AUTHOR : Kukiee Kim

Introduction

Forex trading is one of the most dynamic financial markets, and traders in India are constantly exploring profitable strategies. Among these, arbitrage trading stands out as a low-risk, high-reward approach. This blog will walk you through the fundamentals of forex arbitrage, the strategies that work in India, and the challenges traders face in this market. What are the implications of having a high Forex reserves?

What is Forex Arbitrage?

Forex arbitrage is a trading strategy that takes advantage of price differences in different markets or currency pairs to make risk-free profits. Traders exploit these inefficiencies in the forex market before the price discrepancy disappears. Arbitrage strategies are widely used by institutional traders but can also be executed by individual forex traders with the right tools and knowledge.

Types of Forex Arbitrage Strategies

Triangular Arbitrage

This strategy involves three different currency pairs where traders identify mispricings and execute a sequence of trades to profit from exchange rate disparities. For instance, if there is a difference in conversion rates between USD/INR, EUR/USD, and EUR/INR, traders can execute trades in a cycle to make a profit.

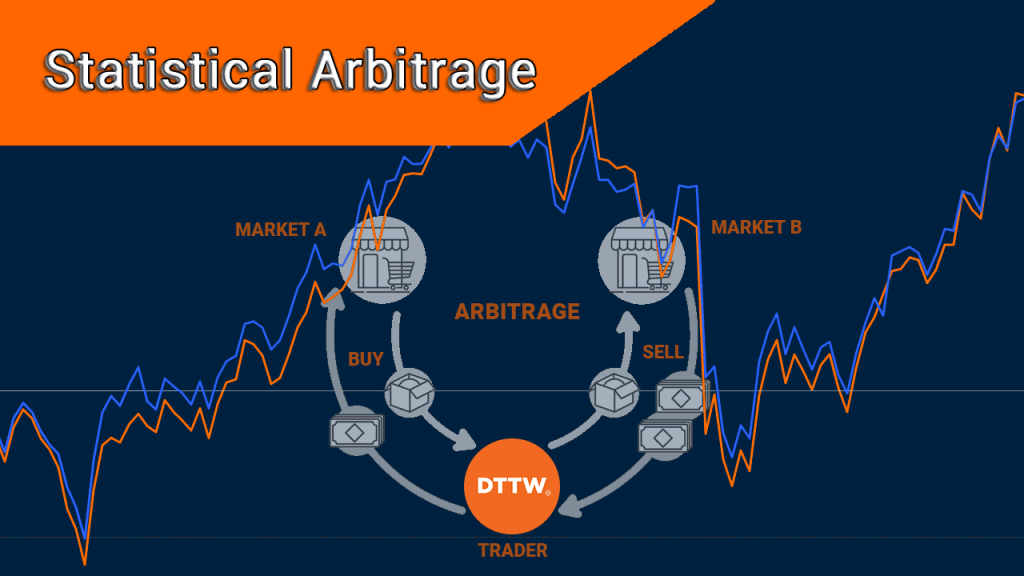

Spatial Arbitrage

Also known as geographic arbitrage[1], this strategy involves taking advantage of currency price differences between different forex exchanges. In India, forex traders can compare quotes from the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and international brokers to find arbitrage opportunities.

