ATHOUR : DARLAKIM

Introduction

Forex trading is a highly dynamic and volatile market, where traders can profit by buying and selling currencies. One of the most intriguing concepts in forex trading is gap trading, which offers a unique way to capitalize on sudden price movements that occur between trading sessions. However, gap trading, like any other trading strategy, comes with its own set of risks. In this article, we will explore the fundamentals of gap trading in the forex market, the risks involved, and how traders in India can effectively manage these risks.What-is-your-worst-experience-in-Forex-trading

Understanding Forex Trading

Forex trading, also known as currency trading, involves the exchange of one currency for another at an agreed price. It operates 24 hours a day, five days a week, and involves a wide range of participants, including governments, financial institutions, hedge funds, corporations, and individual traders.

The objective of forex trading is to capitalize on the shifting values between different currencies in order to generate profit. Since the forex market operates globally, it is affected by various factors, such as economic reports, political events, and market sentiment. The market’s volatility provides ample opportunities for traders to make profits, but it also comes with significant risks.

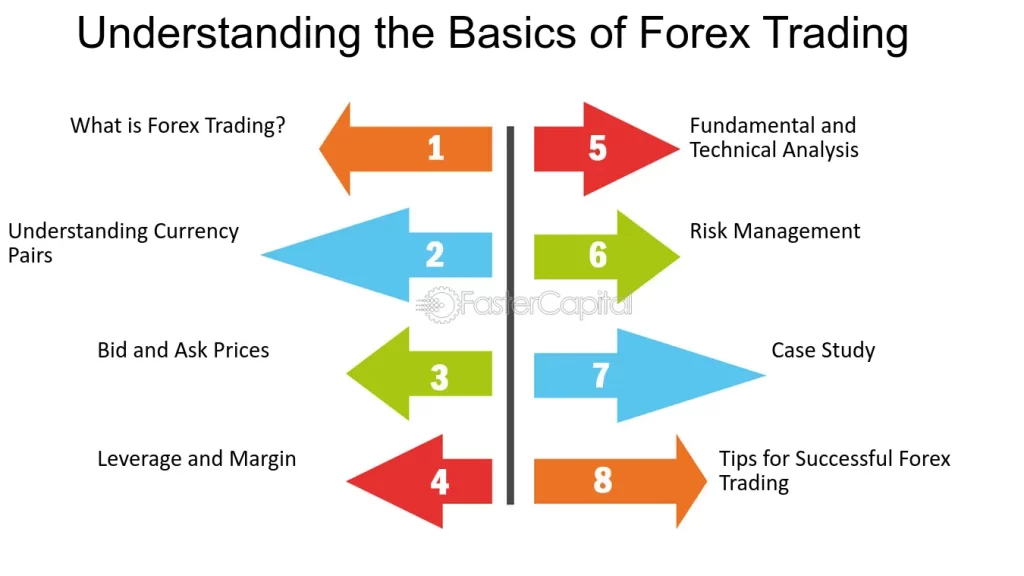

Key Concepts in Forex Trading:

- Currency Pairs: Forex trading[1]involves trading in pairs of currencies, such as EUR/USD (Euro/US Dollar), GBP/JPY (British Pound/Japanese Yen), etc.

- Leverage: Forex brokers offer leverage, which allows traders to control larger positions with a smaller capital outlay.

- Pip: A pip (percentage in point) is the smallest unit of price movement in the forex market.

- Lot Size: The size of a trade, measured in standard lots, mini lots, or micro lots.

What is Gap Trading in Forex?

Gap trading is a strategy that exploits price gaps in the forex market. A price gap occurs when the price of a currency pair jumps significantly between two trading periods, leaving a gap on the price chart. This gap can occur for various reasons, such as economic announcements, geopolitical events, or major market reactions to news.

A typical gap happens when the market closes at one price and opens at a significantly different price during the next trading session. These gaps can occur between daily trading sessions or even within shorter timeframes like hourly charts.

Types of Gaps in Forex Trading:

- Breakaway Gaps: These occur when the price breaks out of a trading range[2] and moves sharply in one direction, signaling the start of a new trend.

- Runaway Gaps: These happen during strong trends and signal that the current trend is likely to continue.

- Exhaustion Gaps: These appear at the end of a trend and suggest that the trend is about to reverse.

Gap trading strategies involve identifying these gaps and deciding whether to take a position in the direction of the gap or wait for a potential reversal.

