AUTHOR : LISA WEBB

Introduction

In the world of forex trading, traders constantly look for tools and strategies to help them make informed decisions. One such tool that has gained popularity among forex traders is the Hull Moving Average (HMA). Developed by Alan Hull in 2005, the HMA aims to provide a more accurate and responsive moving average indicator than traditional ones, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA). For traders in India, understanding how to use HMA can be particularly beneficial in navigating the highly volatile forex market. What are negative basis points in forex trading?

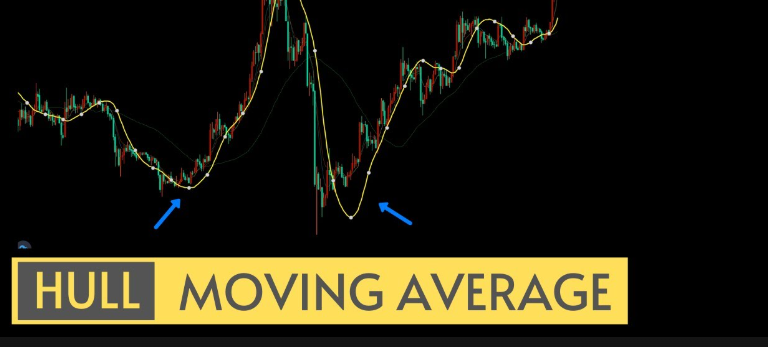

What is the Hull Moving Average (HMA)?

The HMA is an advanced technical indicator designed to reduce the traditional moving averages[1], offering faster and more accurate signals. Unlike regular moving averages[2], which take the average of prices over a set period, HMA incorporates weighted averages[3] and square roots to provide smoother price action.

The primary objective of the HMA is to capture trends faster while minimizing noise and lag. The indicator helps identify market trends, reversals, and entry/exit points by smoothing out price data and allowing traders to see trends in real time.

How Does the Hull Moving Average Work?

The HMA is built on the foundation of a weighted moving average (WMA), which gives more weight to the most recent price action.

- First, calculate the weighted moving average (WMA) for half of the period (N/2).

- Then, calculate another WMA for the full period (N).

- Subtract the WMA from step 1 from the WMA from step 2.

- Finally, apply a square root to the result, which smooths out the curve.

This calculation results in a smoother moving average line, which reacts faster to changes in price while reducing the lag that traditional moving averages suffer from.

Why Use the Hull Moving Average in Forex Trading?

Faster Signal Generation

Traditional moving averages often generate signals too late, causing traders to miss profitable opportunities. The HMA solves this problem by responding more quickly to price changes, Forex Trading Hull Moving Average India, helping traders catch trends earlier.

Reduced Lag

One of the most significant benefits of the HMA is its ability to reduce lag. Traditional moving averages can lag significantly, especially in volatile markets like forex. The HMA eliminates much of the lag and offers a more accurate representation of price trends.

Smoother Data

The HMA smooths out price fluctuations, making it easier for traders to identify trends without being distracted by market noise. This is crucial in the forex market[4], Forex Trading Hull Moving Average India, where prices can move erratically in the short term.

Trend Reversal Detection

The Hull Moving Average helps traders identify potential trend reversals by highlighting shifts in market direction. By observing the HMA’s slope and movement, traders can recognize whether a trend is starting to turn and take appropriate action.

Customizable Settings

Indian traders can easily customize the settings of the HMA based on their trading style[5] and preferences. By adjusting the period used in the calculation, Forex Trading Hull Moving Average India, traders can tailor the indicator to suit short-term or long-term trading strategies.

How to Use the Hull Moving Average in Forex Trading?

Identifying Trends

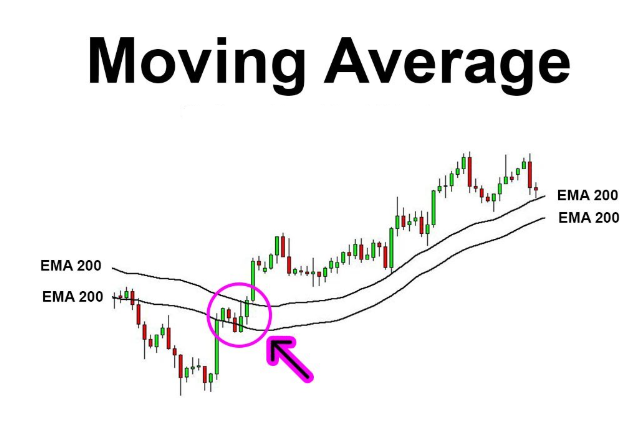

The primary use of the HMA is to identify the prevailing trend in the forex market. When the HMA line is sloping upward, it signals an uptrend, while a downward sloping HMA indicates a downtrend. Traders can enter buy positions in an uptrend and sell positions in a downtrend.

Confirming Entries and Exits

The HMA can act as a confirmation tool for entry and exit points. For example, when the price crosses above the HMA line, it could indicate a potential buy signal. Conversely, when the price falls below the HMA line, it could signal a sell opportunity. Traders can use this along with other indicators.

Avoiding False Signals

The HMA is effective at reducing false signals by filtering out noise in the market. However, no indicator is perfect, so traders should always use the HMA in conjunction with other tools, such as support and resistance levels, candlestick patterns, or fundamental analysis, to confirm trends.

HMA in Action: Example for Indian Traders

Let’s say you’re an Indian trader who specializes in the USD/INR currency pair. After applying the HMA to your chart, you observe that the line starts sloping upward, and the price crosses above the HMA. This indicates a potential uptrend, and you decide to take a long position. However, you notice that there’s a resistance level just above the current price, so you wait for a break above that level before entering. As the price moves above the resistance and continues to rise.

Conclusion

The Hull Moving Average offers significant advantages for Indian forex traders looking to improve their trading strategies. With its faster response times, reduced lag, and smoother signals, the HMA helps traders better navigate the volatile forex market. By incorporating the HMA into your technical analysis toolkit, you can make more informed decisions, identify trends early, and potentially increase your profitability.

FAQs

What is the Hull Moving Average (HMA)?

The HMA is a technical indicator that smooths price data to reduce lag and improve trading signals in Forex markets.

How is the Hull Moving Average calculated?

It is calculated using weighted moving averages (WMA) to reduce lag and provide a faster signal.

Can the HMA be used for Forex trading in India?

Yes, the HMA is widely used in Forex trading globally, including in India, to help identify trends and entry/exit points.

Is the Hull Moving Average better than other moving averages?

The HMA is faster and more responsive than traditional moving averages, making it suitable for Forex traders seeking quicker signals.

How do I use the HMA in Forex trading?

Traders use the HMA to spot trend reversals and follow trends by analyzing price action relative to the moving average.