Introduction

In the ever-evolving world of forex trading[1], technological advancements have significantly reshaped how traders approach the market. Among these innovations, neural networks[2] have emerged as a powerful tool for predicting price movements and making informed trading decisions[3]. Neural networks, a subset of artificial intelligence (AI), have the potential to analyze vast amounts of market data and uncover patterns that might be hidden from the human eye.

In India, where forex trading is gaining popularity, understanding how to integrate neural network-based trading strategies[4] can offer a substantial edge to both beginner and experienced traders. This guide will delve into the fundamentals of neural networks in forex trading, explore effective strategies, and provide actionable insights for Indian traders looking to harness the power of AI for better trading outcomes[5].

What Are Neural Networks in Forex Trading?

. It consists of interconnected layers of nodes (or neurons) that process information and make predictions based on input data. In the context of forex trading, neural networks are used to analyze historical market data, identify patterns, and generate forecasts regarding currency price movements.

Neural networks are a critical component of machine learning (ML), where algorithms learn from data over time, improving their accuracy with each iteration. In forex trading, these networks can analyze price trends, economic data, sentiment analysis, and other factors that impact currency values.

How Neural Networks Work in Forex Trading

Neural networks use a multi-layered structure where each layer of neurons processes specific aspects of the data, allowing for complex pattern recognition. Here’s how neural networks are used in forex trading:

1. Data Collection and Preprocessing

Neural networks rely on large datasets, which can include historical price data, trading volume, economic indicators, and even news sentiment. This data must be preprocessed to remove noise and ensure it is in a format suitable for analysis.

2. Training the Model

Once the data is ready, the neural network undergoes a training phase. During training, the network learns from the patterns in the data by adjusting the weights of connections between neurons.Forex trading neural network trading strategies India

3. Prediction Generation

After training, the neural network is ready to make predictions. It processes new, real-time data and produces output predictions, such as the likely direction of a currency pair (up or down) or the future price levels of a pair.

Key Benefits of Neural Network Trading Strategies in India

Neural network-based trading strategies offer a range of benefits for forex traders, particularly in the Indian market, where currency volatility is influenced by global and local factors. Here are the main advantages of using neural networks in forex trading:

1. Data-Driven Decisions

Neural networks can analyze vast amounts of data, eliminating emotional biases and decision fatigue. Indian traders can rely on AI-generated signals for more objective, data-driven trading decisions.

2. Pattern Recognition

Neural networks are highly effective at identifying complex, non-linear patterns in forex data. These patterns may not be easily noticeable through traditional technical analysis, giving traders an edge in recognizing future price trends.

3. Adaptability

One of the most notable features of neural networks is their ability to adapt over time. The more data they process, the better they get at predicting currency movements. This continuous learning allows Indian traders to stay ahead of market changes and capitalize on emerging opportunities.

4. Risk Mitigation

Neural networks can help identify potential risk factors by analyzing market volatility, price trends, and economic indicators. By incorporating these insights into risk management strategies, traders can better protect their investments from large losses.

Effective Neural Network Strategies for Forex Trading in India

To leverage neural networks in forex trading, Indian traders must integrate effective strategies into their approach. Below are some popular neural network-based strategies:

1. Predictive Modeling Using Historical Data

This strategy involves training a neural network on historical price data, allowing it to predict future price movements. Indian traders can use this model to forecast short-term trends in major currency pairs like USD/INR, EUR/INR, and GBP/INR.

- Inputs: Historical closing prices, trading volume, economic data.

- Output: Predicted price movement (up, down, or neutral).

2. Sentiment Analysis with Natural Language Processing (NLP)

Another strategy involves using natural language processing (NLP) techniques to analyze news articles, social media, and financial reports for sentiment.

- Inputs: news headlines, social media posts, economic reports.

- Output: Sentiment score, predicting potential market impact.

3. Time-Series Forecasting

Time-series forecasting is a technique used to predict future currency prices based on past price trends. Neural networks can be trained on time-series data, which helps traders identify short-term and long-term trends in currency markets.

- Inputs: Historical time-series data (price, volume).

- Output: Future price prediction for a currency pair.

4. Reinforcement Learning for Optimizing Trading Decisions

Reinforcement learning is a branch of machine learning where the neural network learns to optimize its actions through trial and error. By receiving feedback on past trading decisions, the network continuously improves its strategy, resulting in more effective forex trades.

