AUTHOR : JENNY

Introduction

Forex trading has become increasingly popular in India, with retail traders looking for ways to navigate the volatile and fast-paced currency markets. It helps traders identify trends, make informed decisions, and develop strategies to manage risk and maximize returns. In this blog, we will explore the use of moving averages in forex trading in India, how they work, and how traders can apply them effectively.Why there are few honest and trusted forex brokers?

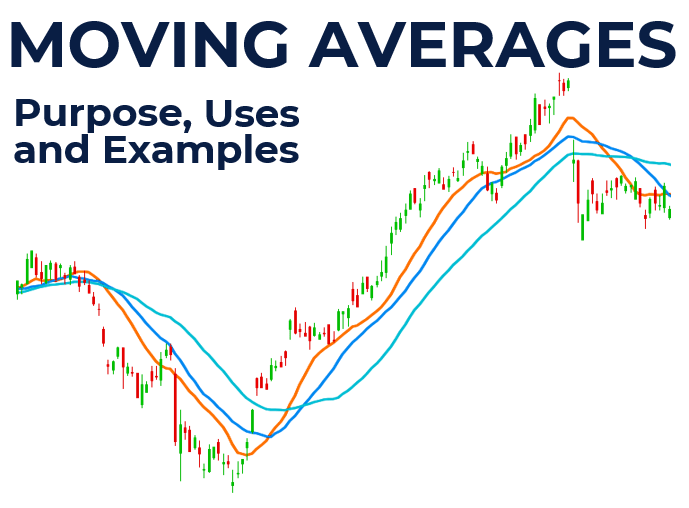

What are Moving Averages?

A moving average (MA) is a statistical tool used to smooth price fluctuations by calculating the average price over a specific period, continuously updating as new data points become available. It is called a “moving” average because it is continually recalculated as new data becomes available. Moving averages are primarily used to identify trends, confirm market direction, and help traders spot potential entry and exit points.

In forex trading, there are various types of moving averages, but the two most widely used are:

- Simple Moving Average (SMA): This is the most basic type of moving average, calculated by averaging a currency pair’s closing prices over a specified period (e.g., 50, 100, or 200 periods).

- Exponential Moving Average (EMA): The EMA places greater emphasis on recent prices, allowing it to react more quickly to price fluctuations compared to the Simple Moving Average (SMA). It’s often favored by traders looking for quicker signals.

Why Use Moving Averages in Forex Trading?

Moving averages play a crucial role in forex trading due to their ability to provide a clearer picture of the market trend. India’s forex market is highly volatile, and moving averages help smooth out noise, allowing traders to focus on the broader market direction. Here are a few reasons why moving averages are so popular in forex trading:

- Trend Identification: Moving averages help traders identify the overall trend of a currency pair, which is essential for making informed trading decisions. By using moving averages, traders can quickly determine whether a currency pair is in an uptrend, downtrend, or sideways movement.

- Entry and Exit Signals: When the price crosses a moving average, it can signal a potential entry or exit point. For example, if the price crosses above the moving average, it may indicate a buying opportunity, while a cross below might suggest a sell signal.

- Smooths Price Data: The forex market is known for its high volatility, especially in India, where economic events and market sentiment can cause rapid price changes. Moving averages help filter out this “noise” and present a clearer market picture.

Types of Moving Average Strategies in Forex Trading

Traders in India often use various moving average strategies[1] to capitalize on forex market trends. These strategies can be combined with other indicators and market analysis for greater accuracy. Let’s look at a few popular strategies involving moving averages:

Moving Average Crossover Strategy

One of the most commonly used moving average strategies is the crossover strategy, where two different moving averages are used together: a fast-moving average[2] (shorter period) and a slow-moving average[3] (longer period).

For example, a trader might use a 50-period SMA and a 200-period SMA. The strategy works as follows:

- Bullish Signal: When the fast-moving average crosses above the slow-moving average, it is considered a buy signal (golden cross).

- Bearish Signal: When the fast-moving average crosses below the slow-moving average, it is considered a sell signal (death cross).

In India, traders often use this strategy with pairs like USD/INR or EUR/INR to catch medium to long-term trends in the market.

Single Moving Average Strategy

Some traders prefer using a single moving average[4] to follow the trend. This is especially effective in trending markets. For instance, a trader may use a 200-period SMA to identify the long-term trend.

- Buy: When the price is above the moving average, the trend is considered bullish, and traders look for buying opportunities.

- Sell: When the price is below the moving average, the trend is considered bearish, and traders look for selling opportunities.

This strategy works well in trending markets, but it can produce false signals during sideways or choppy market conditions. In India, where market movements can be volatile, traders may combine this strategy with other indicators, such as RSI (Relative Strength Index), for better accuracy.

Exponential Moving Average (EMA) Strategy

Traders often prefer the EMA over the SMA due to its responsiveness to recent price movements. The EMA reacts faster to price changes, making it ideal for traders looking for quicker signals.

A common strategy is to use a 9-period EMA and 21-period EMA. The logic is the same as the crossover strategy:

Buy Signal: A buy signal occurs when the 9-period EMA moves above the 21-period EMA.

Sell Signal: A sell signal is generated when the 9-period EMA drops below the 21-period EMA.

This strategy is popular in India’s fast-moving forex market because of its quicker response to sudden price shifts.

Using Moving Averages with Other Indicators

While moving averages are useful on their own, they are often more effective when combined with other technical indicators, such as the Relative Strength Index (RSI) or MACD (Moving Average Convergence Divergence).

For example, traders in India[5] may use a moving average crossover to confirm trend direction, then check the RSI to ensure the market is not overbought or oversold. By combining moving averages with other tools, traders can filter out false signals and improve the accuracy of their trades.

Conclusion

Using moving averages in forex trading in India helps identify trends, manage risk, and find entry and exit points. Whether using the simple moving average (SMA) or exponential moving average (EMA), combining them with other tools and understanding market fundamentals is key. By practicing disciplined risk management and staying informed, traders can improve their strategies and increase success in the dynamic forex market.

Faqs

What is a moving average in forex trading?

A moving average smooths price data to help identify trends and market direction.

How does the exponential moving average (EMA) differ from the simple moving average (SMA)?

The EMA gives more weight to recent prices, making it more responsive than the SMA.

What is a moving average crossover strategy?

It’s a strategy where a short-term moving average crossing above a long-term moving average signals a buy, and crossing below signals a sell.

Why use moving averages in forex trading?

Moving averages help identify trends, manage risk, and provide clear buy or sell signals.

Which moving averages are most commonly used in forex trading in India?

The 50-period and 200-period moving averages are commonly used for trend identification.