AUTHOR : JENNY

Introduction

Forex trading has become increasingly popular in India, with many traders exploring different strategies to maximize profits. Among these strategies, the Fibonacci Forex Trading Strategy stands out as one of the most widely used and effective tools for both novice and experienced traders. In this blog, we will explore the Fibonacci Forex Trading Strategy in-depth, focusing on its application in the Indian forex market, how it works, and how traders can use it to enhance their trading outcomes.How can I recover money from a scammed broker?

What is the Fibonacci Forex Trading Strategy?

The Fibonacci Forex Trading Strategy is based on the Fibonacci sequence, a mathematical concept discovered by Italian mathematician Leonardo Fibonacci in the 13th century. The sequence consists of numbers where each number is the sum of the two preceding ones.

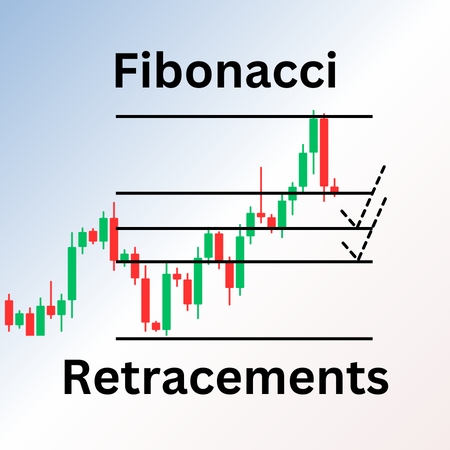

In forex trading, traders apply the Fibonacci sequence to price movements, using key levels derived from the sequence to identify potential support and resistance levels in the market. These levels, known as Fibonacci retracement levels, help traders anticipate price corrections, reversals, and entry points.

Key Fibonacci Levels in Forex Trading

The most commonly used Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 100%. Traders base these levels on the ratios derived from the Fibonacci sequence and plot them on a price chart to determine potential levels where a price reversal may occur:

- 23.6%: This level indicates a small price retracement and is often used as a first point of entry in the market.

- 38.2%: A more significant retracement, often seen as a level where the price might reverse after a trend.

- 50%: Though not a Fibonacci number, the 50% retracement is widely used in trading due to its effectiveness in predicting market reversals.

- 61.8%: Known as the “golden ratio,” this is the most important Fibonacci retracement level and is often a key level for price reversals.

- 100%: A full retracement, indicating that the price has retraced the entire original move.

By using these levels, traders can predict potential areas of price reversals and plan their trades accordingly.

How Does the Fibonacci Forex Trading Strategy Work?

The Fibonacci Forex Trading Strategy works by identifying significant price movements and applying Fibonacci retracement levels to forecast possible reversal points. Here’s how the strategy works[1] step by step:

- Identify a Trend: Before applying Fibonacci retracement[2] levels, you need to identify a clear trend in the market. The Fibonacci strategy works best in trending markets, whether up or down.

- Draw Fibonacci Levels: Once the trend is identified, you plot the Fibonacci retracement levels on the chart. If the market is in an uptrend, you place the Fibonacci levels from the swing low to the swing high. For a downtrend, you plot from the swing high to the swing low.

- Look for Price Reversals: After applying the Fibonacci levels, monitor how the price behaves when it reaches any of the key retracement levels. Prices often experience support or resistance at these levels, which makes them ideal points for placing trades.

- Confirm with Other Indicators: While Fibonacci levels are useful, they should not be relied on in isolation. Combining them with other technical analysis tools, such as moving averages, RSI, or MACD, can provide stronger confirmation of a potential trade signal.

- Enter and Exit Trades: Once a potential reversal point is confirmed, you can enter a trade in the direction of the trend. It’s important to place a stop-loss just below the Fibonacci level to manage risk effectively. Additionally, set take-profit levels at key resistance or support levels based on the Fibonacci extension levels.

Applying the Fibonacci Strategy in the Indian Forex Market

The Indian forex market operates in accordance with regulations set by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). As an Indian trader[3], applying the Fibonacci Forex Trading Strategy requires understanding both the strategy and the local market dynamics.

Currency Pairs to Trade with Fibonacci in India

Indian traders have access to several currency pairs involving the Indian Rupee (INR) for forex trading. The most popular pairs for applying the Fibonacci Forex Trading Strategy are:

- USD/INR: The most commonly traded pair in India, reflecting the value of the Indian Rupee[4] against the US Dollar.

- EUR/INR: The Euro to Indian Rupee pair, which can provide profitable opportunities in volatile markets.

- GBP/INR: The British Pound to Indian Rupee pair, often influenced by global economic events and geopolitical news.

- JPY/INR: The Japanese Yen to Indian Rupee pair, a less volatile pair that can offer unique trading[5] opportunities.

Traders can analyze each of these pairs using Fibonacci retracement levels, helping them identify potential entry points for trades as these pairs exhibit strong trends.

Timeframes for Fibonacci Trading

The Fibonacci Forex Trading Strategy can be applied to different timeframes, depending on your trading style and objectives.

- Short-term traders: If you are a day trader or swing trader, you may focus on shorter timeframes such as 15-minute, 30-minute, or 1-hour charts. Fibonacci retracement levels on shorter timeframes help you spot small price corrections within a larger trend.

- Long-term traders: For position traders, using longer timeframes like 4-hour, daily, or weekly charts can offer more reliable Fibonacci levels, as they reflect significant market movements.

Conclusion

The Fibonacci Forex Trading Strategy helps Indian traders navigate the market by identifying key support and resistance levels in currency pairs like USD/INR, EUR/INR, and GBP/INR. It aids in anticipating price corrections and making informed decisions. While it has limitations, combining Fibonacci with other technical tools and sound risk management can enhance its effectiveness. As with any strategy, practice and experience are crucial for success in the forex market.

FAQS

What is the Fibonacci Forex Trading Strategy?

The Fibonacci Forex Trading Strategy uses key retracement levels to identify potential support and resistance points, helping traders predict market reversals.

How do Fibonacci retracement levels work in forex trading?

Traders plot Fibonacci retracement levels on a price chart to forecast potential price reversals, corrections, or continuation in trends.

Which currency pairs can Indian traders apply the Fibonacci strategy to?

Indian traders can apply the Fibonacci strategy to currency pairs like USD/INR, EUR/INR, and GBP/INR.

Is the Fibonacci strategy suitable for all types of traders?

Yes, the Fibonacci strategy is suitable for both novice and experienced traders, as it helps identify key market levels.

Can the Fibonacci strategy be used for short-term trading?

Yes, traders can apply Fibonacci retracement on short-term charts like 15-minute, 30-minute, or hourly charts to spot quick trade opportunities.