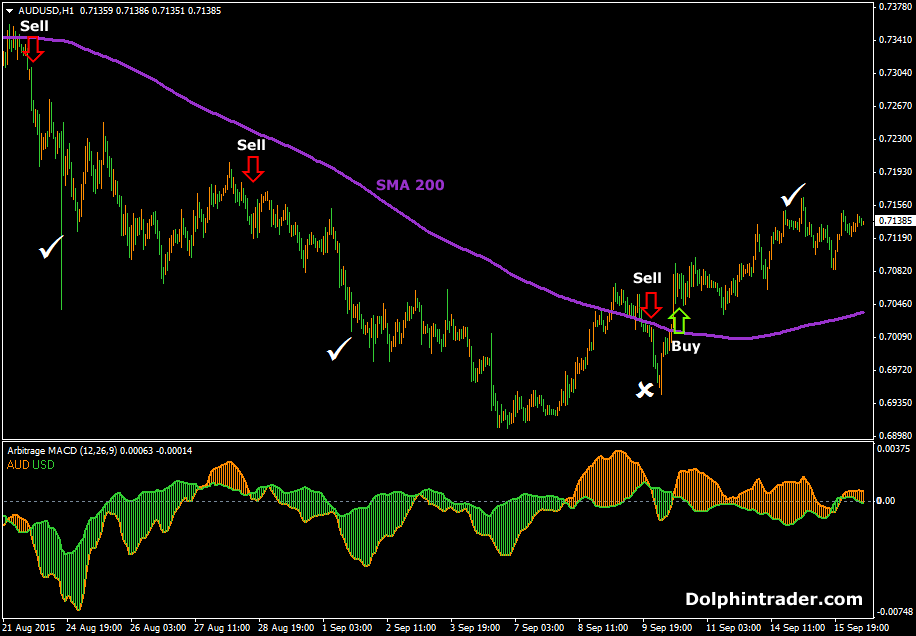

Statistical Arbitrage

Statistical arbitrage[2] relies on complex mathematical models and trading algorithms to find inefficiencies in currency pairs. Using historical data, traders identify patterns and execute automated trades to capture small but frequent gains.

Latency Arbitrage

Latency arbitrage takes advantage of price lag in different trading platforms. Traders using faster internet connections and advanced trading software can execute orders before slower traders react, gaining an edge in the forex market.

How to Trade Forex Arbitrage in India?

Step 1: Open a Forex Trading Account

You can trade currency derivatives through registered brokers on exchanges like NSE and BSE.

Step 2: Use Arbitrage Trading Tools

Arbitrage trading requires real-time data analysis, which can be done using tools like MetaTrader 4 (MT4), NinjaTrader, and proprietary arbitrage software that scans for price inefficiencies.

Step 3: Execute Trades Quickly

Since arbitrage opportunities disappear within seconds, speed is crucial. Many traders use algorithmic trading[3] bots to automate arbitrage strategies.

Step 4: Manage Risks

While arbitrage is considered low-risk, slippage, execution delays, and regulatory restrictions can impact profitability. Always monitor trades and adjust strategies accordingly.

Challenges in Forex Arbitrage Trading in India

- Regulatory Restrictions: Forex trading[4] is only allowed in USD/INR, EUR/INR, GBP/INR, and JPY/INR currency pairs on Indian exchanges.

- High Transaction Costs: Brokerage fees, spreads, and exchange commissions can reduce arbitrage profits.

- Market Volatility: Sudden price fluctuations can impact the effectiveness of arbitrage strategies.

- Technology Barriers: High-speed execution requires low-latency networks and advanced trading platforms, which may not be easily accessible to all traders.

Final Thoughts

Forex arbitrage[5] is an excellent strategy for traders looking for low-risk, systematic profits. While challenges exist, having the right tools, knowledge, and regulatory awareness can help traders in India execute arbitrage strategies successfully. If you’re new to forex trading, start with a demo account, use arbitrage trading software, and always comply with RBI and SEBI regulations.

Conclusion

Forex arbitrage strategies provide an exciting opportunity for traders to profit from market inefficiencies. However, in India, regulatory restrictions, execution speed challenges, and broker policies can limit the effectiveness of such strategies. Traders must ensure they operate within legal frameworks and use the right technology to enhance their arbitrage trading success. With careful planning and strategic execution, forex arbitrage can still be a viable trading approach within the permitted boundaries of the Indian forex market.

FAQs

Is Forex arbitrage legal in India?

Yes, forex trading and arbitrage are legal in India but are subject to strict regulations by RBI and SEBI. Only specific currency pairs are allowed for trading on recognized exchanges.

Can I use automated trading bots for arbitrage in India?

Yes, algorithmic trading is permitted on NSE and BSE, but traders must ensure compliance with regulatory guidelines.

What are the best platforms for forex arbitrage trading?

Popular platforms include MetaTrader 4 (MT4), NinjaTrader, and proprietary trading platforms offered by registered brokers.

What are the risks of forex arbitrage?

Although forex arbitrage is considered low-risk, factors like slippage, execution delays, market volatility, and regulatory changes can impact profits.

Do I need special software for forex arbitrage?

Yes, traders often use arbitrage software or trading algorithms to identify and execute trades quickly.