AUTHOR : LISA WEBB

Introduction

Forex trading, also known as currency trading, has gained immense popularity worldwide, including in India. The foreign exchange market offers unparalleled liquidity and the opportunity to trade around the clock, making it an attractive venture for both beginners and experienced traders. However, successful forex trading requires more than just technical knowledge; understanding market behavior is critical. One of the most effective strategies for anticipating price movements is through supply and demand zones. Is the stovecraft IPO positive or negative?

Understanding Supply and Demand Zones

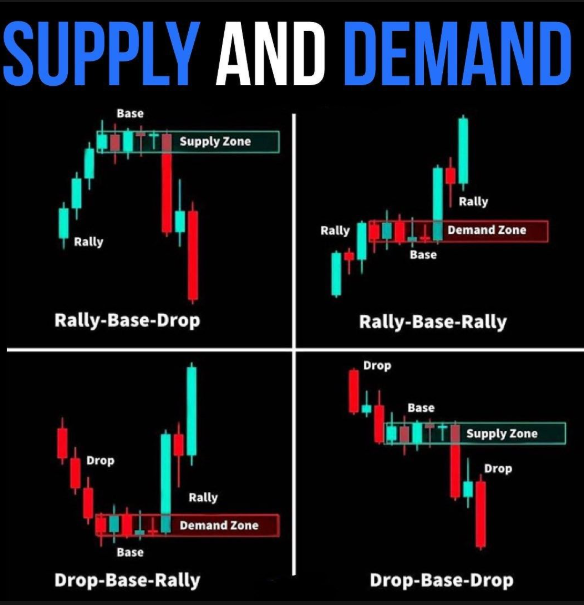

Supply and demand are fundamental economic principles that play a crucial role in the forex market[1]. These zones represent[2] areas on a price chart where the forces of supply (sellers) and demand (buyers) are in balance or imbalance.

- Supply Zone: This is an area where there is an excess of sellers, causing the price to drop. It is a potential area for a market reversal, where prices often begin to fall.

- Demand Zone: This is an area where buyers outnumber sellers, creating upward price pressure. It represents a point where prices are likely to rise.

How Supply and Demand Zones Work

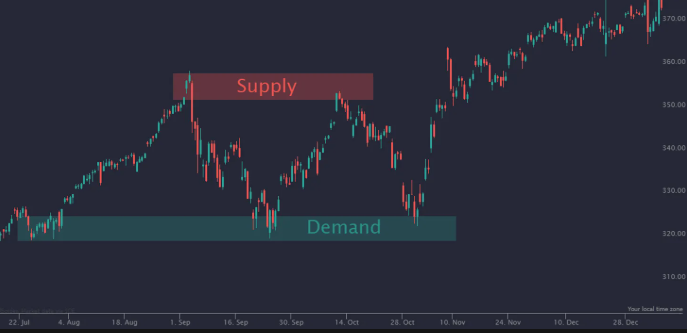

In the context of forex[3] trading, supply and demand zones are used to predict where price reversals or breakouts may occur. When the price reaches a supply zone, pushing the price down. Conversely, when the price reaches a demand zone, there is buying pressure, pushing the price up.

Here’s a breakdown of how these zones can guide forex traders[4]

- Establishing the Zones:

Traders identify supply and demand zones by analyzing historical price data. Key characteristics of these zones include sharp price movements that lead to significant reversals. A supply zone is created when a price move sharply drops. - Price Action and Retests:

Once a zone is identified, price may either reverse or break through the zone. Often, the price will revisit these zones before continuing its movement. The price action at these retests provides traders. - Volume Confirmation:

To increase the accuracy of the strategy, traders can use volume as an additional confirmation tool. A strong price movement accompanied by high volume often indicates that a supply or demand zone is significant.

Why Supply and Demand Zones Are Crucial in Forex Trading

In the forex market, understanding where supply and demand zones exist gives traders a significant edge over those relying solely on traditional indicators like moving averages or RSI. Supply and demand zones are leading indicators, meaning they can predict price movements before they happen.

The importance of these zones can be summarized in the following points:

- Clear Entry and Exit Points:

By identifying supply and demand zones, traders can pinpoint areas where they should consider entering or exiting trades. For example, entering near a demand zone when prices are low can provide an opportunity to buy at a favorable price. - High Probability Trades:

Trading around these zones gives traders higher probability setups. Since these areas represent price levels where significant market participants (institutions, hedge funds, and large banks) are involved. - Price Patterns and Market Sentiment:

Price patterns like “double tops,” “double bottoms,” and “head and shoulders” often develop near supply and demand zones. These patterns, combined with an understanding of market sentiment, offer traders a robust strategy to make informed decisions.

Practical Tips for Trading Supply and Demand Zones in India

Indian forex traders can significantly benefit from using supply and demand zones Forex Trading Using Supply And Demand Zones India if they follow:

- Leverage Indian Time Zones:

The Indian forex market operates within the Asian trading session[5], which overlaps with key global markets. Traders can adjust their strategies to take advantage of price action during this time. - Study Indian Market Liquidity:

Unlike major global currencies, the Indian Rupee (INR) is not as liquid as others like the USD or EUR. - Risk and Capital Management:

India has specific regulations regarding forex trading, and many traders use brokers regulated by the Reserve Bank of India (RBI) or other regulatory authorities. Indian traders should use proper risk management strategies. - Use Technical Analysis Tools:

Traders can combine supply and demand zones with other technical analysis tools such as Fibonacci retracement, candlestick patterns, and trend lines to increase their odds of success. A well-rounded strategy is always more effective. - Understand Market Fundamentals:

While supply and demand zones are technical in nature, keeping an eye on geopolitical events, RBI policies, and global economic factors can provide additional insights. News about India’s economic growth.

Conclusion

Forex trading using supply and demand zones is a powerful strategy for Indian traders looking to enhance their trading game. Forex Trading Using Supply And Demand Zones India, These zones offer a systematic approach to anticipate price movements with a higher probability of success. By understanding the forces of supply and demand, identifying key zones, and implementing proper risk management strategies, Indian traders can increase their chances of achieving consistent profits in the forex market.

FAQs

How do supply and demand zones affect forex trading?

These zones help traders identify potential reversal points, allowing them to make informed buy or sell decisions.

Can supply and demand zones be used for all currency pairs?

Yes, supply and demand zones can be applied to any currency pair in forex trading.

How do you identify a supply zone in forex trading?

A supply zone is identified by observing a sharp price drop after a consolidation, indicating strong selling pressure.

What is the role of demand zones in forex trading?

Demand zones represent areas where buying pressure is strong, leading to price increases after a period of consolidation.

Is trading with supply and demand zones effective in India?

Yes, traders in India successfully use supply and demand zones as part of their forex strategy.