AUTHOR : SIMON DRAVIS

Introduction

Forex trading[1] in India has grown significantly in the last few years, attracting both seasoned investors and beginners looking to profit from currency fluctuations. However, as with any financial market[2], there are inherent risks involved, and one of the most challenging risks in forex trading is the “gap risk.” In this article, we will explore forex trading gap risk strategies tailored for Indian traders, how to mitigate this risk, and answer some frequently asked questions.

What is Gap Risk in Forex Trading?

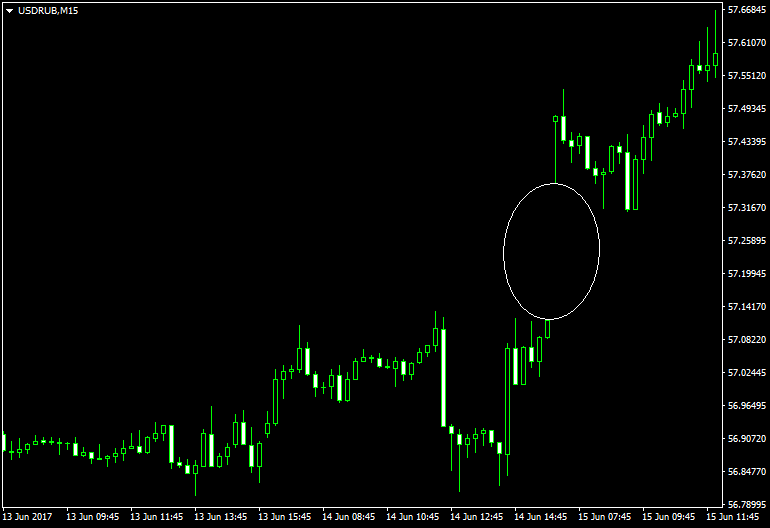

Gap risk[3] occurs when there is a significant price movement between the closing price of one trading session and the opening price of the next session. In the forex market[4], gaps can happen due to various factors like economic data releases, political events, or geopolitical tensions, leading to sudden price fluctuations[4]. For instance, a currency pair might close at 1.2000 and open the next day at 1.2050, resulting in a 50-pip gap. This gap can either lead to significant profit opportunities or considerable losses, depending on the trader’s position.

In India, the forex market operates 24/5, but due to the time zone differences, the opening price of the Indian market on Monday can sometimes differ substantially from the closing price on Friday, resulting in gaps over the weekend. The gap risk is a particular concern for traders who hold positions over the weekend or overnight.

Why is Gap Risk Important in Forex Trading?

Gap risk is significant for traders for several reasons:

- Increased Volatility: Gaps often indicate sudden and sharp movements, leading to volatile market conditions. This can result in unexpected profit or loss, which is hard to manage.

- Unpredictability: Gaps are often caused by external events such as economic reports or geopolitical events, making them highly unpredictable.

- Slippage: When a gap occurs, slippage may happen, meaning the trader may not be able to execute their trade at the desired price. This can lead to unexpected losses or missed opportunities.

- Risk Management Challenges: Gap risk challenges traditional risk management techniques. For instance, stop-loss orders may not be effective in a gap scenario, as the price may “skip” over the stop price, leading to larger-than-expected losses.

Strategies to Manage Forex Gap Risk in India

While gap risk can never be completely eliminated, traders can adopt certain strategies to minimize the impact of gaps and protect their capital.

1. Use of Stop-Loss and Take-Profit Orders

One of the most basic and effective risk management strategies in forex trading is the use of stop-loss and take-profit orders. While these orders may not always be effective during major gaps, they can help limit losses and lock in profits when the market is moving normally.

- Stop-Loss Orders: A stop-loss order automatically closes your position when the price reaches a certain level. In case of a gap, having a well-placed stop-loss can minimize losses.

- Take-Profit Orders: Similarly, take-profit orders help traders lock in profits at predetermined levels. This ensures that traders don’t get greedy and end up losing their profits if the market reverses unexpectedly.