Risk Management in Gap Trading

While gap trading offers attractive profit opportunities, it is important to manage the risks involved. The forex market is highly unpredictable, and gaps can lead to substantial losses if not managed carefully. Here are some key risk management techniques for gap trading:

1. Use Stop-Loss Orders

Stop-loss orders are essential in any trading strategy,[3] but they are especially important in gap trading. Gaps can sometimes lead to sharp price movements in either direction, and without a stop-loss order, a trader could lose a significant amount of capital if the market moves against their position.

Placing stop-loss orders at strategic levels, such as just beyond the gap or key support/resistance levels, can help limit potential losses. However, keep in mind that price gaps can sometimes cause the stop-loss to be triggered at a worse price than expected due to slippage.

2. Position Sizing

Another important aspect of risk management is proper position sizing. In gap trading, the potential for significant price movement means that it’s essential to adjust your trade size based on your risk tolerance.

Traders should never risk more than a small percentage of their trading account on a single trade. A good rule of thumb is to risk no more than 1-2% of your account balance per trade. By managing position sizes appropriately, traders can mitigate the risk of large losses in case a gap goes against their position.

3. Risk-to-Reward Ratio

Gap trading requires careful evaluation of the risk-to-reward ratio. Traders should assess the potential profit against the potential loss before entering a trade. A good risk-to-reward ratio is typically 1:2 or higher, meaning that for every dollar risked, the potential reward should be at least twice as much.

By maintaining a favorable risk-to-reward ratio, traders can stay profitable over the long term, even if they experience a few losing trades.

4. Monitor Economic News

Since gaps in the forex market are often caused by economic reports or major news events, it’s crucial for traders to stay informed about upcoming events. Analyzing economic data, interest rate decisions, and geopolitical developments can help anticipate potential gaps and make more informed trading decisions.

In India, traders should be particularly mindful of reports like the Reserve Bank of India (RBI) monetary policy announcements, inflation data, and GDP figures, which can have a significant impact on the Indian Rupee (INR) and other currency pairs.

5. Avoid Overtrading

Overtrading is a common pitfall in forex trading, especially when traders become overly confident after a few profitable trades. Gap trading can be highly profitable, but it can also be very risky if traders take too many positions without proper analysis.

To avoid overtrading[4], traders should wait for clear gap setups that align with their trading strategy and avoid chasing every potential gap that appears on the chart.

How Gap Trading Works in India

Forex trading is permitted in India, though it operates under specific regulatory guidelines set by financial authorities. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) oversee forex trading activities in the country. Indian traders often participate in forex trading through regulated platforms that offer access to the global forex market.

For gap trading, Indian traders can use various Electronic trading platforms[5] that offer access to major currency pairs like EUR/USD, GBP/USD, USD/INR, and others. It is important to choose a reliable and regulated broker to ensure a safe trading environment.

Conclusion

Gap trading can be a profitable strategy for forex traders, especially when combined with proper risk management techniques. By understanding the types of gaps, using stop-loss orders, managing position sizes, and staying informed about economic events, traders can minimize the risks associated with gap trading. For Indian traders, it is crucial to stay within the regulatory framework and choose reliable brokers to ensure a safe trading experience. While gap trading offers potential rewards, it is important to approach it with caution and discipline to achieve long-term success in the forex market.

FAQ

1. What causes price gaps in the forex market?

Price gaps in the forex market are often caused by significant events such as economic data releases, geopolitical developments, or market reactions to news. These events can lead to sharp price movements, resulting in a gap between two trading sessions.

2. Can gaps be predicted in forex trading?

While it is difficult to predict gaps with certainty, traders can use technical analysis and monitor key economic events to anticipate potential price movements that might cause gaps. Additionally, chart patterns and historical data can help traders identify areas where gaps are more likely to occur.

3. What is the best way to manage risk in gap trading?

The best way to manage risk in gap trading is by using stop-loss orders, managing position sizes, maintaining a favorable risk-to-reward ratio, and staying informed about market news and events. These measures can help protect traders from significant losses due to unexpected price movements.

4. Is gap trading suitable for beginners in forex?

Gap trading can be profitable, but it also comes with significant risks, especially for beginners. New traders should focus on learning the basics of forex trading, including technical analysis, risk management, and trading psychology, before attempting gap trading.

5. How can Indian traders participate in gap trading?

Indian traders can participate in gap trading by choosing a regulated forex broker that provides access to global currency pairs. Traders should ensure they are aware of the legal regulations surrounding forex trading in India, including the guidelines set by the RBI and SEBI.