AUTHOR: LUCKY MARTINS

Introduction

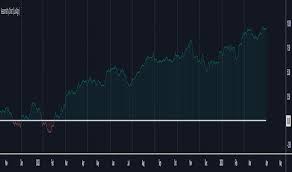

Forex trading[1], also known as foreign exchange trading, involves the buying and selling of currencies in a global decentralized market. It is a highly dynamic and volatile market[2] where traders aim to profit from the fluctuations in currency values. strategies traders[3] use to gain an edge is seasonality—the tendency for certain currency pairs[4] to perform better or worse during specific times of the year. In India, forex traders can take advantage of seasonality to optimize their trading decisions and improve their profitability.

This article delves into forex trading seasonality strategies in India, exploring how seasonal trends influence currency markets[5] and how Indian traders can harness these patterns. We will discuss the key concepts of seasonality in forex, identify major seasonal trends, and provide actionable strategies to implement during different seasons. Lastly, we will address frequently asked questions to clear any doubts you may have.

What is Forex Trading Seasonality?

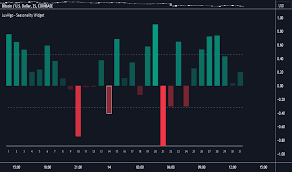

Seasonality in Forex refers to recurring trends in the forex market that occur at specific times of the year. These patterns are driven by factors like holidays, economic reports, fiscal year-end activities, and even climatic conditions. Many forex pairs tend to follow predictable patterns during certain months, quarters, or seasons, which traders can anticipate and use to their advantage.

In India, seasonality can be influenced by various factors such as the Indian fiscal calendar, cultural festivals, global economic cycles, and geopolitical events. Understanding these patterns is crucial for traders looking to make profitable trades by taking advantage of market trends that emerge during particular times.

Key Factors Influencing Forex Seasonality in India

Several factors can influence seasonality in the forex market, particularly for Indian traders. Let’s examine some of these key influences:Forex trading seasonality strategies India

1. Indian Festivals and Holidays

India has numerous religious and cultural festivals, such as Diwali, Holi, and Durga Puja, which can influence domestic consumer spending, gold demand, and overall market sentiment. These events can have an impact on currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, and GBP/INR.

During festivals, demand for gold rises, and this can influence the Indian Rupee’s value. For example, if gold demand surges, the INR may depreciate, reflecting a shift in investor sentiment.Forex trading seasonality strategies India

2. Monsoon Season

The monsoon season in India, typically from June to September, plays a significant role in agricultural output. The performance of India’s agriculture sector is closely tied to the success of the monsoon, which can impact economic growth, inflation, and trade balances. A good monsoon can lead to positive economic sentiment, while a poor monsoon can have the opposite effect.

The Indian Rupee (INR) may experience fluctuations based on the success or failure of the monsoon season, especially against currency pairs like USD/INR.

3. Fiscal Year-End (March)

The Indian government’s fiscal year runs from April to March, and as the fiscal year-end approaches, there may be adjustments in capital flows, tax planning, and government spending. This period often sees increased volatility as traders speculate on the government’s budget and its economic implications.

The end of the fiscal year can lead to a reduction in liquidity, increasing the potential for sharp moves in currency pairs, particularly those involving the INR.

4. Global Economic Cycles

Global economic cycles affect all countries, and India is no exception. For instance, the end of the year is traditionally a time when many businesses finalize their fiscal reports, and central banks may adjust interest rates. These changes can significantly influence forex markets worldwide and may lead to certain seasonal trends in currency pairs involving India.

Furthermore, Indian traders need to keep an eye on the global commodity cycle (especially oil), as fluctuations in oil prices can directly affect the Indian economy and the INR.

