AUTHOR : Kukiee Kim

Introduction

Forex trading has gained significant traction in India, thanks to technological advancements and the increasing interest in global financial markets. However, the key to sustained success in forex trading lies not just in strategy but in sound money management. Without a proper money management plan, even the best trading strategies can lead to losses. This blog explores essential money management strategies for Indian forex traders to enhance profitability and minimize risks. What are some names of Indian forex brokers?

Understanding Money Management in Forex Trading

Money management refers to strategies and techniques used to manage capital, control risks, and protect investments while trading in the forex market. The Indian forex market operates under the regulations of the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Traders in India[1] can trade currency pairs through authorized brokers on platforms like NSE, BSE, and MCX-SX.

The fundamental principles of money management help traders to:

- Protect their capital from excessive losses

- Optimize risk-to-reward ratios

- Improve consistency in profits

- Maintain emotional discipline

Essential Forex Trading Money Management Strategies

Risk Per Trade – The 2% Rule

One of the most crucial rules of money management[2] is limiting the risk per trade. The 2% rule suggests that a trader should never risk more than 2% of their total trading capital on a single trade. For example, if you have a trading capital of INR 1,00,000, the maximum loss per trade[3] should be INR 2,000.

By following this rule, traders can withstand multiple losses without significantly impacting their total capital.

Leverage Management

In India, brokers provide leverage ranging from 10x to 50x, meaning that with INR 10,000, a trader can control a position worth INR 1,00,000 or more.

While leverage can amplify profits, it also increases risks. Traders should:

- Use leverage conservatively (preferably 10x or lower)

- Avoid overleveraging, which can wipe out accounts quickly

- Understand margin requirements and liquidation risks

Stop Loss and Take Profit Orders

A stop-loss order automatically closes a trade when a predefined loss level is reached, limiting further losses. Similarly, a take-profit order ensures a trade closes when a specific profit target[4] is met.

Best practices for stop-loss placement:

- Use technical indicators like moving averages, support & resistance levels

- Set a stop-loss at a level where the trade setup becomes invalid

- Maintain a risk-to-reward ratio of at least 1:2 (risking INR 500 to gain INR 1,000)

Position Sizing

Position sizing refers to determining how much capital to allocate to each trade based on risk tolerance. Instead of randomly choosing lot sizes, traders should calculate position sizes using this formula:

Position Size = (Total Capital * Risk % per trade) / Stop-loss Distance

For example, if a trader has INR 1,00,000 and follows the 2% risk rule with a stop-loss of 50 pips, they should adjust their position size accordingly to ensure they do not lose more than INR 2,000 per trade.

Diversification and Hedging

Putting all capital into a single currency pair or strategy increases risk. Instead, traders should:

- Diversify their portfolio by trading multiple currency pairs

- Use hedging strategies to offset potential losses (e.g., buying EUR/USD while shorting USD/INR)

Diversification helps balance risks and smooth out returns over time.

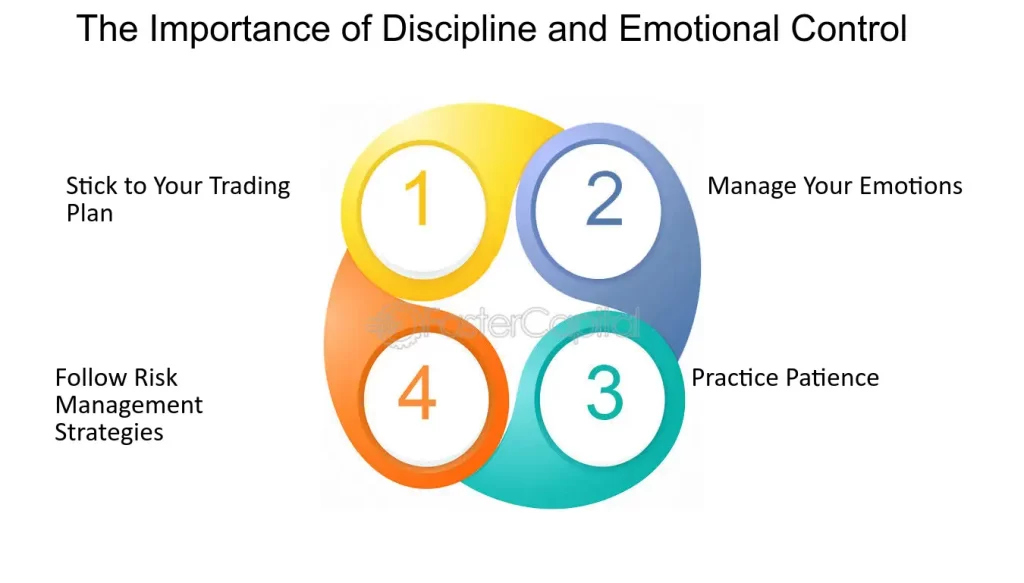

Emotional Discipline and Psychological Control

Many traders in India fail due to emotional decision-making, such as revenge trading[5] after a loss or becoming greedy after a winning streak. To maintain emotional discipline:

- Stick to a well-defined trading plan

- Avoid impulsive trading decisions

- Maintain a trading journal to track performance and emotions

- Take breaks after a series of losses to reassess strategies

Regularly Reviewing and Adapting Strategies

Forex markets are dynamic, and traders must continuously evaluate their strategies. Reviewing past trades, analyzing mistakes, and adapting to market conditions can improve long-term success.

- Conduct monthly reviews of trading performance

- Adjust stop-loss, take-profit, and risk levels based on market conditions

- Stay updated with economic news and global forex trends

Conclusion

Money management is the backbone of successful forex trading in India. By following sound risk management strategies such as limiting risk per trade, managing leverage wisely, using stop-loss orders, diversifying investments, and maintaining emotional discipline, traders can improve their chances of long-term profitability. Whether you are a beginner or an experienced trader, implementing these money management strategies can help you navigate the forex market effectively. Consistency, patience, and discipline are key to mastering forex trading in India.

FAQs

What is money management in forex trading?

Money management refers to strategies and techniques used to manage capital, control risks, and protect investments while trading in the forex market. It helps traders safeguard their funds, optimize risk-reward ratios, and improve consistency in profits.

How much capital should I risk per trade?

A common rule is to risk no more than 2% of your total trading capital on a single trade. This prevents significant losses and ensures longevity in the market.

What is leverage, and how should I use it?

Leverage allows traders to control larger positions with a smaller capital outlay. Indian brokers provide leverage ranging from 10x to 50x. It is advisable to use leverage conservatively (preferably 10x or lower) to mitigate risks.

How do stop-loss and take-profit orders help in money management?

A stop-loss order automatically closes a trade at a predefined loss level, limiting further losses. A take-profit order ensures a trade closes when a specific profit target is met. Both help traders protect their capital and lock in gains.

What are the benefits of diversification in forex trading?

Diversifying by trading multiple currency pairs and using hedging strategies can balance risks and smooth out returns over time. It helps reduce the impact of losing trades on overall capital.