AUTHOR : BERRY

Forex Trading Statistical Arbitrage in India: A Comprehensive Guide

Forex trading[1] has garnered significant attention in India as both institutional and retail traders are increasingly involved in the global currency market[2]. Among the various strategies available to traders, statistical arbitrage (stat arb) has emerged as one of the more sophisticated and potentially profitable methods. This article delves into the concept of statistical arbitrage in Forex trading, its applications in India, and how traders can leverage it for success.

What is Statistical Arbitrage in Forex Trading?

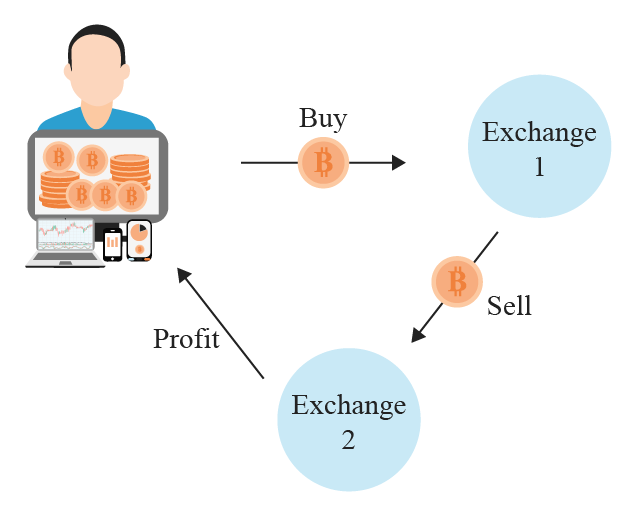

Statistical arbitrage is a strategy that involves using mathematical models and statistical techniques to identify mispricings in currency pairs, aiming to profit from the convergence or divergence of prices. Unlike traditional arbitrage[3], which takes advantage of price discrepancies between two markets or exchanges, statistical arbitrage in Forex trading relies on historical price data and complex algorithms to predict future price movements.

The primary principle behind stat arb is that currency pairs have a tendency to move in correlation over time. When these correlations break down due to short-term fluctuations or inefficiencies, traders can exploit the opportunity to buy undervalued pairs and sell overvalued ones, hoping the prices will eventually revert to their historical norms.

Statistical Arbitrage in the Indian Forex Market

The Growing Forex Market in India

India’s Forex market has experienced [4]rapid growth, with both retail and institutional participation increasing over the past decade. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) regulate the Forex market[5], and the country’s increasing connectivity to global markets has made it an attractive hub for Forex trading. This growth has opened new opportunities for traders, especially those looking to implement sophisticated trading strategies like statistical arbitrage.

Statistical arbitrage, although traditionally used by institutional traders, has gained popularity among Indian retail traders, especially with the advent of algorithmic trading platforms and low-cost trading accounts. The Indian Forex market, characterized by high volatility and liquidity, is an ideal environment for such strategies to succeed.

Tools for Statistical Arbitrage

To implement a statistical arbitrage strategy in Forex trading, traders need access to the right tools and technologies. Some of the most important tools include:

- Statistical Models: Traders use time-series analysis, cointegration models, and machine learning algorithms to identify correlations and trends in currency pairs. These models predict future price movements based on historical data, and they serve as the backbone for statistical arbitrage strategies.

- Trading Platforms: Sophisticated trading platforms are required for executing statistical arbitrage strategies, which often involve high-frequency trading (HFT). Platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and other advanced algorithmic trading systems allow traders to test, optimize, and deploy their models.

- Backtesting Software: Traders often backtest their strategies using historical data to determine their potential profitability. By running simulations, they can evaluate how their statistical arbitrage model would have performed in different market conditions.

How Statistical Arbitrage Works in Forex Trading

Statistical arbitrage strategies rely on quantitative models and extensive data analysis. Here’s an overview of how this process works:

1. Data Collection

The first step in a statistical arbitrage strategy is gathering large volumes of historical price data for various currency pairs. This data is essential for creating the statistical models that will identify correlations and potential inefficiencies in pricing.

2. Identifying Correlations

Once the data is collected, traders analyze it to identify correlations between different currency pairs. Correlation can be positive (when two currencies move in the same direction) or negative (when they move in opposite directions). A high correlation between two currency pairs is a strong indicator that they may move together in the future.

3. Algorithmic Trading Models

Using advanced algorithms, traders create models that identify instances when the correlation between two or more currency pairs diverges beyond historical norms. When such divergences occur, traders take advantage of the price discrepancy, assuming the prices will eventually converge back to their historical relationship.

