Author: Shin Hari

Introduction

Trend-following indicators are essential tools for forex traders in India, helping them identify and capitalize on sustained price movements. Unlike momentum indicators, which measure the speed of price changes, trend-following indicators focus on the direction and strength of a trend over time. This makes them particularly useful for swing traders, position traders, and long-term investors who aim to ride major market trends[1]. How can I file a complaint against an online forex trading company

Why Trend-Following Indicators Matter in Forex Trading

The forex market[2] is known for its constant fluctuations, and trading against the trend can be risky. Trend-following indicators help traders stay on the right side of the market, minimizing losses and maximizing profits. Whether trading major currency pairs like USD/INR, EUR/INR, or GBP/INR, these indicators provide valuable insights into long-term market movements.

In India, where forex trading[3] is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), traders must be cautious about market conditions and trends. Using reliable trend-following indicators can give them an edge in making well-informed trading decisions.

Enhancing Forex Trading with Trend-Following Indicators in India

Forex traders in India rely on trend-following indicators to spot and capitalize on sustained market movements. These indicators are particularly useful in markets where trends develop over extended periods, allowing traders to ride the wave of price momentum rather than getting caught in short-term fluctuations.

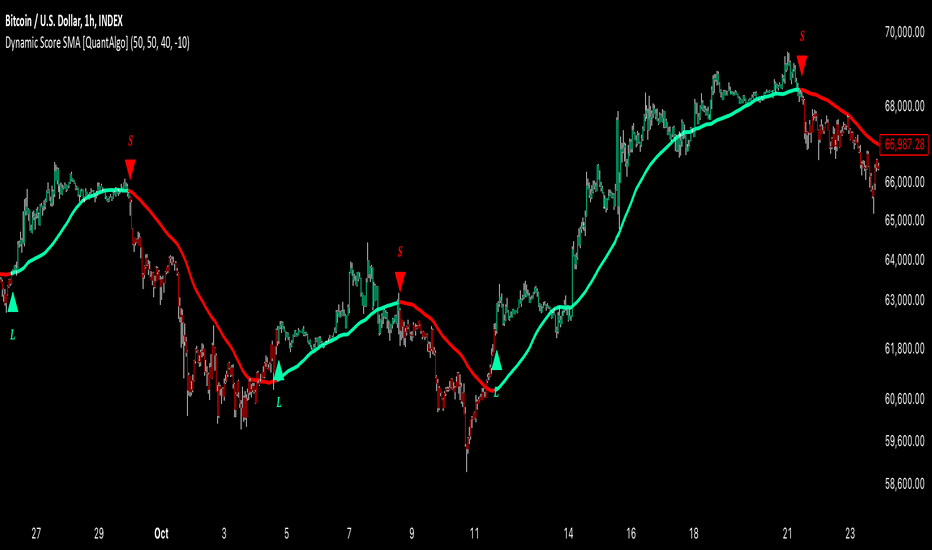

One of the most effective techniques for traders in India is combining trend-following indicators with momentum indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). This approach helps in filtering out false signals and improving trade accuracy. For instance, if a 50-day Exponential Moving Average (EMA) is trending upward while MACD shows a bullish crossover, it strengthens the case for a long position

Adapting Trend-Following Indicators to Indian Forex Market Conditions

The Indian forex market operates under unique conditions, influenced by Reserve Bank of India (RBI) regulations, global economic trends, and domestic macroeconomic factors. While trend-following indicators work well globally, traders in India must adapt their strategies to the specific characteristics of INR-based currency pairs like USD/INR, EUR/INR, and GBP/INR.

One key aspect Indian traders should consider is liquidity and volatility. The USD/INR pair, for example, tends to follow strong trends during major global trading sessions—particularly the London and New York sessions. By aligning trend-following indicators with these market movements, traders can enhance accuracy and reduce false signals.

How to Use Trend-Following Indicators Effectively

- Combine Multiple Indicators – No single indicator is perfect. Indian traders often use a combination of indicators like MACD with RSI or Bollinger Bands[4] with Moving Averages to confirm signals.

- Avoid Overtrading – Just because an indicator shows a trend doesn’t mean a trade should be executed immediately. Wait for confirmation from multiple signals.

- Use Proper Risk Management – Always set stop-loss orders to protect capital and prevent large losses.

- Stay Updated on Market News – Economic events, RBI announcements, and global factors influence Forex trends. Keep an eye on news that can impact currency prices.

- Backtest Strategies – Before using an indicator in live trading[5], test it on historical data to see how well it performs.

Regulations and Challenges in Forex Trading in India

In India, forex trading is overseen by the RBI and SEBI. Currently, Indian traders can trade only certain currency pairs like USD/INR, EUR/INR, GBP/INR, and JPY/INR through authorized brokers. Trading international currency pairs is restricted for retail traders unless they use offshore brokers, which comes with its own risks.

To ensure compliance, traders should always choose SEBI-registered brokers and trade through legally recognized platforms. Additionally, traders should be aware of capital gains taxes on Forex earnings and adhere to the taxation rules set by the Indian government.

Conclusion

Trend-following indicators are essential for Indian forex traders looking to ride major price movements and minimize risk. While moving averages, ADX, Bollinger Bands, Parabolic SAR, and Ichimoku Cloud provide valuable insights into trend direction, traders must use them strategically. Combining trend indicators with momentum analysis, risk management, and fundamental factors ensures better trading decisions and long-term profitability in the forex market.

FAQs

- Which is the best trend-following indicator for forex trading?

Moving Averages and ADX are among the most reliable indicators for identifying strong trends. - How do I avoid false signals in trend-following indicators?

Use multiple indicators together, confirm trends with ADX, and check for global market influences. - Is forex trading legal in India?

Yes, forex trading is legal in India but restricted to RBI-approved currency pairs and SEBI-regulated platforms. - What is the best strategy for trend-following trading?

The Moving Average Crossover and Ichimoku Cloud Breakout strategies are widely used for effective trend trading. - Can I use trend-following indicators for short-term trading?

Yes, but they work best for medium to long-term trades. Scalpers may prefer momentum-based indicators for quick trades.