Seasonal Trends in Forex Trading

Understanding seasonal trends is key for traders who want to maximize their profits and minimize risk. Here are some general seasonal trends that have been observed in the forex market, particularly from an Indian perspective:

1. The Post-Diwali Season (October-November)

Diwali, the festival of lights, is one of India’s most important and widely celebrated festivals. Post-Diwali, there is often an increase in demand for gold and other precious metals, which could impact the INR’s value. Traders can capitalize on any currency fluctuations in the weeks after Diwali as global and domestic sentiment shifts.

2. Pre-Budget Season (January-February)

India’s national budget is presented every year in February. The anticipation leading up to the budget announcement often triggers volatility in the forex market. Traders may use this period to trade the INR against other major currencies as they predict what policies will be included in the budget and their potential economic impact.

3. The Monsoon Season (June-September)

As mentioned earlier, India’s monsoon season can greatly influence the country’s economy and agricultural output. The INR can be sensitive to these changes. A good monsoon could strengthen the INR due to expectations of higher agricultural output, while a bad monsoon could weaken the currency.

4. Year-End and Holiday Periods (December-January)

The end of the year and the beginning of a new one can see lower trading volumes, which often results in heightened volatility. For traders in India, this can be a good time to take advantage of price swings during the holiday season when market participation tends to drop.

Seasonal Forex Trading Strategies for Indian Traders

Traders in India can use the seasonality concept to develop strategies that fit their risk tolerance and market goals. Below are a few key seasonal strategies:

1. Capitalizing on Festive Market Sentiment

During Indian festivals like Diwali, demand for gold and other commodities increases. By monitoring these shifts, traders can adjust their forex strategies to profit from movements in INR and other currency pairs.

2. Anticipating Budget Volatility

Traders can prepare for potential market volatility around the presentation of the Indian Union Budget. By studying past trends, they can take positions on currency pairs like USD/INR, EUR/INR, and GBP/INR based on the expected fiscal and economic policies.

3. Trading During Global Economic Cycles

Indian traders should not only focus on local seasonality but also on global trends that affect forex markets. For example, closely following the U.S. Federal Reserve’s interest rate decisions, as well as the seasonal fluctuations of global commodities like oil, can help traders make informed decisions.

4. Risk Management

During seasons of high volatility, such as the end of the fiscal year or pre-budget season, it’s crucial for traders to implement strong risk management strategies. Using stop-loss orders, diversifying positions, and avoiding overleveraging are all important techniques during these times.

Conclusion

Forex trading seasonality strategies offer a unique approach to capitalizing on recurring patterns in the forex market. For Indian traders, understanding the key factors that influence seasonality, such as domestic festivals, monsoons, and fiscal year cycles, can give them an edge in trading. By integrating seasonal insights with other strategies like technical analysis and risk management, traders can enhance their chances of success in the highly dynamic world of forex.

FAQ:

1. What is the best time of year to trade forex in India?

The best time to trade forex in India largely depends on the trader’s strategy and the currency pair they are interested in. However, times around the Indian budget (February) and Diwali (October-November) often present opportunities due to increased market volatility and sentiment shifts.

2. How do Indian festivals affect forex trading?

Indian festivals like Diwali, Holi, and others can lead to changes in domestic demand for gold, commodities, and foreign currencies. Traders can take advantage of these shifts to make profitable trades in pairs like USD/INR or EUR/INR.

3. Is seasonality a reliable strategy for forex trading in India?

While seasonality can provide useful insights, it is important to remember that forex markets are influenced by multiple factors. Seasonality should be used as part of a broader trading strategy, along with technical and fundamental analysis.

4. Can global economic cycles impact forex seasonality in India?

Yes, global economic cycles, such as changes in oil prices or central bank policies, can have a significant impact on forex seasonality in India. The INR is often affected by global economic conditions, particularly due to India’s import dependence on commodities like oil.

5. How should I manage risk when trading during seasonal periods?

During high-volatility seasons, it’s important to manage risk by setting tight stop-loss orders, staying informed about economic events, and avoiding excessive leverage. Diversifying your positions can also help minimize risk during unpredictable periods.