AUTHOR : ANGEL ROY

Introduction

In the world of forex trading[1], liquidity is crucial for ensuring smooth transactions, and liquidity providers play a key role in maintaining that flow of assets. Understanding the strategies employed by forex trading liquidity providers[2] in India is essential for both traders and brokers, as it directly impacts the efficiency, volatility, and overall success of the trading ecosystem. In this article, we will delve into the strategies used by forex trading liquidity[3] providers in India, explore their role in the forex market, and provide insights on how these strategies benefit traders. We will also answer some frequently asked questions to clarify common doubts surrounding liquidity provision in forex trading. What-are-the-methods-used-by-the-police-to-recover-money-from-a-forex-scammer-in-India?

What is a Forex Trading Liquidity Provider?

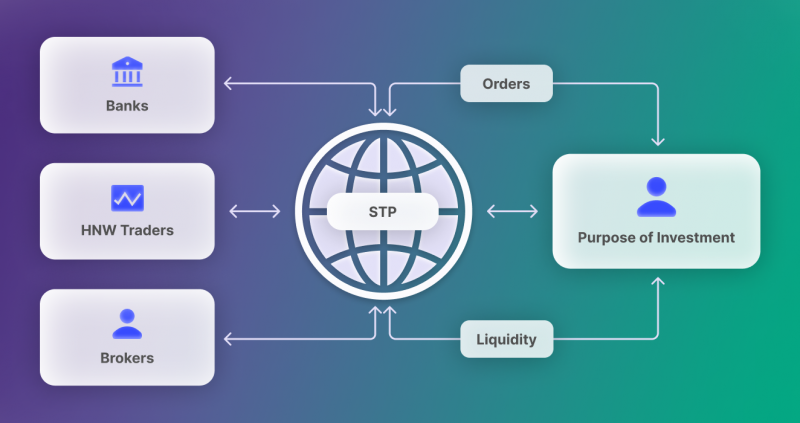

A forex trading liquidity provider is a financial institution, typically a bank or large brokerage firm, that facilitates the buying and selling of currency pairs in the forex market[4]. These liquidity providers maintain an order book and offer buy and sell prices for various currency pairs. Their role is to ensure there is enough liquidity in the market[5] for traders to enter and exit positions without significant slippage. In the Indian context, where the forex market is largely influenced by global trends and domestic regulations, liquidity providers play a pivotal role in shaping the overall trading environment.

The Importance of Liquidity in Forex Trading

In forex trading, high liquidity allows traders to execute trades with minimal slippage, ensuring they get the best possible prices for their trades. Without adequate liquidity, forex markets can become erratic, with price swings and delayed orders causing traders to lose money.

Key Benefits of High Liquidity in Forex Trading:

- Reduced Slippage: With more liquidity, orders can be executed swiftly, minimizing slippage—the difference between the expected price and the actual execution price.

- Tighter Spreads: High liquidity results in smaller spreads, which means traders pay less in transaction costs when entering or exiting trades.

- Market Stability: Liquidity providers ensure that the market remains stable, even during volatile periods, which benefits traders who require a predictable environment.

- Increased Market Depth: A higher level of liquidity ensures that a variety of orders can be matched quickly, allowing for smoother price discovery.

Forex Trading Liquidity Provider Strategies in India

1. Aggregating Liquidity from Multiple Sources

One of the key strategies employed by liquidity providers in India is the aggregation of liquidity from multiple sources. This includes liquidity from domestic banks, global financial institutions, and major forex exchanges. By consolidating this liquidity, liquidity providers can offer tighter spreads and better market depth to traders. For Indian traders, this means faster execution and the ability to trade currency pairs at better rates.

2. Utilizing Algorithmic Trading Models

Algorithmic trading is a widely used strategy by liquidity providers to optimize market-making and liquidity provision. By using advanced algorithms, liquidity providers can automate the process of providing bids and asks in the forex market, ensuring that they can respond to price movements and market changes swiftly. These algorithms are designed to balance risk and reward by adjusting liquidity based on market conditions, ensuring that liquidity providers remain competitive and profitable.

3. Market Making

Market-making is another crucial strategy used by liquidity providers in India. In return, market makers profit from the spread between the bid and ask prices. In India, market makers help maintain liquidity for major currency pairs such as USD/INR, EUR/INR, and GBP/INR. By constantly quoting prices, market makers ensure there is enough liquidity to accommodate both retail and institutional traders.

4. Risk Management Through Hedging

Hedging is a risk management strategy commonly used by liquidity providers in India to protect against adverse market movements. Liquidity providers can reduce the risk of offering liquidity in volatile markets by utilizing hedging strategies like forward contracts or options. This strategy ensures that liquidity providers can continue to offer competitive prices and maintain liquidity even in uncertain market conditions.

5. Building Relationships with Local Banks and Brokers

Additionally, by working with local brokers, liquidity providers can gain insights into the specific needs and preferences of Indian traders. This allows them to tailor their offerings to the Indian market and provide more relevant liquidity solutions.

6. Regulatory Compliance and Adapting to SEBI Rules

In India, the Securities and Exchange Board of India (SEBI) regulates forex trading and sets guidelines for brokers and liquidity providers. Compliance with these regulations is a key aspect of any liquidity provider strategy in India. Liquidity providers must ensure they follow SEBI’s rules on margin trading, leverage limits, and transaction transparency.

7. Offering Tailored Liquidity Solutions for Retail Traders

Retail traders in India often face unique challenges when accessing liquidity due to the fragmented nature of the market. These solutions may include low-latency connections, customizable spreads, and access to a wide range of currency pairs. By offering these solutions, liquidity providers help retail traders in India access the forex market with the best possible conditions.

Conclusion

Forex trading liquidity provider strategies in India are vital for maintaining a stable and efficient market. By leveraging techniques such as aggregation, market making, and hedging, liquidity providers help ensure that traders can execute their trades smoothly and at competitive prices. For Indian traders, understanding these strategies can provide insight into how liquidity impacts their trading decisions and allow them to make more informed choices in the forex market.

FAQs

1. What are the main liquidity providers in India?

The main liquidity providers in India are large banks, financial institutions, and brokers that operate both in the domestic and international forex markets.

2. How do liquidity providers influence forex trading in India?

Liquidity providers influence the forex market by ensuring there is enough liquidity for traders to buy and sell currencies without significant slippage. They also help determine the spreads, which can directly affect the cost of trading for Indian traders.

3. What role does SEBI play in forex trading liquidity in India?

SEBI regulates the forex market in India, ensuring that liquidity providers and brokers follow legal guidelines, such as leverage restrictions and transparency rules. By enforcing these regulations, SEBI helps maintain a stable and fair forex trading environment in India.

4. How do liquidity providers manage risk in volatile markets?

Liquidity providers manage risk through various strategies, including hedging, diversification, and using sophisticated risk management algorithms. These strategies help protect them from large losses during volatile periods and ensure they can continue to provide liquidity.

5. Can retail traders access the liquidity provided by major banks?

Yes, retail traders can access the liquidity provided by major banks through online forex brokers that partner with liquidity providers. These brokers aggregate liquidity from banks and provide it to retail traders via their trading platforms.