- Inputs: market data, trading decisions, feedback.

- Output: Optimized trading actions based on feedback.

5. Portfolio Management with Neural Networks

This helps reduce exposure to highly volatile currencies and balance risk across various assets.

- Inputs: Historical data for multiple currency pairs.

- Output: Recommended portfolio allocations and risk levels.

Neural Network Tools and Platforms for Forex Trading in India

Several platforms and tools allow Indian traders to implement neural network-based strategies for forex trading. Here are a few options:

1. MetaTrader 4/5 with Neural Network Plugins

MetaTrader platforms are widely used by forex traders. These platforms support AI-driven plugins that integrate neural network strategies to generate trading signals and automate trade execution.

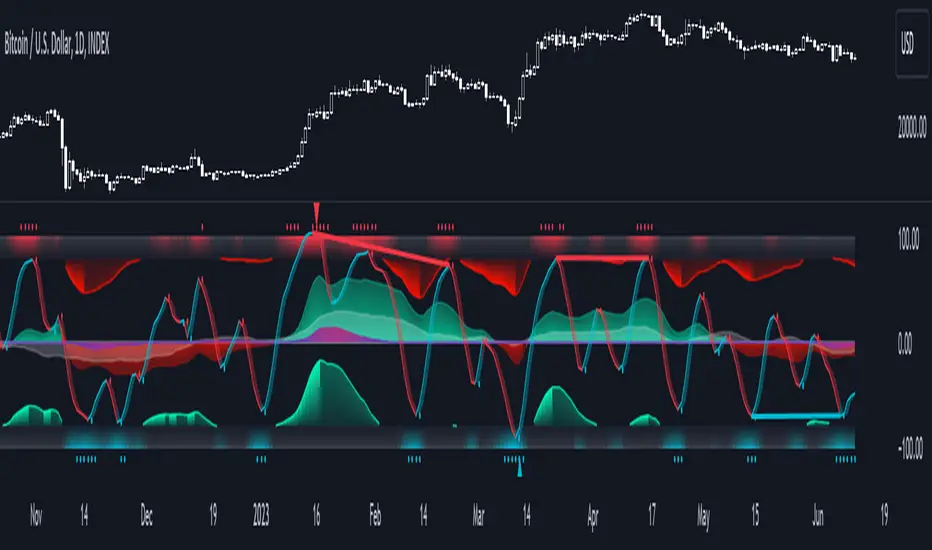

2. TradingView with Machine Learning Indicators

TradingView offers advanced charting tools and the ability to integrate machine learning indicators. Traders can incorporate AI-powered predictions into their analysis and trading decisions.

3. Custom Neural Network Models

For advanced traders, building custom neural network models using Python libraries such as TensorFlow or Keras can provide greater flexibility and control over the trading strategy.

Conclusion

Neural network-based strategies offer Indian forex traders a powerful tool for navigating the complexities of the forex market. By leveraging data-driven insights, recognizing hidden patterns, and automating trading decisions, traders can gain a significant edge in a competitive market. Whether you are new to forex trading or an experienced trader looking to incorporate advanced AI techniques, neural networks can help enhance your trading strategies and improve your overall success in the forex market.

FAQ:

1. What is a neural network in forex trading?

A neural network in forex trading is an AI-based system that analyzes historical and real-time data to predict future price movements of currency pairs. It learns from data and continuously improves its predictions over time.

2. How can neural networks improve my forex trading strategy?

Neural networks can enhance your forex trading strategy by identifying hidden patterns in market data, generating accurate predictions, and automating trade decisions, leading to more data-driven and efficient trading.

3. What are the key benefits of using neural networks in forex trading in India?

The main benefits include improved accuracy in predictions, risk reduction through data-driven decisions, adaptability to market changes, and the ability to automate trading for greater efficiency.

4. Can neural networks be used for long-term forex predictions?

Yes, neural networks can be used for both short-term and long-term predictions by analyzing historical data and identifying trends that influence currency values over time.

5. Are neural networks suitable for beginner forex traders in India? While neural networks can be complex, beginner traders in India can start by using AI-powered platforms with pre-built neural network models. As they gain experience, they can move on to more advanced custom models.