2. Gap Trading Strategy

Gap trading strategies involve trading based on the expectation that the gap will be filled (i.e., the price will eventually return to the level it was before the gap). This strategy works well when the gap is caused by minor news events or economic reports. Traders can wait for the price to close the gap and enter positions in the direction of the gap’s closure.

3. Weekend Gap Risk Management

Weekend gaps are a particular concern for Indian traders as the market closes on Friday and reopens on Monday. During this period, significant events such as global economic reports or geopolitical tensions can cause large price movements over the weekend. To manage weekend gap risk:

- Avoid Holding Positions Over the Weekend: If you’re a short-term trader, it’s often a good idea to avoid holding positions over the weekend. This minimizes exposure to unexpected weekend news.

- Close Positions Before Market Close on Friday: If you’re concerned about gap risk, consider closing your trades before the market closes on Friday. This ensures that you don’t face any unexpected price movements when the market reopens.

4. Trading the News

News events often drive gaps in the forex market. Economic announcements, such as inflation reports or central bank meetings, can cause sudden price changes. Traders can prepare for such gaps by anticipating major news releases and using strategies like:

- News Trading: Place trades based on economic reports and anticipate potential gaps in prices. For example, if a central bank is expected to raise interest rates, the currency might experience a gap upward.

- Wait for Confirmation: Instead of jumping into a trade immediately after news is released, wait for confirmation of the price movement. This could help you avoid entering trades that may not follow through.

5. Use of Options to Hedge Gap Risk

Forex options provide an effective way to hedge against gap risks. Traders can purchase “put” or “call” options to protect themselves from sudden price movements. A put option allows a trader to sell at a specific price, while a call option allows them to buy at a specific price. By purchasing options, traders can limit their downside while still benefiting from favorable price movements.

6. Diversification of Currency Pairs

Diversification is another effective strategy to reduce gap risk. By trading a variety of currency pairs, you can spread your risk across different markets. If a gap occurs in one currency pair, it may not affect your entire portfolio, reducing the overall risk of your trades.

7. Trade with a Forex Broker Offering Gap Risk Protection

Some forex brokers offer gap risk protection tools, such as guaranteed stop-loss orders. These brokers provide additional security by ensuring that your stop-loss orders are filled at the exact price, even if there is a gap in the market. While such features may come at a cost, they can offer peace of mind for traders who are concerned about gap risk.

Conclusion

Forex trading gap risks are a part of the market that traders must understand and manage. The key to successful trading in India lies in understanding how gaps occur, anticipating potential gaps, and using risk management strategies to minimize their impact. By employing techniques like stop-loss orders, gap trading, weekend risk management, and news trading, traders can protect themselves from significant losses due to gap risk. Moreover, using options and diversifying currency pairs can further safeguard your trades from sudden price movements. Always remember, no strategy can eliminate gap risk entirely, but a combination of effective strategies can certainly reduce its impact on your forex trading journey.

FAQs

1. What causes gaps in the forex market?

Gaps occur when there is a significant difference between the closing price of one session and the opening price of the next session. This can happen due to various factors like economic data releases, geopolitical events, or natural disasters.

2. How can I protect myself from weekend gap risk?

To avoid weekend gap risk, you can either close all positions before the market closes on Friday or use protective options to hedge your trades against possible price fluctuations.

3. Are stop-loss orders effective during gaps?

Stop-loss orders may not always be effective during gaps since the market may “skip” over the stop price. However, using guaranteed stop-loss orders offered by some brokers can mitigate this risk.

4. Is gap trading profitable?

Gap trading can be profitable if you can correctly predict the direction of the gap’s closure. However, it requires a good understanding of the market and proper risk management to be successful.

5. What is the best way to handle news-related gaps?

The best way to handle news-related gaps is to anticipate the news release and either trade based on the expected outcome or wait for confirmation before entering a trade to avoid sudden market reversals.

6. Can I avoid gap risk entirely in forex trading?

Unfortunately, gap risk cannot be entirely avoided, but it can be minimized through proper risk management strategies, such as using stop-loss orders, avoiding overnight or weekend positions, and trading with diversified currency pairs.