AUTHOR : JENNY

Introduction

Forex trading in India has evolved significantly, with traders continuously exploring tools to help them refine their strategies and make more informed decisions. One such tool that has gained attention is the On Balance Volume (OBV) indicator. OBV is a momentum-based technical indicator that helps traders assess the strength of a price movement by analyzing trading volume. In this blog, we will discuss what OBV is, how it works in forex trading, its advantages, and how Indian traders can use it to improve their trading strategies.I invested my money on a fake platform. How do I recover my funds?

What is OBV (On Balance Volume)?

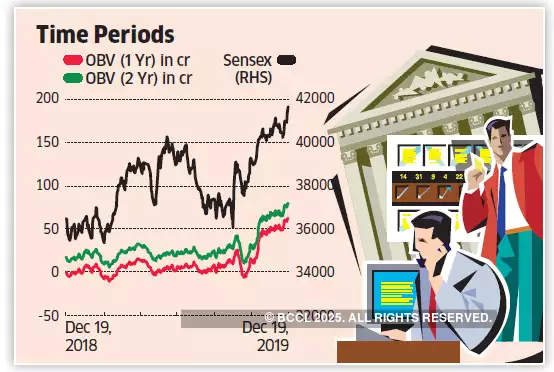

The On Balance Volume (OBV) indicator, developed by Joe Granville in the 1960s, is a technical analysis tool that uses volume flow to predict price movements. By monitoring the volume and price movement, OBV helps traders understand the buying and selling pressure in the market.

The OBV is calculated by adding the volume to a cumulative total when the price closes higher than the previous close, and subtracting the volume from the cumulative total when the price closes lower than the previous close.

How Does OBV Work in Forex Trading?

OBV works by combining price movements with trading volume to measure the strength of a trend. Here’s how it functions:

- Price Closes Higher: If the current closing price is higher than the previous close, the OBV value increases by the volume of that trading period[1]. This indicates bullish momentum.

- Price Closes Lower: If the current closing price is lower than the previous close, the OBV value decreases by the volume. This signals bearish momentum.

- Flat Close: If the price closes unchanged from the previous period, there is no change in OBV.

By analyzing the OBV line[2], traders can assess whether the price movement is supported by high or low volume, offering insights into the strength or weakness of a trend.

How to Interpret OBV in Forex Trading?

- Bullish Divergence

- When the price of a currency pair is making new lows, but the OBV is making higher lows, this signals a potential bullish reversal.

- Bearish Divergence

- If the price is making new highs but the OBV is making lower highs, this indicates a bearish divergence. It suggests that buying pressure is weakening, and a trend reversal to the downside might be on the horizon.

- Trend Confirmation

- The OBV is particularly useful for confirming the strength of a trend. If the price is rising and the OBV is also increasing, it confirms that the upward price movement is supported by buying volume, making the trend more likely to continue.

- Conversely, if the price is rising but OBV is flat or declining, it indicates that the trend lacks sufficient buying volume and may be vulnerable to reversal.

- Breakouts

- OBV can help traders spot potential breakouts. If the price is trading within a range and breaks out in one direction, a rising OBV can confirm that the breakout is supported by increased volume.

- Support and Resistance

- Traders can use OBV in conjunction with traditional support and resistance levels. A breakout above a resistance level that is accompanied by increasing OBV suggests that the breakout is legitimate, and the price is likely to continue higher.

Advantages of Using OBV in Forex Trading

- Volume Confirmation

- OBV provides confirmation of price movements by incorporating volume data. While price alone may not provide a complete picture, combining it with OBV allows traders to better assess the strength of price trends and avoid false signals.

- Spotting Divergences

- OBV can help traders spot divergences between price and volume, which often precede trend reversals.

- Easy to Use

- OBV is a simple indicator that is easy to interpret. Unlike some complex indicators, it only requires a basic understanding of how price and volume relate to each other.

- Versatility

- OBV can be used across different timeframes and currency pairs, making it a versatile tool for traders.

- Trend Strength

- OBV is an effective tool for assessing the strength of a trend. If the OBV is trending in the same direction as the price, it provides confirmation that the trend has strength and may continue.

Limitations of OBV

- Lagging Indicator

- Like many technical indicators, OBV is a lagging indicator, meaning it reacts to price movements rather than predicting them. This can cause OBV signals[3] to arrive late, especially during rapid price movements.

- Volume Discrepancies

- In forex, volume data is often not as reliable as in other markets, such as stocks. Since the forex market [4]is decentralized, different brokers may report varying volume figures, which can impact the accuracy of OBV.

- No Information on Price Direction

- While OBV helps confirm the strength of price trends, it does not provide information about price direction by itself.

- False Signals

- While OBV is great for identifying divergences, it can still generate false signals, particularly in volatile markets.

How Indian Traders Can Use OBV

For Indian forex traders[5], OBV can offer valuable insights into market volume dynamics. Here’s how to effectively use it in your strategy:

- Combine OBV with Other Indicators: Use OBV alongside tools like Moving Averages, RSI, or MACD to improve signal accuracy. For example, an OBV bullish divergence with a MACD crossover can indicate a strong buy signal.

- Use OBV for Breakout Confirmation: OBV helps confirm breakouts. When OBV rises with the price, it indicates strong support, suggesting the breakout will likely continue.

- Risk Management: While OBV provides insights, always use proper risk management, including stop-loss orders, as OBV signals can sometimes be inaccurate.

- Monitor Key Levels: Pay attention to support and resistance levels and use OBV to confirm breakouts or breakdowns, helping you avoid false signals.

Conclusion

OBV is a powerful tool for Indian forex traders, providing insights into market strength and trend confirmation. By combining OBV with other technical indicators, using it for breakout confirmation, and implementing risk management strategies, traders can improve their chances of success in the forex market. Practice and experience are essential to mastering OBV’s potential.

FAQS

What is OBV in forex trading?

OBV (On Balance Volume) is a technical indicator that uses volume flow to predict price movements.

How do you calculate OBV?

OBV is calculated by adding volume to the cumulative total when the price closes higher and subtracting volume when the price closes lower.

How can OBV help Indian forex traders?

OBV helps traders assess market strength, confirm trends, and spot potential reversals based on volume and price movement.

Can OBV be used alone in forex trading?

OBV should be used in conjunction with other indicators like Moving Averages or MACD for more accurate trading signals.

What does an OBV bullish divergence indicate?

An OBV bullish divergence suggests that the market is gaining buying pressure, potentially signaling a price reversal to the upside.