AUTHOR : ROSELLA LEE

Forex trading has evolved considerably in India over the past decade. Traders are constantly seeking new techniques and strategies to stay ahead of the market, and one such advanced approach is Forex Trading Advanced Market Profiling India[1]. This strategy allows traders to gain deep insights into market behavior and make more informed decisions based on data-driven analysis.

In this article, we will explore what Forex Trading Advanced Market Profiling[2] India is, how it works, its benefits, and how Indian traders[3] can use it to improve their trading skills and profits. How-do-I-get-money-back-from-a-Forex-scammer-in-India?

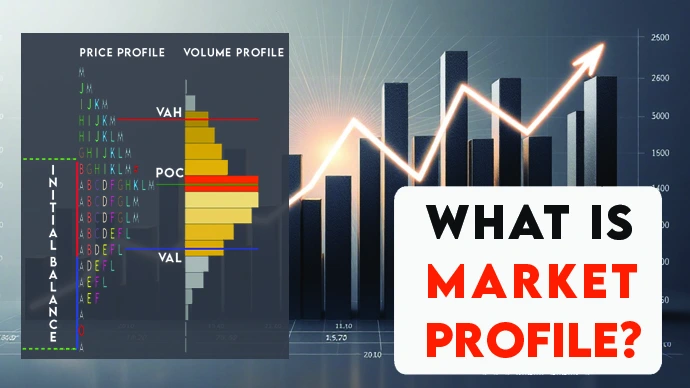

What is Forex Trading Advanced Market Profiling?

Forex Trading[4] Advanced Market Profiling is an analytical approach used to understand the behavior of financial markets, specifically the foreign exchange (Forex) market. Market profiling involves organizing price and volume data to visualize market activity, making it easier for traders to identify trends and patterns. The idea behind advanced market profiling is to analyze how price levels interact with volume and time to predict future movements.

In Forex Trading Advanced Market[5] Profiling India, the goal is to understand the underlying market structure, particularly the buying and selling dynamics, to gain a competitive edge. Professional traders often use it to improve their market timing, spot key price levels, and optimize risk management.

Key Components of Advanced Market Profiling

Volume at Price Levels

Trade volume analysis is one of the most crucial aspects of advanced market profiling. Volume represents the number of trades that occur at a specific price level. By examining volume at various price points, traders can identify price levels where significant market participants are active. These levels are often crucial support and resistance zones.

Market Auction Theory

The concept of market auction theory helps traders understand how prices move in the market. It proposes that price moves based on the buying and selling actions of market participants, akin to an auction. In Forex Trading Advanced Market Profiling India, market auction theory helps traders predict how prices will react to supply and demand dynamics in various market conditions.

Value Area and Point of Control (POC)

In advanced market profiling, the Value Area (VA) and Point of Control (POC) are critical concepts. The Value Area is the price range where the majority of trading occurs. The Point of Control is the price level where the most volume is traded. By analyzing these areas, traders can identify potential support and resistance levels and spot potential reversals.

Market Profile Charts

Market profile charts provide a visual representation of price action and volume at different price levels. These charts help traders see where significant trading activity has occurred and where prices are likely to move in the future. The charts typically display price on the vertical axis and time on the horizontal axis, making it easy to spot trends and patterns.

How to Use Advanced Market Profiling in Forex Trading

Analyze Market Structure

The first step in applying Forex Trading Advanced Market Profiling India is to analyze the overall market structure. This involves identifying whether the market is in an uptrend, downtrend, or sideways consolidation phase. By understanding the market structure, traders can focus on trades that align with the current trend.

Identify Key Support and Resistance Levels

Using volume analysis and market profile charts, traders can identify key support and resistance levels. These levels act as psychological barriers where the market tends to reverse. By identifying these critical price levels, traders can strategically time their entries and exits to maximize potential gains.

Monitor the Point of Control (POC)

The Point of Control (POC) signifies the price level with the highest trading volume, often acting as a magnet for market prices due to its significance in balancing supply and demand. Traders can leverage the POC not only to set more precise stop-loss orders but also to identify optimal entry points, as price action often tends to revert toward this level, making it a reliable indicator for potential market turns.

Watch for Market Profile Patterns

Advanced market profiling uncovers distinct patterns in both price and volume, offering key insights into potential market shifts. Patterns such as the “Double Distribution” or “Trend Day” serve as powerful indicators, enabling traders to pinpoint high-probability breakout zones or reversal points, thus enhancing their ability to make timely and informed trading decisions.

Use Advanced Indicators

While Forex Trading Advanced Market Profiling India focuses on price and volume, traders can also incorporate advanced technical indicators to complement their market profile analysis. Indicators like the Volume Weighted Average Price (VWAP), Market Delta, and Market Profile Volume can help fine-tune trading decisions.

Tools for Forex Trading Advanced Market Profiling in India

To get the most out of Forex Trading Advanced Market Profiling India, traders rely on specialized tools that provide the necessary data for analysis. Some popular tools include:

- MetaTrader 4/5: These platforms offer various indicators and charting tools that can assist in market profiling. The Volume Profile indicator is often used in conjunction with these platforms to track volume distribution.

- TradingView: This web-based platform provides excellent charting capabilities, including the Volume Profile indicator, which is essential for market profiling.

- NinjaTrader: Known for its advanced charting and analysis tools, NinjaTrader offers a comprehensive suite of market profiling tools for Forex traders.

- Sierra Chart: A robust platform for advanced charting and market analysis, Sierra Chart provides in-depth profiling tools for traders looking to incorporate advanced techniques into their strategies.

Conclusion

Forex Trading Advanced Market Profiling India is an invaluable tool for traders looking to improve their trading strategies and increase profitability. By analyzing price and volume data, traders can gain insights into market behavior and make informed decisions. Whether you’re a beginner or an experienced trader, mastering market profiling techniques can significantly enhance your trading outcomes.

(FAQs)

1. What is the best way to start learning about Forex Trading Advanced Market Profiling India?

To start learning, focus on familiarizing yourself with market profile tools like the Volume Profile and Time Price Opportunity charts. Practice using these tools on a demo account before applying them to live trading.

2. How does market profiling help in day trading?

Market profiling helps day traders identify key support and resistance levels, understand price action, and time their entries and exits more effectively.

3. Can Forex Trading Advanced Market Profiling India be used for long-term trading?

Yes, market profiling can be applied to both short-term and long-term trading strategies, helping traders identify significant levels and trends that impact long-term positions.

4. Is Forex Trading Advanced Market Profiling suitable for beginners?

While market profiling is an advanced technique, beginners can still benefit from learning the basics of volume analysis and price action. It’s recommended to practice on demo accounts before trading with real money.

5. Are there any risks associated with Forex Trading Advanced Market Profiling in India?

As with any trading strategy, there are risks involved, including incorrect analysis or poor risk management. Traders should use proper risk management techniques to mitigate these risks.