AUTHOR: JIVI SCOTT

Introduction

Forex trading[1], or currency trading, is a highly dynamic and exciting market that allows traders to profit from the fluctuations in currency exchange[2] rates. While having a solid trading strategy and understanding market trends are essential, a critical factor that often determines a trader’s success is their Forex trading psychology. In this article, we will dive deep into the mental aspects of Forex trading and discuss strategies for Indian traders to improve their psychological approach for better results What-is-the-best-Indian-platform-to-trade-Forex.

Understanding Forex Trading Psychology

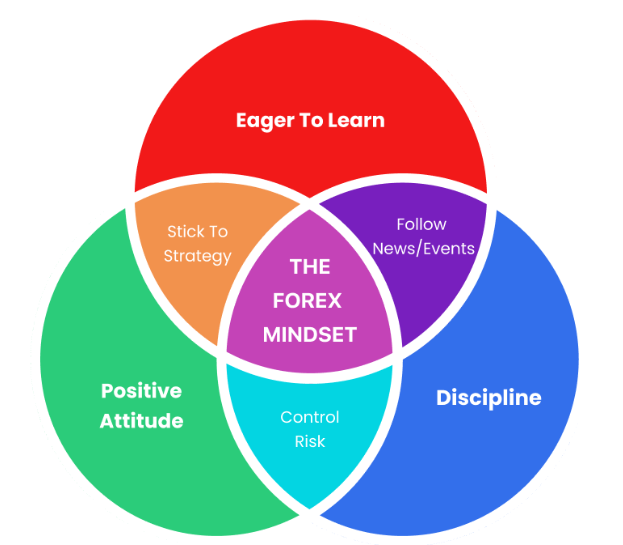

Which-is-the-best-Indian-Forex-broker-that-provides-no-deposit-bonus Forex trading psychology refers to the emotional and mental state of a trader that affects their decision-making process, risk tolerance, and overall approach to trading. Unlike traditional investments[3], Which-is-the-best-Indian-Forex-broker-that-provides-no-deposit-bonus Forex trading operates in a 24/5 market with constant price fluctuations. These movements can trigger emotional responses like fear, greed, frustration, and euphoria, all of which can lead to poor trading strategy[4].

Forex-trading-have-a-high-risk For Indian traders, these emotional factors can be amplified due to various external influences, such as market volatility, political events, and financial pressures. Developing the right mindset is therefore crucial for consistent profitability in the Forex market[5] Can-I-trust-forex-trading.

Key Psychological Traits Every Forex Trader Must Develop

1. Patience

Patience is one of the most important qualities that a Forex trader needs to develop. In the fast-paced world of currency trading, traders often feel the pressure to act immediately when they see market movements. However, making impulsive decisions based on fleeting emotions can lead to significant losses.

For Indian traders, learning to wait for the right setups, sticking to a trading plan, and allowing trades to develop according to plan is vital. Patience in Forex trading helps avoid overtrading, which is one of the leading causes of financial setbacks.

2. Discipline

Discipline is essential when it comes to following a strategy, sticking to risk management rules, and avoiding emotional trading. A disciplined Forex trader adheres to their trading plan, regardless of the current market conditions or external pressure. This includes sticking to stop-loss orders, not increasing position sizes based on greed, and resisting the urge to chase after quick profits.

Indian traders, in particular, may face additional distractions due to domestic market trends, news, and social factors. Being able to filter out noise and focus on their trading plan is key.

3. Emotional Control

Emotional control is the cornerstone of successful Forex trading. A trader’s emotions, whether positive or negative, can have a profound impact on decision-making. When things go well, the trader might feel overly confident or euphoric, leading to overconfidence and risky behavior. On the other hand, a losing streak can lead to frustration, fear, and the temptation to abandon a strategy.

For Indian traders, learning how to control emotions, especially during periods of market volatility, is essential. Developing a calm, rational approach helps prevent these emotional swings from negatively impacting trading results.

4. Confidence

Confidence is essential for every Forex trader, but it must be balanced with caution. A trader should believe in their ability to analyze the market and execute their strategy. However, overconfidence can lead to excessive risk-taking and ignoring established rules.

Indian traders can gain confidence by continuously learning, backtesting strategies, and engaging in demo trading. Gradually, this can help build the mental resilience necessary for live trading.

