Author: Shin Hari

Introduction

Scalping in the forex market is a fast-paced trading strategy where traders aim to make small profits from minor price movements. Traders using this strategy usually enter and exit the market within minutes or even seconds. In India, where forex trading has seen significant growth, scalping has become increasingly popular due to its potential to generate consistent profits over time. However, to succeed in scalping, traders need to use reliable indicators that can offer quick and accurate insights into market movements. In this article, we will discuss the best forex trading indicators for scalping in India, and how they can help traders improve their performance. How do I trade Forex legally from India

What is Forex Scalping?

Forex scalping is a strategy that involves making a large number of trades to capture small price movements. A scalper typically holds a position for just a few minutes, sometimes even seconds, making it a high-speed, high-frequency trading strategy[1]. In India, with the booming forex market, many traders prefer scalping because it can potentially lead to consistent profits without needing to wait for long-term trends to develop.

The Role of Forex Trading Indicators

In scalping indicators[2] are crucial because they help traders quickly identify entry and exit points. These indicators analyze price patterns, volume, and other data, providing signals that help in making swift decisions. Scalping requires tools that can react fast and give accurate results in a short time. So, let’s dive into the best indicators for scalping

Importance of Forex Indicators for Scalping

Indicators are essential tools for forex scalping[3] as they help traders identify entry and exit points with precision. Scalpers need to react quickly to price movements, and indicators allow them to make informed decisions based on data and analysis, rather than relying on gut feelings. These indicators help determine the strength of trends, potential reversal points, and overall market conditions. Some of the most effective indicators for scalping are momentum indicators, oscillators, and moving averages. Let’s explore the most popular ones.

Best Forex Indicators for Scalping in India

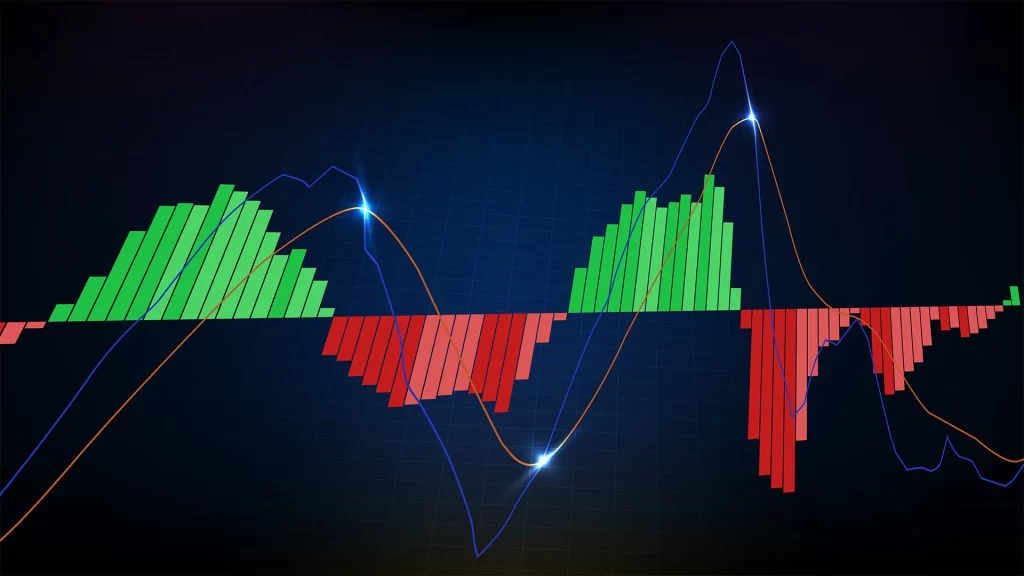

1. Moving Average Convergence Divergence (MACD)

The MACD is a versatile momentum indicator that helps traders identify potential buy or sell signals by comparing the difference between two moving averages. The MACD is often used in scalping because it is excellent at spotting changes in momentum and trend reversals in real-time. Scalpers typically look for crossovers between the MACD line and the signal line to identify trading opportunities.

2. Relative Strength Index (RSI)

The RSI is one of the most widely used indicators in forex trading[4], especially for scalping. It measures the strength of a price movement and indicates whether an asset is overbought or oversold. The RSI operates on a scale from 0 to 100, and readings above 70 suggest overbought conditions, while readings below 30 suggest oversold conditions.

