AUTHOR : JENNY

Introduction

The foreign exchange forex market offers traders numerous opportunities to profit from fluctuations in currency values. Among the various types of forex brokers available, ECN (Electronic Communication Network) brokers have gained significant popularity among professional and retail traders due to their transparency, fast execution speeds, and direct market access. For Indian traders seeking high-quality execution, tight spreads, and the ability to trade directly with other market participants, choosing an ECN forex broker can be an excellent option.How do I find a genuine Forex broker? How do you and where do you complain against him if does now give you withdrawal?

In this blog, we’ll explore the best ECN forex brokers for Indian traders, highlight their key features, and discuss why ECN accounts may be ideal for those who want to access the global forex market with minimal interference.

What is an ECN Forex Broker?

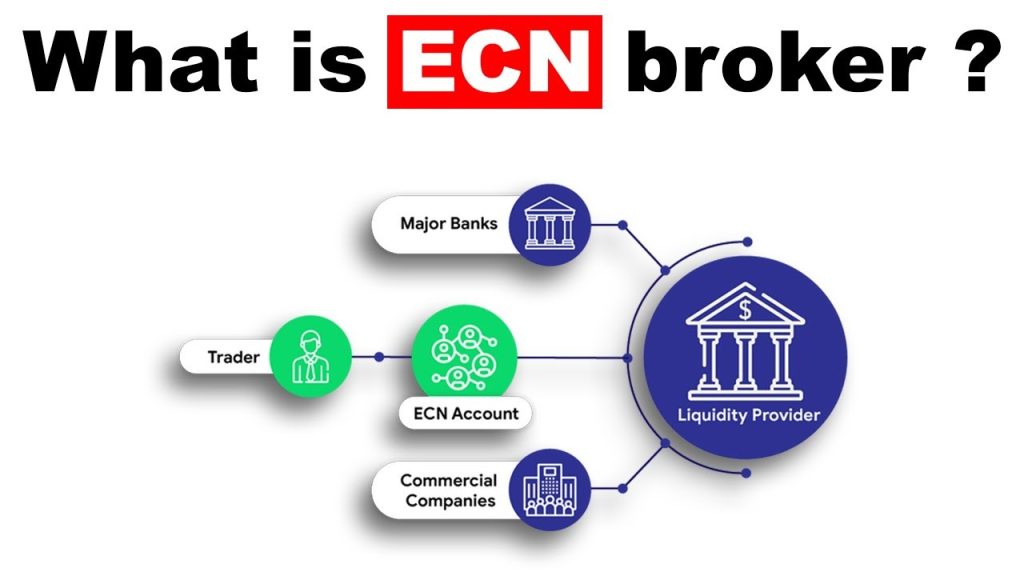

An ECN broker connects traders directly with liquidity providers, such as banks and financial institutions, for real-time order matching. Unlike traditional brokers, ECN brokers don’t take market positions but charge commissions on trades, offering tighter spreads, faster execution, and greater transparency. These brokers provide high liquidity, ideal for efficient trading.

Why Choose an ECN Forex Broker?

ECN brokers offer several advantages, especially for experienced traders who require precision and flexibility. Here are some reasons why Indian traders may prefer ECN forex brokers:

- Tight Spreads

Since ECN brokers provide direct access to liquidity providers, the spreads are typically much tighter than those offered by traditional market makers. - Faster Execution

ECN brokers excel in providing faster order execution times. Since there is no dealing desk involved in processing orders, trades are executed in real-time, reducing latency and slippage, which is especially crucial for high-frequency and scalper traders. - No Requotes or Rejections

ECN brokers usually offer market orders with no requotes or rejections. This means that traders can execute their orders at the price they see, without delays, enhancing their ability to react to market movements instantly. - Greater Transparency

ECN brokers are more transparent in their pricing and order execution. Traders can view the full depth of the market, including available liquidity and prices from various liquidity providers, ensuring a more transparent and fair trading environment. - Access to Raw Market Data

ECN brokers provide traders with direct access to raw market data, such as real-time bid and ask prices, which is vital for traders who use advanced strategies like scalping and algorithmic trading.

Top ECN Forex Brokers for Indian Traders

Several reputable ECN[1] forex brokers cater to Indian traders, providing excellent trading conditions, fast execution, and reliable customer support. Here are some of the top choices:

IC Markets

IC Markets is one of the most popular ECN[2] brokers among Indian traders due to its excellent trading conditions, including low spreads, high liquidity, and fast execution speeds. It offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as cTrader, a trading platform known for its high performance and customizability. IC Markets provides a variety of account types, including raw ECN accounts[3], and offers a range of trading instruments, including forex commodities[4], and indices.

Key Features:

- Raw spreads starting from 0.0 pips

- Fast order execution with a latency of under 40ms

- Leverage up to 1:500

- Regulated by ASIC and CySEC

Pepperstone

Pepperstone is another highly regarded ECN broker that caters to Indian traders. Known for its tight spreads and high-quality execution, Pepperstone provides access to over 70 currency pairs, as well as CFDs on stocks, indices, and commodities.

Key Features:

- Raw spreads from 0.0 pips

- Execution speeds of under 30ms

- Leverage up to 1:500

- Regulated by ASIC and FCA

FXTM (ForexTime)

FXTM is an established ECN broker offering competitive trading conditions to Indian traders. It provides access to raw spreads, a wide range of currency pairs, and advanced trading tools on MT4 and MT5 platforms. FXTM offers multiple account types, including ECN accounts, which are designed for traders who require direct market access and low-cost trading. With customer support available in multiple languages, including Hindi and English, ForexTime [5]is an ideal choice for Indian traders seeking professional-level services.

Key Features:

- Raw spreads from 0.1 pips

- High leverage up to 1:1000

- Access to a wide range of trading instruments

- Regulated by CySEC and FCA

Factors to Consider When Choosing an ECN Broker

Before selecting an ECN broker, Indian traders should consider the following factors:

- Regulation: Ensure the broker is regulated by a reputable authority to guarantee the safety of your funds and secure trading conditions.

- Spreads and Commissions: Compare raw spreads, commissions, and other fees to ensure they align with your trading style and strategy.

- Leverage: Check the leverage options available, keeping in mind the risks associated with high leverage.

- Execution Speed: Choose a broker that offers fast execution times, especially if you trade on shorter time frames like scalping or day trading.

- Customer Support: Look for brokers that offer multilingual customer support, including Hindi and English, to address any issues you may encounter.

Conclusion

ECN brokers provide Indian traders with access to raw market spreads, fast execution speeds, and transparent pricing, making them an excellent choice for experienced traders. Brokers like IC Markets, Pepperstone, FXTM, XM, and Exness stand out as some of the best ECN forex brokers, offering a range of features to suit different trading needs. By selecting the right ECN broker, Indian traders can optimize their trading experience and gain access to global financial markets with greater efficiency and cost-effectiveness.

FAQS

What is an ECN broker?

An ECN broker connects traders directly with liquidity providers, offering fast execution, low spreads, and no dealing desk interference.

Why should I choose an ECN broker?

ECN brokers provide tighter spreads, faster execution, and more transparency, ideal for active traders and scalpers.

Are ECN brokers reliable for Indian traders?

Yes, reputable ECN brokers are regulated by top-tier authorities, ensuring a safe and secure trading environment.

Which ECN brokers are best for Indian traders?

Top ECN brokers for Indian traders include IC Markets, Pepperstone, FXTM, XM, and Exness.

What platforms do ECN brokers offer?

Most ECN brokers offer popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.