AUTHOR : LISA WEBB

Introduction

In Forex trading, traders seek edge-giving strategies to navigate market volatility, manage risk, and leverage technical analysis. The Gann Theory, developed by a renowned trader, has intrigued and challenged traders for decades, W.D. Gann. People revere this theory for combining geometry, astrology, and mathematics to predict price movements. This blog post explores the Gann Theory Indicator, its application in Forex trading, and its relevance for traders in India. Is Forex trading worth it despite the negative opinions surrounding it?

What is Gann Theory?

W.D. Gann, a 20th-century trader, developed a system using geometric angles, numerology, and astrology to predict price movements His theory incorporated[1] the idea that financial markets are cyclical in nature, with repeating patterns. Gann believed that time cycles and price levels repeat, revealing market turning points. The Gann Theory uses tools like Gann angles[2], grids, and price-time squaring to predict market trends. Forex Trading[3] Gann Theory Indicator India: Traders use these tools to analyze price patterns and anticipate future market trends.

Gann Theory in Forex Trading

Forex trading is a 24-hour global market where currencies are traded in pairs. It is inherently volatile due to geopolitical events, economic data releases, and central bank decisions. The Gann Theory Indicator[4] can offer traders a unique way of understanding and predicting the price movements of currency pairs.

The Gann Angle: A Key Concept

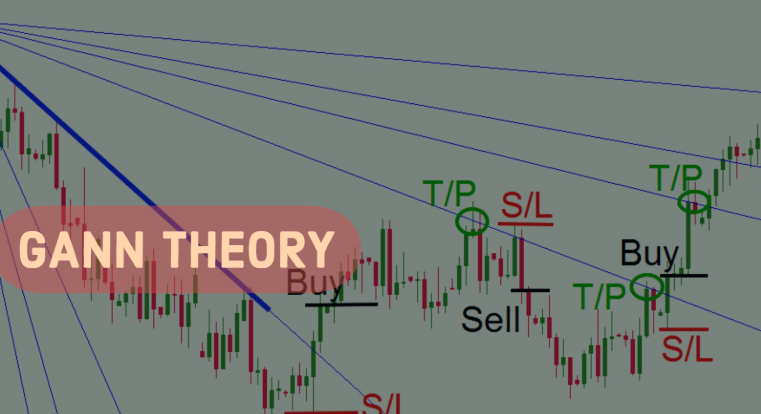

One of the most important components of the Gann theory is the Gann angle. This is essentially a graphical tool that relates price and time, drawing lines at specific angles from a chosen point on the price chart. The most commonly used angles are 1×1, 2×1, and 1×2. These angles represent different price and time relationships. The 1×1 angle means the price changes by one unit for every unit of time.

In Forex trading, these angles can be used to predict key support and resistance levels, with traders looking for price interactions at these levels. When the price moves beyond a key angle, it may indicate trend continuation or a reversal, depending on the direction.

Squaring Price and Time

Another central concept in Gann’s methodology[5] is the idea of squaring price and time. Gann believed that significant price moves would occur when a particular price level coincided with a specific time period. This might sound abstract, but in practice, traders use tools such as the Gann Square of Nine or Gann Fan to visually represent and analyze these relationships.

By combining price and time, traders can potentially forecast the next significant move in the market based on past patterns. This technique can be particularly useful in Forex, where understanding cyclical patterns and key price levels is critical.

How to Use the Gann Theory Indicator in Forex Trading

While the Gann theory might seem complex, there are several ways it can be applied to forex trading. Here are some practical methods:

Identifying Key Price Levels

Using the Gann angles and squares, traders can identify potential support and resistance levels. These are crucial in Forex trading, as currency pairs often move between these levels. By drawing angles from significant price points, traders can determine where the next price level might occur

Trend Reversals and Breakouts

The Gann Theory can also help traders identify potential trend reversals or breakouts. If a currency pair is moving along a particular Gann angle and breaks through it, this could signal a change in trend direction. Additionally, when the price hits a square or angle at a significant time cycle.

Time Cycles and Price Forecasting

Using time cycles is another powerful tool for Forex traders following Gann’s theories. By analyzing past price data, traders can estimate future cycles, predicting when price movements might reach a turning point. Combining these time cycles with price levels offers an advanced method for forecasting Forex trends.

Benefits for Indian Forex Traders

- Market Volatility: The Indian Forex market is highly volatile, especially with global economic factors and geopolitical events influencing the rupee’s exchange rate. By using the Gann Theory, traders can gain insights into potential market turning points.

- Adaptability: The Gann Theory is versatile and can be applied to a variety of currency pairs traded in India, including the USD/INR, EUR/INR, and GBP/INR.

- Advanced Risk Management: The use of Gann angles and time cycles can be incorporated into a broader risk management strategy, helping Indian traders make more calculated decisions.

Conclusion

The Gann Theory Indicator offers a unique perspective for Forex traders, providing a sophisticated way to analyze the price-time relationship in the market. While it might require a learning curve to master, the Gann Theory can be a powerful tool for identifying key price levels, forecasting trends, and managing risk. Forex Trading Gann Theory Indicator India, For Indian traders, the Gann Theory is especially relevant given the dynamic and volatile nature of the Forex market in India. By integrating the Gann Theory Indicator into their trading strategies

FAQs

What is the Gann Theory in Forex Trading?

The Gann Theory involves using geometric angles, time cycles, and mathematical principles to predict market trends.

How does the Gann Theory Indicator work?

It identifies price levels and time cycles that can signal potential market reversals and trends.

Can Gann theory be applied to forex trading in India?

Yes, Gann Theory is universal and can be applied to Forex trading in India, just like in other markets.

Is Gann Theory effective for Forex trading?

While it offers unique insights, its effectiveness depends on the trader’s skill and market conditions.

What tools are needed to use Gann Theory for Forex?

Traders typically use Gann angles, charts, and software that supports Gann-based analysis.