4. Execution and Monitoring

Once the model signals a trade opportunity, it is executed using an automated trading system. Since statistical arbitrage often relies on quick, high-frequency trades, these systems are designed to execute positions in real-time, minimizing the risk of missing an opportunity. Traders continuously monitor the system to adjust the models as needed.

Benefits of Statistical Arbitrage for Indian Traders

1. Reduced Market Risk

Statistical arbitrage aims to profit from the relative price movements of currency pairs, rather than predicting the general direction of the market. This reduces exposure to market risk, as the strategy focuses on inefficiencies within the market rather than betting on broad market trends.

2. Potential for High Returns

When executed correctly, statistical arbitrage can generate consistent returns by exploiting small price discrepancies. Given that Forex markets are highly liquid, these opportunities can be frequent, offering multiple chances for profit. However, it is important to note that high-frequency trading strategies, like stat arb, require precision and speed, which can be challenging for beginners.

3. Automation and Reduced Human Error

One of the biggest advantages of statistical arbitrage is its automation. Once a model is developed and tested, it can be set to operate with minimal human intervention. This removes the potential for human error and allows traders to take advantage of price inefficiencies 24/7, especially in global Forex markets.

Challenges of Statistical Arbitrage in India

1. High Technical Complexity

Implementing a successful statistical arbitrage strategy requires in-depth knowledge of quantitative analysis, programming, and data modeling. Traders who are not well-versed in these areas may struggle to develop and optimize profitable models.

2. Infrastructure Costs

Statistical arbitrage strategies, particularly those involving high-frequency trading, require advanced infrastructure and powerful computing resources. For Indian traders, the cost of setting up and maintaining such systems can be high, especially if they lack the technical expertise to do it efficiently.

3. Regulatory Constraints

Forex trading in India is subject to strict regulations set by the Reserve Bank of India (RBI) and SEBI. Traders must ensure that their statistical arbitrage strategies comply with Indian laws regarding foreign exchange and trading practices. Non-compliance can lead to legal issues and penalties.

Conclusion

Statistical arbitrage in Forex trading offers Indian traders the potential for significant profit by exploiting pricing inefficiencies between correlated currency pairs. While the strategy offers several advantages, including reduced market risk, potential for high returns, and automation, it also comes with challenges such as technical complexity, infrastructure costs, and regulatory considerations.

Traders interested in implementing statistical arbitrage in India must invest time in learning quantitative analysis, backtesting, and algorithmic trading. Additionally, they should ensure they have access to the necessary infrastructure and stay compliant with the country’s regulatory framework. With the right knowledge and tools, statistical arbitrage can be a highly effective strategy in the Indian Forex market.

FAQ

1. What is statistical arbitrage in Forex trading?

Statistical arbitrage in Forex trading involves using quantitative models and statistical techniques to exploit mispricings or inefficiencies in currency pairs. The strategy identifies correlations between currency pairs, and when these correlations deviate from historical norms, traders capitalize on the price discrepancies with the expectation that prices will revert to their historical relationship.

2. Is statistical arbitrage legal in India?

Yes, statistical arbitrage is legal in India as long as it adheres to the rules and regulations set by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Retail traders must ensure that their trading activities comply with India’s foreign exchange laws, particularly in relation to capital controls and permissible currency trading on recognized platforms.

3. What tools are required to implement statistical arbitrage in Forex trading in India?

To implement statistical arbitrage strategies, traders need access to sophisticated trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), along with backtesting software to test their models using historical data. They also need powerful computing infrastructure and statistical models (like time-series analysis and cointegration models) for data analysis and automated trading.

4. What are the risks of using statistical arbitrage in Forex trading in India?

The primary risks include the technical complexity of developing and maintaining trading models, the potential for high infrastructure costs, and regulatory risks. Additionally, statistical arbitrage relies on small price discrepancies, and while the strategy is designed to reduce market risk, it still carries the risk of losses if market conditions do not behave as expected or if there are errors in the trading model.

5. Can a retail trader in India profit from statistical arbitrage?

Yes, retail traders in India can profit from statistical arbitrage, but it requires a good understanding of quantitative analysis, programming, and Forex market dynamics. Successful execution also depends on having access to the right tools and infrastructure, as well as staying updated with market conditions. Due to its complexity, retail traders may find it challenging without proper expertise and resources, but with the right setup, it can be a profitable strategy.

Get It Touch

Error: Contact form not found.