AUTHOR : SOPHIYA

Introduction

In the world of Forex trading, understanding market dynamics and price movements is key to success. One of the most powerful tools traders use to assess market behavior is the Market Profile Indicator. This tool is particularly valuable in countries like India, where Forex trading is gaining significant momentum among retail traders. How can one take legal action against an Indian forex broker who has refused to pay profits and deposit balance after a complaint was filed against them?

What is Market Profile?

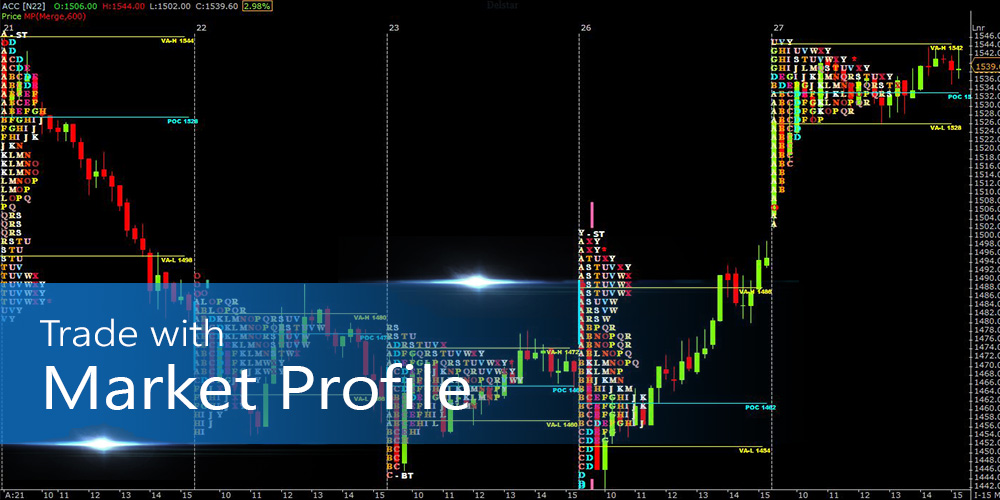

The Market Profile indicator is a technical analysis tool that organizes price data into a visual format, often referred to as a “market profile chart.” The concept was developed by Peter Steidlmayer in the 1980s and has since become an essential tool for traders, especially those involved in futures and Forex markets. Market Profile helps traders understand price distribution and market behavior over time. Market Profile arranges data by price levels rather than time intervals. This approach helps traders pinpoint market concentration, activity levels, and key support and resistance zones.

Components of Market Profile

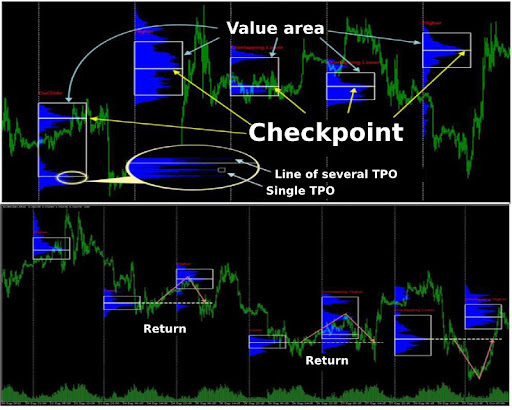

Value Area (VA): The Value Area represents the price range where 70% of the trading volume occurs(1). This is crucial as it helps identify where the majority of market participants are transacting. If the market is trading within the Value Area, it signifies a balanced market. Conversely, when prices move outside of the Value Area, it suggests that the market is trending.

Point of Control (POC): The Point of Control is the price level where the highest volume of trades occurred within the Value Area. It acts as a critical support or resistance level in Forex trading(2). Traders use the POC to gauge the market’s sentiment and possible price reversals.

Initial Balance (IB): The Initial Balance refers to the price range during the first 30 minutes to 1 hour of trading. This period is essential because it reflects the market’s opening sentiment. A break from the Initial Balance range can signal the start of a new trend.

TPO (Time Price Opportunity): TPO is a visual representation of price distribution. Each “letter” or block on the Market Profile chart indicates a specific time frame during which a price level was traded. This feature helps traders understand the price action(3) and the market’s behavior over time.

How Does the Market Profile Indicator Work in Forex Trading?

Forex markets are volatile and operate 24/7, which can make predicting price movements quite difficult. The Market Profile Indicator(4), however, breaks down complex price behavior into digestible patterns that traders can use to their advantage. By understanding how price distributes(5), traders can make more informed decisions.

Here’s how the Market Profile Indicator can be applied to Forex trading:

Trend Identification: The Market Profile helps identify whether the market is in a trending or range-bound phase. If the price is moving within the Value Area and testing the Point of Control, the market is considered to be in balance. If the price breaks out of the Value Area, it could indicate the start of a trend.

Support and Resistance Levels: The POC, Value Area High, and Value Area Low serve as key levels of support and resistance. When price approaches these levels, traders can anticipate a reversal or breakout.

Trade Entries and Exits: Traders can use the Market Profile to time their entries and exits more effectively. For example, if the price is moving towards the Value Area High and shows signs of rejection, traders may choose to sell. Similarly, if the price is near the Value Area Low, a potential buy trade may be in play.

Volume Analysis: The Market Profile Indicator inherently includes volume analysis. This means that traders can identify the level of participation at various price points. High-volume levels signify areas of interest, while low-volume levels can indicate a lack of consensus among traders.

The Role of Market Profile in Indian Forex Trading

The Indian Forex market has seen rapid growth in recent years, with many retail traders seeking to participate in global currency trading. In India, brokers typically carry out Forex trading through platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and other platforms that support advanced charting tools like the Market Profile Indicator.

Here’s how the Market Profile Indicator is gaining traction among Indian traders:

- Risk Management: Indian traders, like those in other parts of the world, understand the importance of risk management. By using the Market Profile Indicator, they can determine price levels with the highest probability of market reactions, minimizing their exposure to risks.

- Improved Market Timing: Given the highly volatile nature of the Forex market, Indian traders are increasingly relying on Market Profile for better timing of their trades. Understanding when the market is likely to reverse or trend can provide an edge in an environment where timing is everything.

- Customizable Settings: Platforms used by Indian traders allow for customizable settings on the Market Profile Indicator. Traders can adjust the parameters according to their trading style, timeframes, and the specific currency pairs they are trading.

- Educational Resources: With the rise in Forex education, many Indian traders are becoming proficient in using advanced tools like the Market Profile Indicator. Numerous courses and webinars are now available to help traders understand its application in real-world scenarios.

Conclusion

The Market Profile Indicator offers Forex traders in India a unique perspective on market dynamics, helping them make informed trading decisions based on price and volume distribution. Understanding key concepts like Value Area, Point of Control, and Initial Balance enhances traders’ entries, exits, and strategy. As Indian retail traders continue to expand their participation in the global Forex market, mastering advanced tools like the Market Profile Indicator will be essential for achieving long-term success.

FAQ’s

What is the Market Profile indicator in Forex trading?

The The Market Profile indicator visualizes price distribution, highlighting areas of value and activity.

How does the Market Profile indicator work?

It segments price data into time-based “TPOs” (Time Price Opportunities) to highlight key support and resistance levels in the market.

Can Market Profile be used for day trading in India?

Yes, day traders in India often use Market Profile to identify short-term price movements and trends.

Is Market Profile suitable for beginners?

While it provides valuable insights, Market Profile may require experience and understanding of price action for effective use by beginners.

How accurate is the Market Profile indicator for Forex in India?

Accuracy relies on market conditions and the trader’s interpretation, offering a clearer market context but not guaranteed results.