5. Risk Management

Proper risk management is an integral aspect of Forex trading psychology. Managing risk means controlling the amount of capital you are willing to risk on each trade and knowing when to cut losses. Inexperienced traders, particularly those new to Forex trading, may get caught up in the excitement of quick profits, neglecting risk management.

For Indian traders, understanding and implementing risk management strategies—such as setting stop-loss levels and limiting trade size—can help protect against significant losses and ensure long-term sustainability in the market.

Strategies for Indian Traders to Improve Forex Trading Psychology

1. Develop a Trading Plan

A solid trading plan is the foundation of a successful Forex trading career. Indian traders should ensure that their plan includes clear goals, risk management rules, entry and exit strategies, and emotional guidelines. Following a pre-defined plan helps avoid impulsive decisions and keeps emotions in check.

2. Use a Demo Account

Before risking real money, it is wise to practice on a demo account. Demo accounts allow Indian traders to familiarize themselves with the platform and test strategies without the risk of losing capital. The psychological pressure of trading with real money can be overwhelming, but practicing in a risk-free environment helps to build confidence and emotional control.

3. Take Regular Breaks

Extended trading sessions can lead to mental exhaustion, which can impair decision-making. Indian traders should consider taking regular breaks to reset their minds and avoid fatigue-induced mistakes. This practice can prevent traders from overexerting themselves and help them maintain focus on their goals.

4. Keep a Trading Journal

A trading journal is a powerful tool for improving Forex trading psychology. By keeping detailed records of every trade—why the trade was made, how it was executed, and what the outcome was—Indian traders can learn from their successes and mistakes. Reflecting on past trades helps develop greater self-awareness and discipline.

5. Set Realistic Expectations

Forex trading is not a get-rich-quick scheme. Indian traders should set realistic expectations, acknowledging that there will be losses along the way. Focusing on gradual, consistent growth rather than seeking large, immediate profits can help mitigate emotional stress and frustration.

Overcoming Common Psychological Pitfalls in Forex Trading

Fear of Missing Out (FOMO)

FOMO is a common psychological challenge faced by many Forex traders, especially in volatile markets. The fear of missing a potential profit can lead to impulsive decisions, such as entering trades without proper analysis. Indian traders should learn to avoid chasing the market and stick to their well-thought-out strategies.

Revenge Trading

Revenge trading is the act of trying to recover losses by making impulsive, high-risk trades. After experiencing a loss, some traders are driven by the desire to “get even.” This often leads to poor decision-making and increased losses. Indian traders should refrain from revenge trading by maintaining emotional control and adhering to their risk management rules.

Overtrading

Overtrading occurs when traders take excessive positions in the market, often due to emotions like greed or the urge to recover losses. This can lead to significant losses and is often driven by the desire for quick profits. Indian traders should focus on quality over quantity by selecting high-probability trades and avoiding overexposure.

Conclusion

Mastering the psychological aspects of Forex trading is just as important as developing technical and fundamental trading skills. By cultivating traits such as patience, discipline, emotional control, and risk management, Indian traders can greatly improve their chances of success. Remember, Forex trading is a marathon, not a sprint, and maintaining the right mindset will help you achieve long-term profitability.

FAQs

1. How important is Forex trading psychology for success?

Forex trading psychology is crucial for success because it influences decision-making, risk-taking, and emotional control. Without mastering psychological aspects, even the best trading strategies can fail.

2. How can I overcome fear while trading in the Forex market?

Overcoming fear in Forex trading requires experience, preparation, and emotional control. Traders can reduce fear by using demo accounts, practicing risk management, and developing a strong trading plan.

3. What are the best ways to stay disciplined in Forex trading?

Staying disciplined involves sticking to a trading plan, avoiding impulsive decisions, setting realistic goals, and managing risks effectively. Regularly reviewing trades and reflecting on outcomes also helps improve discipline.

4. How can I avoid emotional trading?

To avoid emotional trading, traders should focus on following their strategy, sticking to predetermined rules, and taking breaks when needed. Maintaining a trading journal also helps identify emotional triggers and mitigate their impact.

5. What role does patience play in Forex trading?

Patience is essential for waiting for the right setups, avoiding overtrading, and letting trades develop according to plan. It helps traders remain calm and make decisions based on analysis rather than emotions.