AUTHOR: LUCKY MARTINS

A Complete Guide

Forex trading is becoming increasingly popular[1] in India as more individuals seek opportunities to profit from the foreign exchange market[2]. However, before diving into trading, it’s essential to understand margin requirements[3]—a fundamental concept that determines how much capital a trader needs to control a larger position in the market. Margin plays a crucial role in managing risk, leverage, and the overall trading strategy.

This comprehensive guide will explain Forex trading[4] margin requirements in India, helping you understand how they work, how to calculate them, and their impact on your trades. We’ll also explore key regulations, the role of leverage, and best practices for managing margin[5] effectively.

What is margin in forex trading?

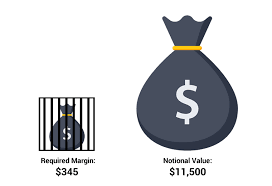

In Forex trading, margin refers to the amount of money required to open and maintain a position. It’s not a fee or cost that you pay upfront, but rather a deposit that your broker holds to ensure you have enough funds to cover any potential losses on your trades.

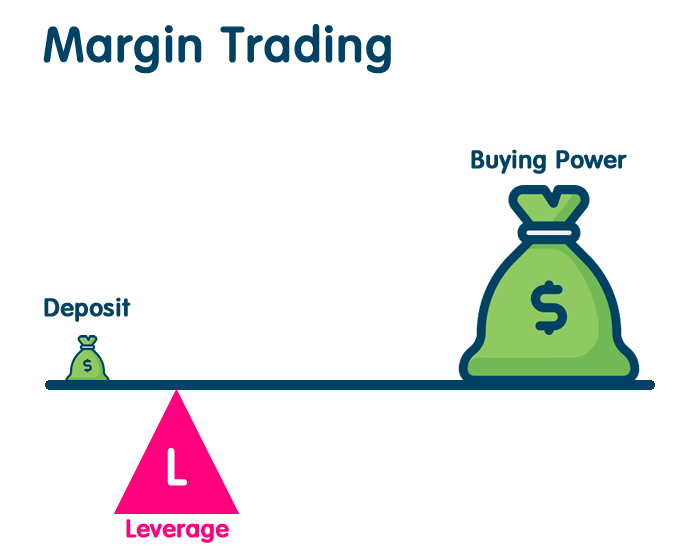

A margin is a way for traders to access larger positions in the market without having to invest the full amount of capital needed. This is where leverage comes into play—margin allows you to control a larger position with a smaller amount of capital.

Types of Margin in Forex Trading

1. Initial Margin

It is typically calculated as a percentage of the total position size. The broker will specify the margin requirement for each currency pair, which can vary based on the volatility of the pair and the leverage offered.

For example, if the margin requirement is 1% and you wish to open a position worth ₹1,000,000, the initial margin required will be ₹10,000.

2. Maintenance Margin

Once a position is open, brokers require traders to maintain a minimum margin level to keep the trade active. If the value of your account falls below the maintenance margin due to losses, you may receive a margin call asking you to deposit additional funds to cover the deficit.

Margin Requirements in India for Forex Trading

In India, Forex trading is regulated by the Securities and Exchange Board of India (SEBI), and there are specific rules and regulations governing margin requirements for retail traders.

1. Leverage and Margin in India

In India, the maximum leverage allowed for retail Forex traders is 1:50. This means that for every₹1 of your own capital, you can control a position worth₹50 in the market. For example, if you have₹10,000 in your account, you can take a position of up to₹500,000.

While leverage can amplify profits, it also increases the risk of significant losses, which is why it’s important to use margin cautiously and in line with your risk tolerance.

2. Maximum Exposure and Position Size

Different brokers in India may have slightly different margin requirements based on the currency pair and market conditions. While most brokers in India offer leverage of up to 1:50, this may be subject to the broker’s policies and the currency pair being traded.

It’s essential to verify the margin requirement for each currency pair before entering a trade to ensure you’re aware of the exposure and the capital needed to open the position.

How to Calculate Margin in Forex Trading

Calculating margin in Forex trading is relatively straightforward once you understand the components. Here’s a simple formula to calculate the margin required for a position:

Margin Required = Position Size × Market Price ÷ Leverage

- Position Size: The size of the trade (in terms of the base currency).

- Market Price: The current exchange rate of the currency pair being traded.

- Leverage: The ratio of borrowed funds to your own capital.

Role of Leverage in Margin Trading

Leverage is a double-edged sword in Forex trading. It allows traders to control large positions with a smaller amount of capital, but it also increases the risk of significant losses.

1. Leverage and Profit Potential

Leverage amplifies the profit potential in Forex trading. A small price movement in your favor can result in a large return on your investment. For instance, with 1:50 leverage, a 1% move in your favor would result in a 50% return on your margin.

2. Leverage and Risk

The flip side is that leverage also magnifies potential losses. A small adverse price movement can lead to significant losses, quickly depleting your margin. Therefore, it’s crucial to use leverage wisely and avoid overexposing yourself to excessive risk.

Margin Calls and Stop-Outs

1. Margin Call

If this happens, your broker will ask you to deposit more funds into your account to maintain your position. If you fail to meet the margin call, your broker may close some or all of your positions to prevent further losses.

2. Stop-Out Level

A stop-out occurs when your account equity falls to a level where the broker automatically closes some or all of your positions to prevent further losses. This level is typically set at 50-80% of the required margin, depending on the broker’s policies.

Best Practices for Managing Margin in Forex Trading

1. Use Leverage Cautiously

Although leverage offers the potential for higher profits, it also increases risk. Use leverage cautiously and ensure that you’re comfortable with the level of risk before taking a trade. Start with smaller leverage and gradually increase as you gain more experience.

2. Maintain Adequate Margin

Always ensure that you have enough margin in your account to support your positions, especially if the market moves against you. If necessary, use stop-loss orders to limit losses and prevent your margin from being wiped out.

Conclusion

Understanding Forex trading margin requirements is essential for anyone looking to succeed in the Forex market. By knowing how margin works, how to calculate it, and how to use leverage responsibly, you can better manage risk and make informed decisions. Always ensure you have enough margin in your account to cover your positions, and use risk management tools like stop-loss orders to protect your capital. With the right approach, Forex trading in India can be a rewarding

FAQ:

1. What is the minimum margin required to trade forex in India?

The minimum margin requirement for Forex trading in India depends on the broker and the currency pair being traded. Typically, brokers in India offer leverage of up to 1:50, which means you need 2% of the position value as margin to open a trade.

2. How does leverage affect margin in Forex trading?

The higher the leverage, the less margin you need to open a position. However, higher leverage increases the potential for both profits and losses.

3. Can I trade forex without margin?

No, Forex trading requires a margin to open positions. However, you can choose to trade with lower leverage, which means less margin is required, reducing your exposure to risk.

4. What happens if my margin falls below the required level?

If your margin falls below the required level, your broker may issue a margin call, requiring you to add funds to your account. If you don’t meet the margin call, your positions may be closed automatically by the broker (a stop-out).

5. How can I avoid margin calls in Forex trading?

To avoid margin calls, use appropriate position sizes, monitor your margin levels regularly, and apply risk management techniques such as stop-loss orders. Also, avoid overleveraging your trades.