AUTHOR: SNOW WHITE

Introduction

Forex trading[1], also known as foreign exchange trading, is the process of exchanging one currency for another in the global financial market. As one of the largest and most liquid financial markets, forex attracts traders from all over the world. However, when it comes to Indian residents, the question arises: Can they trade forex internationally? This article explores the legal aspects, available options, and potential risks for Indian traders[2] looking to engage in international forex markets. Is Finq.com a scam or a good forex broker?

Legal Framework Governing Forex Trading in India

Reserve Bank of India (RBI) Regulations

In India, forex trading is regulated by the Reserve Bank of India (RBI), the central bank of the country. The RBI is responsible for managing India’s foreign exchange reserves and overseeing the foreign exchange market. Indian residents are subject to restrictions when it comes to trading currencies on international platforms[3] due to concerns about capital flows, currency stability, and speculative risk.

FEMA (Foreign Exchange Management Act)

The Foreign Exchange Management Act (FEMA) regulates all transactions involving foreign exchange within India. FEMA restricts Indian residents from participating in direct forex trading on foreign platforms. The primary purpose of these regulations is to control capital flows out of the country and ensure that currency trading does not destabilize the Indian Rupee (INR)[4].

Can Indian Residents Trade Forex Internationally?

Direct Forex Trading on International Platforms

Indian residents are not permitted to trade forex directly on international platforms or with foreign brokers. This restriction is in place to ensure that individuals do not circumvent the country’s foreign exchange laws and engage in speculative activities that could affect India’s economy[5]. According to FEMA guidelines, participating in cross-border forex transactions without authorization is prohibited. Which Forex broker can I trust?

Indirect Methods to Trade Forex

Indian residents can engage in forex trading through alternative routes, despite restrictions on direct participation in international markets. These methods allow traders to access global currency markets in a compliant manner.

1. Currency Futures on Indian Exchanges

Indian traders can legally trade currency futures on domestic exchanges such as the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE). Currency futures are financial contracts that allow traders to speculate on the future value of specific currencies, such as the US Dollar (USD), Euro (EUR), or Japanese Yen (JPY). Indian authorities regulate these contracts, settling them in Indian Rupees (INR) to ensure full compliance with local laws.

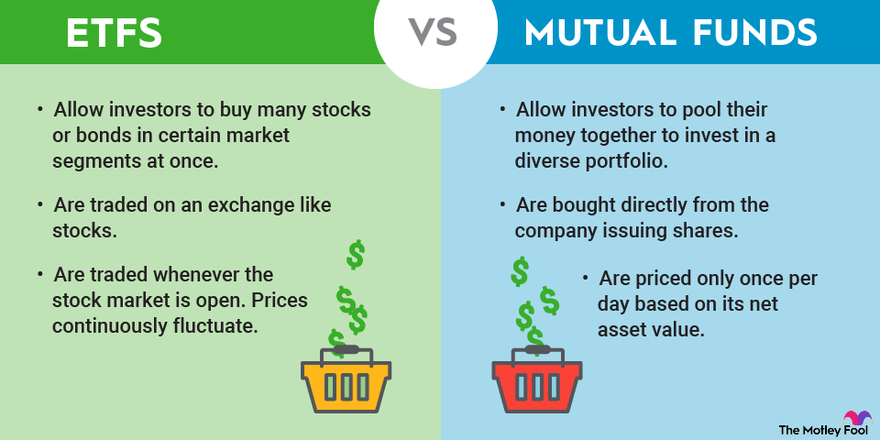

2. Forex-Linked Mutual Funds or ETFs

Another way to gain exposure to the forex market is through forex-linked mutual funds or exchange-traded funds (ETFs). These funds invest in foreign currencies or currency-related assets and are available for Indian investors. By investing in these funds, traders can indirectly benefit from global currency fluctuations while staying within Indian regulatory frameworks. Which Forex broker do traders trust?

3. Offshore Forex Brokers (With Caution)

Some Indian residents may choose to trade with offshore forex brokers based in jurisdictions where regulations are less strict. While not illegal, this method comes with several risks, including:

- Regulatory Issues: Offshore brokers are not regulated by Indian authorities, which can lead to issues related to fraud or manipulation.

- Tax Implications: Profits earned from offshore forex trading must be reported to Indian tax authorities, and failure to do so can result in penalties.

It is advisable for traders to carefully assess the risks before engaging with offshore brokers and to ensure they comply with Indian tax laws.

Risks and Challenges

Regulatory Risks

Engaging in forex trading through unregulated foreign brokers can expose Indian traders to significant risks. Since these brokers are not governed by Indian laws, there may be no recourse for traders in case of disputes or fraud. Additionally, bypassing Indian regulations could lead to legal consequences under FEMA.

Taxation Issues

Forex trading profits are taxable in India. Traders must report their earnings accurately to avoid legal issues. Tax authorities categorize profits from forex trading as short-term or long-term capital gains based on the holding period.

Volatility and Speculation Risks

Forex trading is highly speculative and subject to significant volatility. Currency prices can change rapidly due to global events, economic data releases, and geopolitical factors. Traders should be aware of the risks involved and trade cautiously.

Conclusion

Indian residents cannot directly trade forex internationally due to restrictions set by the RBI and FEMA. However, they can still participate in the global forex market through alternatives such as currency futures on domestic exchanges, forex-linked mutual funds, and ETFs. Trading with offshore brokers is an option but carries significant risks, including regulatory concerns and tax implications. It is crucial for Indian traders to understand the legal framework and seek professional advice before engaging in forex trading.

FAQ

1. Is forex trading legal in India?

Yes, forex trading is legal in India, but it is highly regulated. Indian residents can trade forex through domestic exchanges or invest in forex-linked funds, but they cannot trade directly on foreign platforms.

2. Is it possible for Indian residents to engage in forex trading through foreign brokers?

Indian residents cannot trade directly on international forex platforms but can use offshore brokers to access markets. However, this comes with significant risks related to regulation, tax implications, and fraud.

3. What are currency futures?

Currency futures are financial contracts that allow traders to speculate on the future value of a specific currency. Indian traders engage in forex trading through contracts traded on domestic exchanges like NSE and BSE, ensuring regulation.

4. Are forex trading profits taxable in India?

Indeed, earnings from forex trading are subject to taxation in India. Tax authorities classify gains as short-term or long-term capital gains based on the currency’s holding period. Traders must report these profits to the tax authorities.

5. Can I trade forex through mutual funds in India?

Yes, Indian residents can invest in forex-linked mutual funds or ETFs, which provide indirect exposure to the forex market without violating Indian regulations. These funds invest in foreign currencies or related assets.