AUTHOR : LUCKY MARTINS

Currency Pairs You Can Trade

Forex (foreign exchange[1]) trading has become a popular investment option for many traders worldwide, and India is no exception. However, like any other financial market[2], Forex trading in India is subject to regulatory guidelines set by the Reserve Bank of India (RBI) and the Securities and Exchange Board[3] of India (SEBI). The Indian Forex trading currency pairs allowed in India Forex market[4] is highly regulated, and traders are allowed to trade only specific currency pairs. This article will provide a detailed overview of Forex trading, the currency pairs allowed in India, and how to get started with trading.

What is Forex Trading?

Forex trading, also known as currency trading[5], involves buying and selling currencies against each other in a decentralized global market. Unlike traditional stock markets, Forex markets are open 24 hours a day, five days a week, providing ample opportunities for traders to capitalize on currency fluctuations.

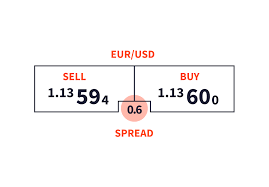

For example, in the currency pair EUR/USD, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. Forex trading currency pairs allowed in India

Forex Trading Regulations in India

Regulatory Bodies

In India, Forex trading is regulated by the Reserve Bank of India (RBI) under the Foreign Exchange Management Act (FEMA). The RBI’s regulations ensure that foreign currency transactions are conducted in an orderly and transparent manner. Additionally, the Securities and Exchange Board of India (SEBI) regulates brokers and trading platforms that offer Forex trading services to Indian traders.

The RBI restricts currency trading to only those pairs that include the Indian Rupee (INR), such as USD/INR, EUR/INR, and GBP/INR.Forex trading currency pairs allowed in India

Allowed Currency Pairs in India

IThese pairs are available on Indian exchanges such as the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and other authorized platforms. Let’s take a look at the most popular currency pairs that Indian traders can trade.

1. USD/INR (US Dollar/Indian Rupee)

The USD/INR pair is the most actively traded currency pair in India. As the US dollar is the world’s dominant reserve currency, it is widely traded in the Forex market. Indian traders often trade the USD/INR pair because it directly involves the Indian rupee, and the fluctuations in its value are closely tied to global economic events.

3. GBP/INR (British Pound/Indian Rupee)

The GBP/INR currency pair represents the British Pound (GBP) against the Indian Rupee (INR). Indian traders interested in trading the GBP/INR pair must closely monitor these factors.

4. JPY/INR (Japanese Yen/Indian Rupee)

The JPY/INR pair represents the Japanese Yen (JPY) against the Indian Rupee (INR). The Japanese yen is a major global currency and is often seen as a safe-haven currency in times of global uncertainty. The JPY/INR pair can be volatile, and it is influenced by Japanese economic data, trade relations, and geopolitical events in Asia.

How to Trade Forex in India?

Step 1: Choose a Regulated Broker

To begin Forex trading in India, you need to select a reliable and regulated broker. The broker should be registered with SEBI and offer access to authorized Forex platforms such as NSE or BSE. Some well-known brokers in India include Zerodha, Upstox, and Angel One.

Step 2: Open a Trading Account

Once you have selected a broker, you will need to open a trading account. This process involves submitting KYC (Know Your Customer) documents such as proof of identity and address. Additionally, you will need to link a bank account to facilitate the deposit and withdrawal of funds.

Step 3: Fund Your Account

After your account is activated, you will need to deposit funds into it to start trading. Most brokers offer multiple funding options, including bank transfers, UPI, and e-wallets.

Step 4: Select a Currency Pair

Forex trading is a dynamic and fast-paced market. To succeed, you must stay informed about market trends, economic data releases, and geopolitical events that could affect currency values. Use analytical tools such as charts, indicators, and news feeds to help you make informed decisions.

Step 5: Execute a Trade

When you’re ready to trade, you can execute a buy or sell order through your broker’s platform. If you believe the currency pair will increase in value, you buy it (long position). If you think the value will decrease, you sell it (short position). Set stop-loss and take-profit orders to manage risk and lock in profits.

Conclusion

Forex trading in India presents an exciting opportunity for traders to participate in the global financial market. While the RBI restricts trading to currency pairs involving the Indian Rupee (INR), there are still numerous options available for traders to explore, including the popular USD/INR, EUR/INR, and GBP/INR pairs. By choosing a regulated broker, staying informed about market trends, and practicing proper risk management, traders can take advantage of the opportunities in the Forex market while adhering to Indian regulations.

FAQ:

1. Is Forex trading legal in India?

Yes, Forex trading is legal in India, but it is regulated by the RBI. Indian traders can only trade currency pairs that involve the Indian Rupee (INR), such as USD/INR, EUR/INR, and GBP/INR.

2. Can I trade foreign currency pairs like USD/JPY in India?

No, retail traders in India cannot trade currency pairs that do not involve the Indian Rupee (INR). The RBI restricts retail traders to trading pairs like USD/INR, EUR/INR, and GBP/INR.

3. What is the minimum amount required to start Forex trading in India?

The minimum amount required to start Forex trading depends on the broker. Most brokers allow traders to start with a minimum deposit of around ₹5,000 to ₹10,000. However, you should ensure you have enough capital to manage potential losses.

4. Is leverage available for Forex trading in India?

Yes, leverage is available for Forex trading in India. . This means you can control a position worth up to 50 times your initial capital.

5. What are the risks of Forex trading in India?

Currency values can fluctuate rapidly due to economic, political, and global events. It is essential to have a solid risk management strategy in place to protect your capital.