AUTHOR : LISA WEBB

Introduction

Forex trading, or the buying and selling of foreign currencies, has become a popular avenue for investors seeking to profit from fluctuations in the value of different currencies. One of the most widely used technical analysis tools to predict market movements is the Elliott Wave Theory. This theory, developed by Ralph Nelson Elliott in the 1930s, suggests that market prices move in repetitive cycles, driven by the collective psychology of investors. The theory divides these cycles into specific patterns or waves. Can I really make money with trading/forex?

Understanding the Elliott Wave Theory

The Elliott Wave Theory operates on the assumption that markets move in repetitive patterns, influenced by human emotions such as fear and greed. According to Elliott, these market movements unfold in a series of waves that can be predicted and identified.

Elliott’s theory divides these movements into two types of waves:

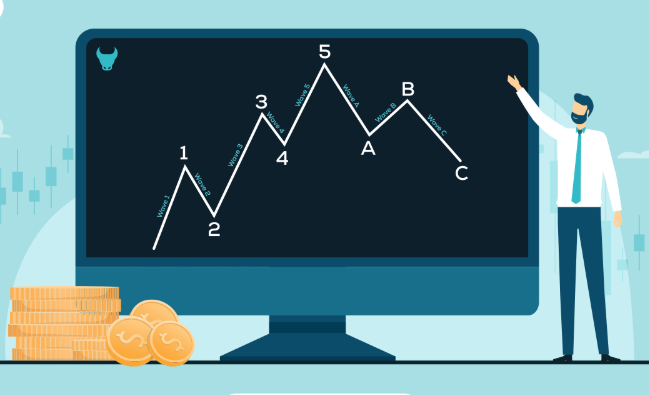

- Impulse Waves (Motive Waves): Impulse Waves[1] are the waves that move in the direction of the larger trend. They consist of five waves (labeled 1, 2, 3, 4, and 5) and are characterized by strong, directional price movements.

- Corrective Waves: Corrective Waves[2] move against the trend, offering temporary retracements or reversals. Corrective waves typically consist of three waves (labeled A, B, and C)

How to Apply Elliott Wave Theory in Forex Trading

Identifying the Waves

The first step in using Elliott Wave Theory in forex trading[3] is to identify the waves on a chart. A typical cycle consists of five waves in the direction of the trend (impulse waves) and three waves against it (corrective waves). Once you can identify a five-wave impulse structure[4], you know that the trend is in motion.

For instance, if you’re trading the USD/INR pair, you would look for a clear five-wave upward movement (impulse waves) followed by a three-wave correction. This would suggest that the market is likely to continue its upward movement after the corrective phase ends.

Recognizing Wave Patterns

Elliott Wave Theory uses a variety of patterns to help identify market trends. The most common patterns include:

- Impulse Pattern (5-3 structure): As described, the five-wave impulse pattern consists of five waves moving in the direction of the trend, followed by three waves in the opposite direction.

- Diagonal Triangles: These are often seen at the beginning or end of trends, and they form a wedge shape. They indicate that the market is consolidating and may soon reverse.

- Flat Corrections: In these, wave B is the same length as wave A, and wave C moves beyond the end of wave A. It shows that the market is correcting before continuing the original trend.

Combining Elliott Waves with Other Indicators

While Elliott Wave Theory can be a powerful tool, it is not foolproof. For this reason, many experienced traders combine it with other technical analysis tools to enhance accuracy. Some useful indicators include:

- Fibonacci Retracements: Elliott Wave traders often use Fibonacci retracement levels to identify possible reversal points within corrective waves.

- Moving Averages: The use of moving averages (such as the 50-day or 200-day moving averages) can help confirm the primary trend direction.

- RSI (Relative Strength Index): The RSI can help identify overbought or oversold conditions. Forex Trading Using Elliott Wave Theory India,When combined with Elliott Waves, it can provide insights into whether a wave may be ending and a reversal might occur.

Trading Strategies Using Elliott Waves

Once the waves are identified, you can develop a trading strategy[5] based on the wave count. Some common approaches include:

- Entering at the End of Corrective Waves: Once a corrective wave (A-B-C) is complete, traders often enter a trade in the direction of the impulse wave. For example, if the corrective wave ends

- Using Wave 3 for Trend Continuation: Wave 3 is often the longest and most powerful of the impulse waves. Once a clear wave 2 correction is complete, entering a trade during the early stages of wave 3 can yield substantial profits.

- Exiting at the End of Wave 5: Once wave 5 is complete, many traders choose to exit their positions, Forex Trading Using Elliott Wave Theory India, as this often marks the end of the larger trend. After wave 5, the market may enter a corrective phase.

Risk Management

As with any trading strategy, risk management is crucial when using Elliott Wave Theory. The theory’s fractal nature means that smaller wave patterns often mirror the larger trends, which can lead to unexpected reversals. It is important to use stop-loss orders and adjust your position sizes accordingly. In India, where currency market volatility can be high, having an effective risk management plan is essential. Traders should never risk more than 1-2% of their capital on a single trade.

Conclusion

The Elliott Wave Theory provides a structured and insightful way to approach forex trading, helping traders identify potential trends and reversals. By recognizing the repetitive nature of market movements, traders in India can take advantage of opportunities in the forex market. However, it is essential to remember that Elliott Wave analysis requires practice, patience, and a deep understanding of market cycles.

FAQs

What is Elliott Wave Theory in Forex Trading?

Elliott Wave Theory predicts market movements based on repeating wave patterns in price charts.

Is Elliott Wave Theory effective in Forex trading?

It can be effective when combined with other technical analysis tools but is not foolproof.

Can Elliott Wave Theory predict Forex market trends?

It offers predictions based on patterns, but the market can be unpredictable, and there is no guarantee of accuracy.

What are the basic waves in Elliott Wave Theory?

The theory consists of five impulse waves and three corrective waves that form a complete cycle.

Is Elliott Wave Theory popular among Indian Forex traders?

Yes, many Indian traders use it along with other strategies for Forex trading analysis.