AUTHOR: LUCKY MARTINS

A Comprehensive Guide

Forex trading[1] can be an immensely rewarding but equally challenging endeavor. Understanding the various high-probability trade setups is key to becoming a successful trader[2], especially in the Indian forex market. This guide will walk you through high-probability[3] setups, the factors that influence these setups, and strategies to apply for improved trading performance.

Introduction to Forex Trading in India

India’s forex market[4] has become increasingly popular as a means of making profits from currency fluctuations. The Indian rupee (INR) against major currencies like the US Dollar (USD), Euro (EUR), and British Pound (GBP) offers traders opportunities to generate significant returns. However, forex trading requires a deep understanding of market conditions, analysis, and strategy development[5].

With proper strategies in place, traders can identify high-probability setups, increasing their chances of success.Forex trading high-probability trade setups India

What Are High-Probability Trade Setups?

High-probability trade setups are those opportunities that offer the best potential for success based on historical price movements, market behavior, and technical analysis. These setups rely on patterns, indicators, and trends that have a high statistical probability of leading to a favorable trade outcome.

In forex, high-probability setups focus on making decisions based on the likelihood of the market continuing a trend or reversing based on well-defined technical signals.Forex trading high-probability trade setups India

Key Factors for Successful High-Probability Trade Setups

Several factors contribute to a high-probability trade setup. Understanding these elements can help you make informed decisions and avoid the common pitfalls that most traders face:

- Market Conditions: The overall market trend or economic climate significantly impacts the effectiveness of a trade setup. For instance, trading in trending markets may be more favorable for trend-following setups.

- Volatility: Volatility dictates the potential for movement in currency pairs. Identifying periods of high volatility can increase the chances of successful breakout trades.

- Liquidity: High liquidity in the forex market provides tighter spreads and ensures that you can enter and exit trades more efficiently.

- Risk-to-Reward Ratio: A favorable risk-to-reward ratio is crucial in maximizing the profitability of high-probability setups. It’s ideal to risk less than the reward expected from the trade.

Types of High-Probability Trade Setups in Forex

There are several types of high-probability setups that forex traders use to identify favorable trade conditions. Each setup works under different market conditions and requires a unique strategy.

a. Trend Continuation Setups

Trend continuation setups occur when the market is in a defined trend and is likely to continue in the same direction. Traders can identify these setups by using trend indicators like moving averages or trend lines to confirm the trend’s strength.

Common trend continuation setups include:

- Pullbacks: A pullback in the direction of the trend offers an opportunity to enter at a better price.

- Flag or Pennant Patterns: These formations indicate consolidation within a strong trend before the market resumes its movement in the same direction.

b. Reversal Setups

Reversal setups are high-probability opportunities that arise when the market shows signs of reversing from its current direction. These setups are common in range-bound or choppy markets.Forex trading high-probability trade setups India

Key indicators for reversal setups include:

- Candlestick Patterns: Reversal candlestick patterns like Doji, Engulfing, or Hammer can signal potential market reversals.

- Divergence: Divergence between price action and technical indicators like the Relative Strength Index (RSI) can often indicate a potential reversal.

The Role of Technical Analysis in Identifying High-Probability Setups

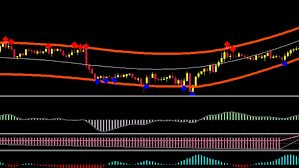

Technical analysis plays a pivotal role in identifying high-probability trade setups. It allows traders to understand the market’s past behavior and predict future movements. Some commonly used tools in technical analysis include:

- Chart Patterns: Recognizing chart patterns like head and shoulders, double top/bottom, and triangles can help identify potential price movements.

- Indicators and Oscillators: Tools like moving averages, RSI, Bollinger Bands, and Fibonacci retracement levels help confirm the strength of trends and identify overbought or oversold conditions.

- Volume Analysis: Volume can provide insight into market strength or weakness. Higher volume during a breakout, for example, suggests a higher probability of the breakout’s success.

How to Implement High-Probability Trade Setups in India

Implementing high-probability trade setups in India requires a solid understanding of both technical and fundamental analysis. Here’s a step-by-step guide:

- Choose Your Trading Platform: In India, brokers like Zerodha, Upstox, and Angel One offer access to forex trading. Ensure that the platform provides real-time data, charting tools, and support for currency pairs.

- Conduct Thorough Market Research: Keep an eye on economic events, geopolitical risks, and central bank decisions that can influence the currency market. Websites like Investing.com and the Economic Times can provide valuable insights.

- Use Technical Indicators: Set up charts with indicators like moving averages, RSI, MACD, and Bollinger Bands to help identify high-probability setups.

Common Mistakes to Avoid in Forex Trading

Even when trying to implement high-probability setups, traders often make common mistakes. Here are a few to be aware of:

- Overleveraging: High leverage can lead to significant losses if the market doesn’t move as expected.

- Ignoring Risk Management: Not setting appropriate stop-loss levels and risking too much on each trade can result in large losses.

- Lack of Patience: Chasing quick profits or jumping into trades too early often leads to poor decisions.

- Overcomplicating Strategies: Simplicity is key in forex trading. Trying to use too many indicators or strategies can cause confusion.

Conclusion

High-probability trade setups are a vital part of successful forex trading. By understanding various setups, incorporating technical analysis, and adhering to solid risk management principles, traders can significantly improve their chances of profitability in the Indian forex market.

FAQ:

a. What is the best time to trade forex in India?

The best time to trade forex in India is during the overlap between the London and New York sessions, which occurs between 1:30 PM and 5:30 PM IST. This period offers high liquidity and volatility.

b. How do I manage risk in forex trading?

Managing risk involves setting stop-loss orders, using a sensible risk-to-reward ratio, and never risking more than 1-2% of your capital on a single trade.

c. Can I start forex trading with a small capital in India?

Yes, you can start forex trading with a small capital, especially with the availability of leveraged trading options. However, always be cautious when using leverage.

d. What indicators are best for identifying high-probability setups?

Indicators like the Moving Average, Relative Strength Index (RSI), Bollinger Bands, and Fibonacci retracements are often used to identify high-probability setups.

e. Is forex trading legal in India?

Yes, forex trading is legal in India, but it is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Only trading on approved platforms and currency pairs is allowed.