Author: Shin Hari

Introduction

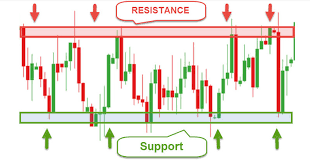

Forex trading[1] is an exciting venture, especially in a dynamic market like India. Many traders look for ways to predict market movement and improve their success. One of the most effective techniques used by traders globally is the use of support and resistance levels. These fundamental concepts help traders understand market behavior and make informed decisions. But what exactly are these levels, and how do they help traders in India. What are the steps to take against forex trading scammers in India Can victims of forex trading scams in India recover their lost funds

Understanding Forex Trading in India

Forex trading involves buying and selling currency pairs to profit from price movements. The Forex market[2] operates 24 hours a day, five days a week, making it one of the most active global financial markets.

However, Forex trading in India is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Indian traders can only trade currency derivatives (futures and options) on NSE, BSE, and MCX-SX. Direct trading on international Forex platforms is not permitted unless through SEBI-registered brokers.

Despite these regulations, Indian traders can use technical analysis[3] tools like support and resistance to make well-informed trading decisions within the legal framework

How Support and Resistance Work in Forex Trading?

- Price Bounces at Support – When a currency pair reaches a support level, buyers enter the market, pushing the price back up.

- Price Reverses at Resistance – When a currency pair reaches resistance, sellers enter the market, causing the price to drop.

- Breakouts Occur – If price breaks above resistance, it signals a bullish continuation. If it breaks below support, a bearish trend may follow.

- Role Reversal Happens – When support is broken, it becomes new resistance. Similarly, when resistance is broken, it becomes new support

What is Support in Forex Trading?

Support is a price level where a currency pair tends to stop falling and may reverse upwards due to increased buying interest. Traders view support levels as buying opportunities because demand for the asset increases at these levels.

For example, if the USD/INR currency pair repeatedly drops to ₹82.00 and bounces back up, then ₹82.00 becomes a support level.

How to Identify Support and Resistance Levels?

- Historical Price Levels: Look at past price action to find areas where prices repeatedly reversed.

- Trendlines: Use sloping lines to identify dynamic support and resistance[4] in trending markets.

- Moving Averages: The 50-day and 200-day moving averages often act as dynamic support and resistance.

- Psychological Price Levels: Round numbers like 75.00 INR, 80.00 INR often serve as strong levels.

Best Strategies for Trading with Support and Resistance

- Bounce Trading Strategy: Buy at support, sell at resistance.

- Breakout Trading Strategy: Enter when the price breaks through support or resistance.

- Role Reversal Strategy: When a broken support becomes resistance and vice versa.

What is Resistance in Forex Trading?

Resistance is a price level where selling pressure prevents further price increase. It acts as a ceiling where the price struggles to break through. Traders see resistance levels as selling opportunities.

For example, if the USD/INR pair struggles to rise above ₹85.00, then ₹85.00 becomes a resistance level.

How Support and Resistance Work in Forex Trading

When the price reaches a support level, traders expect it to rise. If it approaches resistance, traders anticipate a decline. However, if price breaks through these levels, it may signal a trend continuation. These levels help traders decide where to enter or exit a trade.

Best Forex Brokers in India for Trading Support and Resistance

Indian traders[5] must use SEBI-regulated brokers for legal Forex trading. Here are some top choices:

🔹 Zerodha – Best for beginners and charting tools.

🔹 ICICI Direct – Offers currency derivatives trading.

🔹 Angel Broking – Provides strong technical analysis featu

Is Forex Trading Legal in India?

Yes, but with restrictions. Indian traders can trade currency derivatives through SEBI-regulated exchanges like NSE, BSE, and MCX-SX. Trading on international Forex platforms is not permitted for retail investors unless the broker is SEBI-registered

Case Study: Real-Life Example of Forex Trading in India

Let’s take a look at an example from the Indian forex market. Suppose a trader notices that the INR/USD pair has bounced off a support level multiple times. The trader places a buy order near the support, sets a stop-loss just below the support, and takes profit when the price approaches resistance. By following this method, the trader successfully captures profits by recognizing the importance of these key levels.

Conclusion

Support and resistance are fundamental tools that help forex traders make informed decisions in the market. By identifying these levels, understanding their psychological aspects, and using them in conjunction with other indicators, traders can improve their chances of success. Whether you are new to forex trading in India or looking to refine your strategy, mastering support and resistance can take your trading to the next level.

FAQs

- What is the best time frame to use support and resistance in forex trading?

- It depends on your trading style. For short-term traders, a smaller time frame like 15-minute or hourly charts works best, while long-term traders may use daily or weekly charts.

- How can Indian traders benefit from support and resistance?

- Indian traders can use support and resistance to identify key levels, manage risk, and plan trades around these important price points.

- Is support and resistance always reliable in forex trading?

- No, there are times when price breaks through these levels due to strong market forces, but they provide useful guidance when used correctly.

- Can I trade forex without using support and resistance?

- Yes, but it’s highly recommended to use support and resistance levels to improve your chances of success in trading.

- How do I identify strong support and resistance levels?

- Look for areas where the price has repeatedly reversed or struggled to move past. The more times the level has been tested, the stronger it is likely to be.