AUTHOR : SIMON DRAVIS

Introduction

Forex trading has become an essential part of India’s financial landscape, attracting traders looking for opportunities in the global currency markets. One of the most effective ways to mitigate risks and optimize returns in forex trading[1] is through diversification. This strategy helps traders minimize the impact of potential losses while maximizing their chances of success. In this article, we will discuss forex trading diversification strategies tailored for Indian traders, and explore how to implement them effectively.

What is Forex Trading Diversification?

Forex trading diversification[2] refers to the practice of spreading investments across multiple currency pairs, asset classes, or geographical markets to reduce the risk of adverse price movements. By diversifying, traders ensure that their portfolio is not overly dependent on a single asset or market, which helps in limiting potential losses during market downturns or volatile price movements.

For Indian traders, diversification is especially important due to the volatile nature of global markets[3] and domestic economic conditions. Currency pairs often experience fluctuations due to geopolitical events, economic releases, and natural disasters, making diversification an effective risk management[4] tool.

Why is Diversification Important in Forex Trading?

Diversification in forex trading is essential for several reasons:

- Risk Reduction: By diversifying across various currency pairs or markets, traders can reduce the impact of price swings in any single market, limiting overall portfolio risk[5].

- Increased Opportunities: Diversifying provides traders with more opportunities to profit from different markets and assets, as some currency pairs may perform better than others under specific economic conditions.

- Minimized Exposure to Volatility: The forex market can be highly volatile, with sudden price fluctuations driven by news events, interest rate changes, or geopolitical issues. Diversification helps protect traders from such volatility by spreading their positions across different markets.

- Improved Long-Term Performance: Diversified portfolios are less likely to suffer significant losses during adverse market conditions. This increases the potential for more stable long-term returns.

Effective Forex Trading Diversification Strategies for Indian Traders

1. Diversify Across Currency Pairs

One of the simplest and most common ways to diversify in forex trading is by trading different currency pairs. In the forex market, there are major, minor, and exotic currency pairs, each with unique characteristics and market behaviors.

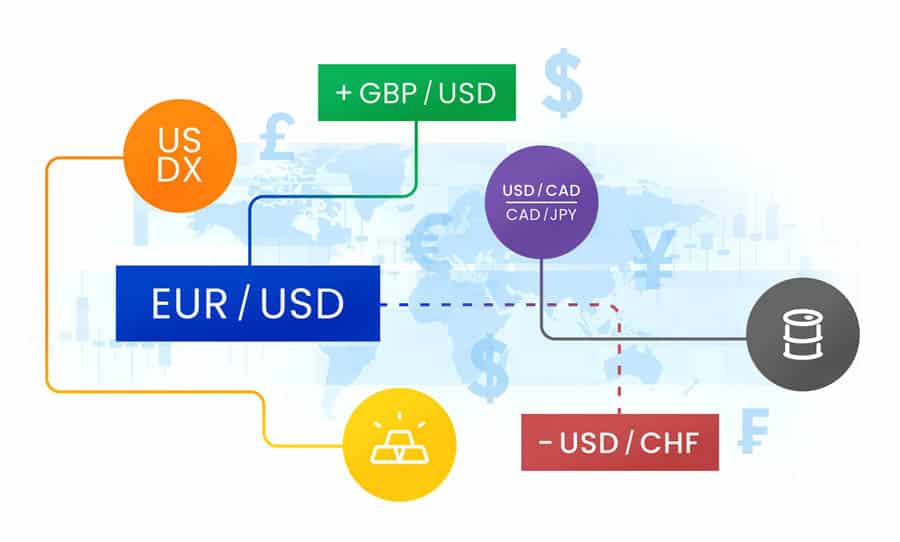

- Major Currency Pairs: These pairs involve the most liquid and widely traded currencies, including EUR/USD, GBP/USD, and USD/JPY. Major pairs tend to have lower volatility and tighter spreads.

- Minor Currency Pairs: Minor pairs consist of currencies that are less liquid than major currencies but still widely traded, such as EUR/GBP, EUR/AUD, or GBP/JPY.

- Exotic Currency Pairs: Exotic pairs involve one major currency and one currency from an emerging market, like USD/INR, USD/TRY, or EUR/SGD. These pairs tend to be more volatile but can offer greater profit opportunities due to their higher spreads.

By diversifying across different types of currency pairs, traders can take advantage of different market dynamics and minimize their exposure to any single pair’s volatility.

2. Diversify Across Geographies and Time Zones

The forex market operates 24/5, with different regions and countries contributing to its movements. Diversifying across various geographical markets can help Indian traders take advantage of trading opportunities in different time zones and regions. This could include:

- Asian Markets: The Asian market is highly liquid, with currency pairs like USD/JPY, AUD/JPY, and USD/SGD seeing significant trading volume during the Asian trading session.

