AUTHOR : ROSELLA LEE

Forex trading in India has gained significant traction over the years as more traders and investors seek to benefit from the fluctuations in currency prices. One of the key concepts that is often discussed in the realm of Forex trading[1] is open interest. In the context of Forex Trading Open Interest Analysis India[2], understanding open interest can offer valuable insights into market sentiment, price movements, and potential trends. This article explores the concept of open interest, its role in Forex trading in India[3], and how it can be analyzed for better trading decisions[4]. What-are-the-consequences-if-someone-is-scammed-in-forex-trading-Is-it-possible-to-take-legal-action-against-the-scammer-in-India?

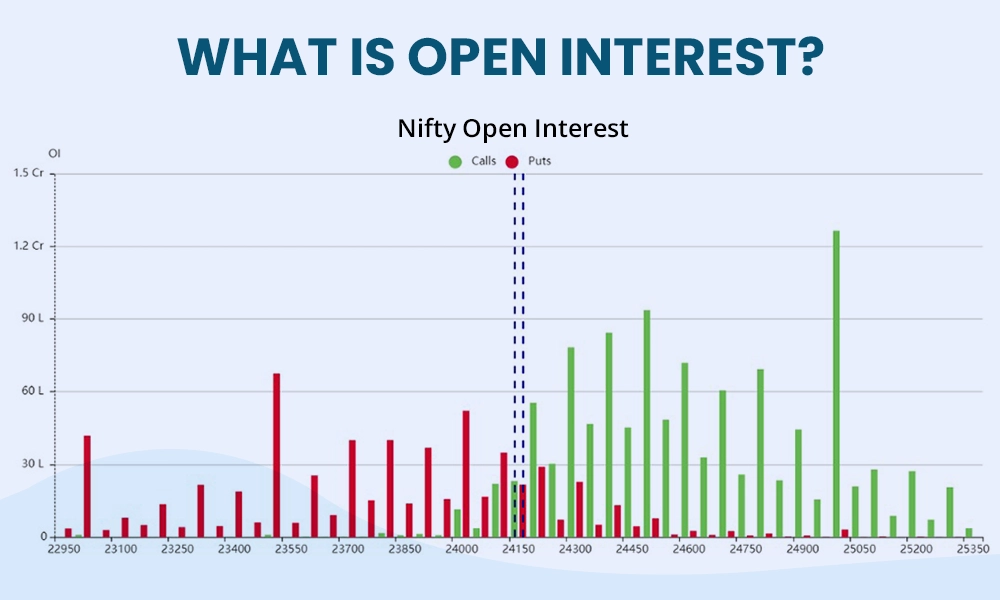

What is Open Interest in Forex Trading?

Open interest represents the total number of outstanding contracts in the market that traders have not settled or closed. In the case of Forex trading, open interest[5] indicates the number of active positions held by traders in the currency derivatives market. When a trader enters into a position (either buying or selling a contract), it increases the open interest. Conversely, closing a position decreases the open interest

Traders use open interest as an important metric to gauge the strength of a market trend. A rising open interest suggests that new money is entering the market, which could indicate the continuation of the current trend. On the other hand, a declining open interest might signal that the trend is losing momentum, as traders are closing their positions.

The Role of Open Interest in Forex Trading in India

Market Sentiment Indicator

Open interest serves as a key indicator of market sentiment, reflecting the level of participation and confidence in current trends. If the open interest is increasing along with a rising price, it indicates that there is strong buying interest, and the current trend is likely to continue. On the other hand, if the open interest is rising while the price is falling, it may indicate that traders are shorting the market, and a bearish trend is likely.

Confirming Price Movements

Open interest analysis can help confirm price movements in the Forex market. For instance, if the price is rising and open interest is also increasing, it shows that the trend is supported by new traders entering the market, confirming the strength of the upward movement. Similarly, if the price is rising, but open interest is stagnant or declining, it may suggest that the price increase is not being supported by fresh buying, and a reversal could be imminent.

