. When unexpected market movements occur, maintaining emotional discipline is crucial. Here’s how to stay calm:

a. Follow Your Trading Plan

A well-structured trading plan includes predetermined rules for entry, exit, and risk management. If you have a solid plan, there’s no need to make impulsive decisions based on emotional reactions to market volatility. Stick to your strategy, and don’t let fear of loss or greed for profit push you into making rash choices.

b. Avoid Overtrading

Overtrading can happen when traders attempt to recover losses or capitalize on every market movement. This often leads to emotional burnout and poor decisions. During periods of market volatility, avoid the temptation to make excessive trades in an attempt to “win back” losses. Taking a step back and waiting for favorable conditions can help preserve both your capital and emotional well-being.

c. Practice Mindfulness

Mindfulness and meditation can be powerful tools for maintaining calm and focus during stressful market movements. Taking a few moments to reset your mind, breathe deeply, and evaluate the situation rationally can help you avoid emotional trading and make better decisions.

4. Be Prepared for News and Events

Unexpected market movements are often driven by economic data releases, news events, or geopolitical shifts. In India, traders must be especially vigilant during certain times when such news releases may lead to unpredictable market behavior.

a. Keep an Economic Calendar

An economic calendar is an essential tool for staying ahead of potential market-moving events. By tracking the release dates of important economic data such as GDP growth, inflation rates, and RBI decisions, you can anticipate and prepare for significant market movements. Being proactive about upcoming news can prevent surprise market shifts from catching you off guard.

b. Understand Market Sentiment

News events often trigger shifts in market sentiment, which can cause price swings. Understanding how the market typically reacts to certain news events—such as interest rate hikes or political instability—can help you make more informed decisions. Keep an eye on financial news outlets and expert analysis to gauge how major events may affect the market.

c. Use Economic Reports Wisely

While economic reports can sometimes lead to market volatility, they also offer trading opportunities. If you’re prepared, you can capitalize on these events by positioning yourself before major announcements. Make sure to review economic reports thoroughly and understand their potential impact on your trades.

5. Diversify Your Portfolio

In times of unexpected market movements, diversification can help protect your capital from sharp losses. By spreading your investments across different asset classes, including commodities, indices, or even stocks, you reduce the risk of significant losses tied to any single market or currency.

a. Currency Diversification

If you primarily trade the INR/USD pair, consider diversifying into other currency pairs, such as EUR/USD or GBP/USD, to reduce your exposure to any single currency. This way, a sudden shift in the Indian Rupee (INR) won’t have as much impact on your overall portfolio.

b. Asset Class Diversification

While forex trading is a great way to make profits, don’t hesitate to look into other investment opportunities, such as stocks, bonds, or commodities. A diversified portfolio across asset classes allows you to minimize the risk of market volatility in one sector impacting your entire financial standing.

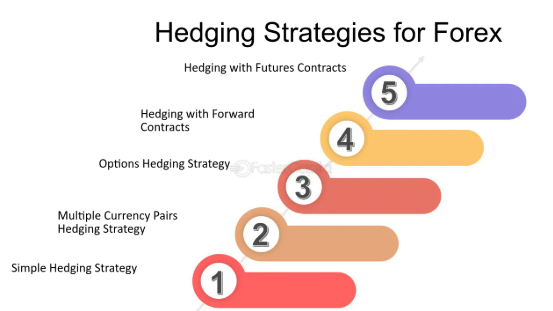

6. Consider Using Hedging Strategies

Hedging is a strategy that involves opening a position that offsets the risk of an existing trade. For instance, if you hold a long position in the INR/USD pair, you might open a short position in another related currency pair as a hedge.

a. Use Currency Options or Futures

Using currency options or futures can help mitigate risks when unexpected market movements occur. While these tools can be more complex, they allow you to lock in profits or reduce potential losses without closing your existing positions.

b. Hedge with Correlated Pairs

Hedging with correlated currency pairs, such as EUR/USD and GBP/USD, can help reduce the risk of one currency movement negatively affecting your entire portfolio. However, hedging comes with its own risks and should only be used by experienced traders who fully understand the strategy.

Conclusion

Unexpected market movements are a constant in forex trading, but with the right strategies and mindset, Indian traders can manage such volatility effectively. By setting clear risk management rules, staying calm during market shifts, preparing for news events, diversifying your portfolio, and considering hedging strategies, you can better handle unpredictable price swings. Most importantly, developing emotional discipline and sticking to your trading plan are crucial in mitigating the adverse effects of sudden market movements.

FAQ

1. What should I do if the market moves unexpectedly against my position?

You should have a stop-loss in place to limit potential losses. Additionally, assess the situation to determine if the market movement is temporary or if it’s part of a larger trend. Never make emotional decisions—stick to your trading plan and manage risk effectively.

2. How can I prevent panic during volatile market conditions?

By following a well-established trading plan, maintaining emotional discipline, and using risk management tools like stop-loss and take-profit orders, you can prevent panic and make rational decisions during volatile conditions.

3. What role does news play in unexpected market movements?

News events such as economic reports, central bank decisions, and geopolitical developments can cause sudden price movements. Keeping up with news and using an economic calendar can help you anticipate and prepare for these shifts.

4. Can hedging help me manage unexpected market movements?

Yes, hedging can reduce the risk of sudden price changes by offsetting losses in one position with profits from another. However, hedging is a more advanced strategy and should be used with caution.

5. Is it a good idea to overtrade during market volatility?

Overtrading during periods of volatility can increase risk and lead to impulsive decisions. It’s better to stay disciplined, take fewer trades, and focus on quality over quantity when the market is volatile.