- European Markets: The European session overlaps with the Asian session, providing increased liquidity. Major European currencies like the euro (EUR), British pound (GBP), and Swiss franc (CHF) are actively traded during this time.

- US Markets: The US session is crucial in the forex market, as the US dollar (USD) is the most traded currency in the world. Currency pairs such as EUR/USD, GBP/USD, and USD/CHF are heavily influenced by US economic reports and monetary policy.

By focusing on different time zones and regional markets, traders can ensure that their portfolio is balanced and remains unaffected by localized market movements.

3. Diversify by Trading Different Asset Classes

While forex trading is the primary focus for many traders, incorporating other asset classes into a trading strategy can further enhance diversification. By adding assets like stocks, commodities, or cryptocurrencies, traders can reduce the correlation between their forex positions and gain exposure to a broader range of market conditions.

- Commodities: Trading commodities like gold, silver, or oil can be beneficial for forex traders, especially when currency markets experience high volatility. Commodities often act as a safe-haven during periods of uncertainty.

- Stocks: Stock indices, such as the Nifty 50, S&P 500, or Dow Jones, can complement forex trading by allowing traders to take positions based on the performance of broader economies.

- Cryptocurrencies: Cryptocurrencies like Bitcoin, Ethereum, and Ripple are increasingly being traded alongside forex. These digital assets tend to have low correlation with traditional markets, which can be useful for diversification.

Traders can reduce the overall risk in their portfolio by diversifying into different asset classes, ensuring that a downturn in one market does not significantly affect the entire portfolio.

4. Use of Different Trading Strategies

Another way to diversify your forex trading portfolio is by employing different trading strategies. This involves balancing your portfolio by combining short-term and long-term strategies, which can reduce your exposure to sudden market fluctuations. Some strategies to consider include:

- Day Trading: Day traders open and close positions within the same trading day, seeking to capitalize on short-term market movements. This strategy provides liquidity and can take advantage of small price movements.

- Swing Trading: Swing traders hold positions for several days to weeks, aiming to capture medium-term price swings. This strategy relies on technical and fundamental analysis.

- Position Trading: Position traders take long-term positions, holding them for weeks, months, or even years. This strategy is typically used to trade based on the overall direction of the market rather than short-term fluctuations.

By combining different strategies, traders can achieve a well-rounded approach to the market, reducing the likelihood of significant losses from a single strategy.

5. Use of Forex Options and Hedging

Forex options and hedging strategies can also provide a means of diversification in forex trading. By using options, traders can limit their risk while still maintaining the opportunity for profit. Options contracts give traders the right (but not the obligation) to buy or sell a currency pair at a predetermined price at a future date.

- Hedging: Hedging allows traders to offset potential losses in one position by taking an opposite position in another currency pair. This strategy can be especially useful during periods of high market volatility.

- Options: Buying put or call options on currency pairs can provide an additional layer of risk management. Options can act as insurance against unexpected price movements, allowing traders to limit potential losses.

Incorporating options and hedging strategies into a forex trading plan can enhance portfolio diversification by adding different types of financial instruments that have lower correlations with traditional forex trades.

Conclusion

Forex trading diversification strategies are essential for Indian traders who want to manage risk effectively and improve long-term profitability. By diversifying across different currency pairs, geographical markets, asset classes, and trading strategies, traders can minimize exposure to volatility and mitigate potential losses. Incorporating options and hedging strategies further strengthens diversification, helping traders build a balanced and resilient trading portfolio.

FAQs

1. What is the best way to diversify in forex trading?

The best way to diversify in forex trading is by trading different currency pairs (major, minor, and exotic), focusing on different time zones and geographical markets, and incorporating other asset classes like commodities, stocks, and cryptocurrencies.

2. How does geographical diversification help in forex trading?

Geographical diversification helps traders take advantage of trading opportunities across various time zones, reducing their exposure to any single region’s economic or political events that could impact currency prices.

3. What are the benefits of diversifying across asset classes in forex?

Diversifying across asset classes, such as commodities or stocks, can reduce the correlation between currency pairs in your portfolio, offering better protection against market volatility and providing additional profit opportunities.

4. Can I use both short-term and long-term strategies in forex trading?

Yes, using both short-term strategies (such as day trading) and long-term strategies (such as position trading) can help balance your portfolio and reduce the impact of short-term market fluctuations.

5. How can options and hedging strategies enhance diversification?

Options and hedging strategies provide a way to limit risk while maintaining the potential for profit. By using these instruments, traders can protect their positions from adverse price movements and further diversify their portfolio