3. Bollinger Bands

Bollinger Bands are a volatility indicator that consists of a simple moving average (SMA) with two standard deviation lines plotted above and below it. The width of these bands adjusts by expanding and contracting in response to market volatility. When the price approaches the upper or lower bands, it can signal that the currency pair is either overbought or oversold, making it an excellent tool for scalpers to identify potential entry points.

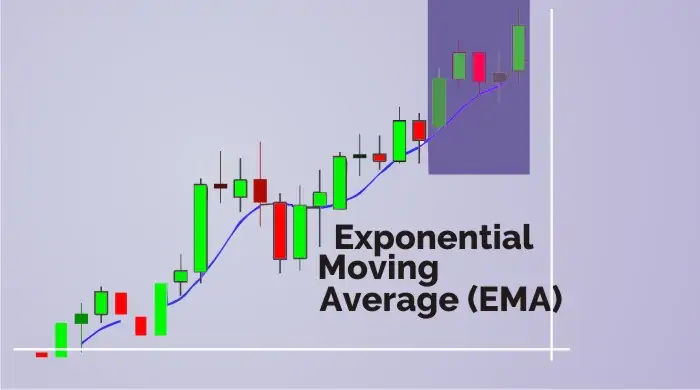

4. Exponential Moving Average (EMA)

The EMA is similar to the simple moving average (SMA) but gives more weight to recent price action, making it more sensitive to recent price changes. The EMA is widely used in scalping because it helps traders follow short-term trends with more precisions.

5. Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator that helps traders determine whether an asset is overbought or oversold. It works by comparing the closing price of a currency pair to its price range over a specific period.

Why Scalpers Prefer These Indicators

Scalpers need indicators that can provide quick and reliable signals in a fast-moving market. The indicators mentioned above are ideal because they offer a blend of speed and accuracy. These indicators help traders spot trends, reversals, and price momentum in real-time, which is essential for making rapid trading decisions. Scalpers in India prefer these indicators because they can react quickly to price movements in the forex market, maximizing their chances of profitable trades.

Combining Multiple Indicators for Better Scalping Results

While using a single indicator can be helpful, combining multiple indicators often provides more reliable results. For example, combining MACD with RSI can give both momentum and trend signals, making it easier to confirm entry and exit points. Similarly, using EMA with Bollinger Bands can help confirm the strength of a trend and volatility, providing a more comprehensive trading strategy.

Tips for Using Indicators in Scalping

- Timeframe Considerations: Scalpers usually focus on very short timeframes, such as the 1-minute or 5-minute charts. The faster the chart, the quicker the signals, which is ideal for scalping.

- Adapt to Market Conditions: The forex market can change quickly. It’s essential to adjust your scalping strategy based on current market conditions. Indicators should be fine-tuned regularly to stay effective.

- Risk Management: Scalping requires tight risk management[5] due to the quick nature of the trades. Use stop-loss orders to minimize potential losses and avoid over-leveraging.

Scalping in India: Key Considerations

In India, forex trading is gaining momentum, but it is important to consider local regulations. Scalping is allowed in India, but traders should ensure they comply with the rules set by the Reserve Bank of India (RBI) and other regulatory bodies. Additionally, traders should choose brokers who offer competitive spreads and fast execution speeds, which are critical for successful scalping.

Conclusion

For scalpers in India, selecting the right forex indicators is crucial to success. Indicators such as MACD, RSI, Bollinger Bands, EMA, and the Stochastic Oscillator are all excellent tools for identifying quick trading opportunities. By understanding how these indicators work and using them in combination, traders can improve their scalping strategies and increase their chances of consistent profits.

FAQs

- What is the best time frame for scalping in forex trading?

Scalpers typically use timeframes of 1 minute or 5 minutes for optimal trade execution. - Can I use scalping strategies on any currency pair?

Scalping works best with highly liquid currency pairs like EUR/USD, GBP/USD, and USD/JPY. - What’s the risk of using multiple indicators in scalping?

Overloading with indicators can lead to conflicting signals. It’s best to use a few complementary indicators for more reliable results. - How much capital do I need to start scalping in India?

You can start scalping with a small amount of capital, but it’s important to have enough margin for quick trades. - Are there any legal concerns for forex scalping in India?

Forex trading, including scalping, is legal in India as long as traders follow regulations and use licensed brokers.