AUTHOR : SIMON DRAVIS

Introduction

Forex trading[1] is a dynamic and complex market that offers numerous strategies for traders to capitalize on currency fluctuations. One of the more unconventional approaches to trading is contrarian strategies, which involve going against the prevailing market sentiment. Contrarian traders[2] seek to identify opportunities where the majority of market participants are wrong, betting on reversals rather than following trends. In this guide, we’ll explore the concept of contrarian strategies, how they work in the forex market, and how Indian traders can leverage them for success.

What Are Contrarian Strategies in Forex Trading?

Contrarian strategies[3] involve taking positions opposite to the prevailing market sentiment. In essence, contrarian traders believe that when the majority of traders are overly optimistic or pessimistic, the market is more likely to reverse rather than continue in the same direction. This approach is rooted in the idea that market participants often react emotionally, leading to overbought or oversold conditions.

In forex trading, contrarian strategies may include going long when the market is overly bearish or shorting when the market is overly bullish. This approach often goes against the flow of popular opinion, relying on the principle that extreme market moves are usually unsustainable and tend to reverse.

Why Use Contrarian Strategies in Forex Trading?

Contrarian strategies offer several advantages, especially for traders in India who want to diversify their approaches to the forex market[4]. Here’s why this strategy can be effective:

- Exploiting Overreaction: Markets often overreact to news, events, and economic data, leading to sharp price moves. Contrarian traders capitalize on these overreactions by taking positions opposite to the trend, betting on price corrections.

- Profit from Reversals: While trend-following strategies seek to capture profits from continuous trends, contrarian strategies focus on market reversals. By predicting and entering trades ahead of reversals, contrarian traders can profit from significant price corrections.

- Diversification of Strategy: Contrarian trading adds variety to a trader’s strategy arsenal. Instead of solely relying on trend-following methods, it allows traders to take advantage of market extremes, providing more opportunities to profit.

- Psychological Edge: Contrarian trading often requires a strong mental game. Since it goes against the prevailing market sentiment, it can be psychologically challenging. However, those who master this strategy can benefit from the ability to remain calm and rational in the face of overwhelming market bias[5]

How to Implement Contrarian Strategies in Forex Trading

Contrarian strategies require careful analysis and precise timing. Here’s how Indian forex traders can effectively use these strategies:

1. Identify Overbought and Oversold Conditions

The first step in contrarian trading is identifying overbought and oversold conditions in the forex market. Tools such as the Relative Strength Index (RSI) or Stochastic Oscillator are often used to spot when a currency pair may be overbought (indicating a potential sell) or oversold (indicating a potential buy).

- RSI: When RSI is above 70, the currency pair is considered overbought, and when it is below 30, it’s considered oversold.

- Stochastic Oscillator: This indicator shows momentum and is helpful in identifying overbought and oversold conditions, typically considered above 80 for overbought and below 20 for oversold.

Once these conditions are identified, contrarian traders can look for reversal signals.

2. Use Price Action to Confirm Reversal Signals

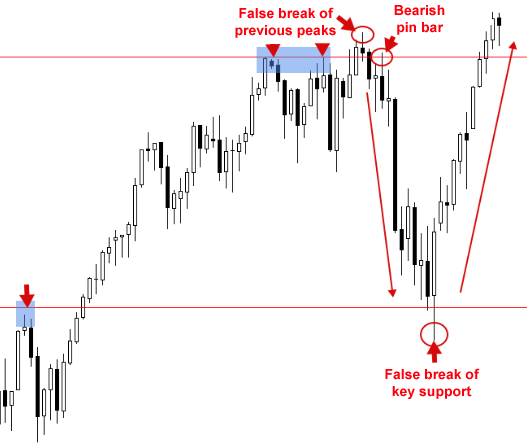

Contrarian trading is not just about technical indicators. Price action analysis is a key component. Look for candlestick patterns like doji, hammer, engulfing candles, and pin bars, which signal potential reversals.