Liquidity and Volatility

High open interest typically correlates with higher liquidity in the market, making it easier for traders to enter and exit positions. Conversely, low open interest might indicate low market participation and could lead to higher volatility. Traders can use Forex Trading Open Interest Analysis India to identify periods of high liquidity and volatility, which are crucial for their trading strategies.

How to Analyze Open Interest in Forex Trading in India?

Price and Open Interest Relationship

The relationship between price and open interest is one of the most crucial aspects of analysis. It helps traders understand whether fresh market participants support the current trend or if it is losing momentum. Here’s how to interpret this relationship:

- Price Increase + Open Interest Increase: This indicates a strong trend, with new money entering the market to support the price movement.

- Price Increase + Open Interest Decrease: This suggests a weak trend, as the price increase is not being supported by fresh buying, and traders might be closing their positions.

- Price Decrease + Open Interest Increase: This typically indicates that traders are becoming bearish, as new contracts are being opened to short the market.

- Price Decrease + Open Interest Decrease: This could signal that the bearish trend is losing momentum, as traders are closing their positions.

Open Interest and Volume

Volume refers to the number of contracts traded in a given period, while open interest reflects the total number of outstanding contracts. Analyzing both together helps traders get a clearer picture of market conditions. For instance, if volume is rising along with open interest, it confirms the strength of the trend. If volume is rising but open interest is falling, it may indicate that traders are simply liquidating their positions without establishing new ones.

Historical Data

Analyzing historical open interest data allows traders to spot patterns and trends that have previously influenced market behavior, offering valuable context for future predictions. By comparing the current open interest with past periods, traders can assess whether the market sentiment aligns with previous trends or if signs of a potential reversal, such as diminishing open interest or changing price behavior, are emerging.

Forex Trading Open Interest Analysis India: Key Considerations

Economic Events and Policy Announcements

Forex markets in India are highly sensitive to global and domestic economic events. Events such as RBI policy announcements, interest rate changes, and geopolitical news can cause significant fluctuations in open interest and trading volumes. Traders should keep an eye on these events and adjust their Forex Trading Open Interest Analysis India accordingly.

Role of Institutional Traders

Institutional investors, such as banks and hedge funds, play a significant role in Forex markets. These players often have access to vast resources and can move the market significantly. Therefore, when analyzing open interest, it is essential to consider the actions of institutional traders and their potential impact on market trends.

Expiry Dates and Contract Settlements

In the Forex derivatives market, contracts have specific expiration dates, and as these dates approach, open interest can experience increased volatility due to the settling of positions. This heightened activity often leads to significant price movements, and traders who are aware of these expiration cycles can anticipate potential shifts in market sentiment, allowing them to make more informed trading decisions and adjust their strategies accordingly.

Conclusion

In the dynamic world of Forex trading in India, understanding Forex Trading Open Interest Analysis India is crucial for making informed decisions. Open interest provides a deeper insight into market sentiment, potential price movements, and liquidity conditions. By carefully analyzing open interest data, traders can assess whether current trends are likely to continue or reverse, helping them develop more effective trading strategies. Whether you are a novice or an experienced trader, incorporating open interest analysis into your trading routine can give you an edge in the competitive Forex market.

FAQ:

1. What does increasing open interest indicate in Forex trading?

Increasing open interest with a rising price signals a strong bullish trend and growing market interest.

2. How can I use open interest to predict price movements in Forex?

Rising open interest with a price increase confirms trend strength, while a price rise with falling open interest may signal a reversal or weakening trend.

3. What is the significance of low open interest in Forex trading?

Low open interest indicates low market participation, leading to higher volatility, wider spreads, and a lack of support for the current price movement.

4. Can open interest alone predict market movements?

Traders should use open interest alongside other technical indicators like price action, volume, and chart patterns for more accurate predictions.

5. How does open interest differ from trading volume?

Open interest reflects outstanding contracts, while trading volume shows the number of contracts traded. Both are crucial for understanding market trends but serve different analytical purposes.