For example, a strong bullish move followed by a bearish reversal candlestick could indicate that the uptrend is losing momentum, and a contrarian trader might take a short position.

3. Analyze Market Sentiment

Sentiment analysis is crucial for contrarian strategies. If the majority of the market is overly bullish or bearish, it might be time for a reversal. Traders can gauge market sentiment through tools like Commitment of Traders (COT) reports or by analyzing news and social media platforms for signs of over-enthusiasm or fear.

In India, local sentiment can also be affected by domestic economic events such as changes in government policies, interest rate announcements by the Reserve Bank of India (RBI), or shifts in global economic conditions. Contrarian traders should monitor these factors to identify potential turning points in the market.

4. Look for Divergence

Divergence occurs when the price moves in one direction while an indicator (like the RSI or MACD) moves in the opposite direction. This often signals a potential reversal. For example, if the price is making new highs while the RSI is not, it could indicate that the uptrend is losing strength and a reversal may be imminent.

5. Wait for Confirmation

Before executing a trade, contrarian traders must wait for confirmation of the reversal. This could come in the form of a breakout from a trendline, a candlestick pattern, or a shift in momentum as indicated by technical indicators. Confirmation helps to reduce the risk of false signals.

Advantages of Contrarian Strategies in Forex Trading in India

- Profit from Market Extremes: Indian forex traders can use contrarian strategies to take advantage of significant price swings when the market overreacts to news or economic events, capitalizing on reversals at extreme price points.

- Access to Non-Traditional Opportunities: By going against the herd, contrarian traders have access to unique opportunities that may be overlooked by trend-following traders. This can result in more diverse trading opportunities in the Indian forex market.

- Better Risk/Reward Ratio: Contrarian trades tend to have better risk/reward ratios, especially when they are taken at major price levels where reversals are likely. Traders can set smaller stop-loss levels while anticipating a larger price move.

Common Mistakes to Avoid in Contrarian Trading

- Overtrading: Contrarian trading requires patience. Traders must wait for clear reversal signals, and overtrading can lead to poor results. Be selective about trade entries and avoid chasing the market.

- Ignoring Fundamental Analysis: While technical indicators and price action are important, contrarian traders should also pay attention to fundamental factors that drive market sentiment. Ignoring the broader economic environment can lead to costly mistakes.

- Entering Too Early: Patience is crucial in contrarian trading. Entering a trade too early before confirmation can lead to losses. Always wait for strong evidence of a reversal before taking a position.

Conclusion

Contrarian strategies in forex trading offer Indian traders a unique approach to the market, focusing on identifying reversals when the majority is overly optimistic or pessimistic. By using technical indicators, price action, and sentiment analysis, contrarian traders can spot opportunities where others may see risks. While challenging, with practice and careful risk management, contrarian strategies can become a powerful tool for forex traders in India looking to capitalize on market extremes.

FAQ

1. What is the best time to use contrarian strategies in forex trading?

Contrarian strategies work best when market sentiment becomes overly one-sided, either too bullish or too bearish. This can happen during major news events, economic announcements, or after significant price moves. Identifying overbought or oversold conditions using indicators is also helpful.

2. Are contrarian strategies suitable for beginners in forex trading in India?

Contrarian strategies can be challenging for beginners, as they require a good understanding of market sentiment, technical indicators, and price action. However, with practice and experience, it is possible for beginners to incorporate contrarian strategies into their trading approach.

3. Can contrarian strategies be combined with other trading strategies?

Yes, many experienced traders combine contrarian strategies with trend-following methods or technical indicators. For instance, using moving averages to identify the overall trend while relying on contrarian strategies to spot reversals can offer a balanced approach.

4. How can I manage risk when using contrarian strategies?

Risk management is crucial in contrarian trading. Always use stop-loss orders to protect against significant losses, and ensure that your risk/reward ratio is favorable. Contrarian traders can set stop-loss orders just outside key support or resistance levels to minimize risk.